Wednesday, April 15, 2009 | 2 a.m.

In Today's Sun

Reader poll

Enlargeable graphic

Sun Archives

- No time like later to clue public in on crisis budget (4-3-2009)

- Lawmakers look at ways to head off program, staff cuts (3-26-2009)

- Economist to Congress: Don't stop at stimulus (3-26-2009)

- Housing help for Nevadans in budget bill (3-25-2009)

- Tax foul-up comes home to roost (3-13-2009)

Sun coverage

Beyond the Sun

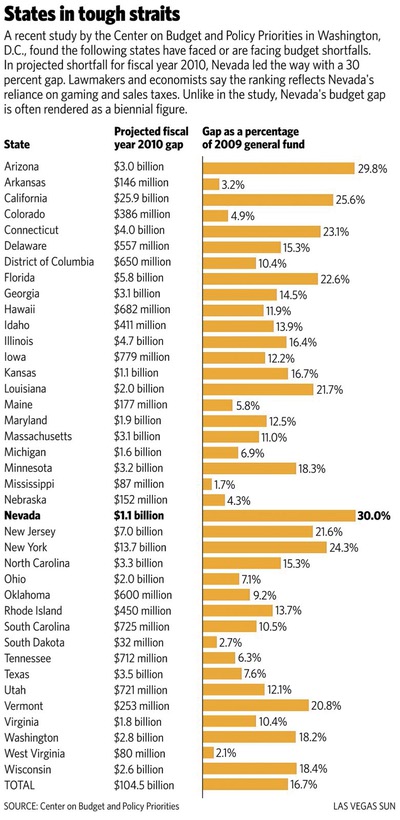

Nevada is No. 1 yet again. The state faces the largest budget deficit in the country for the upcoming fiscal year, according to a recent survey of states by the Washington D.C.-based Center for Budget and Policy Priorities.

The Silver State will have a 30 percent gap between spending and revenue, edging out Arizona, which faces a 29.8 percent deficit, according to the survey. The gap is calculated by taking the amount of money states believe to be necessary to maintain current state services and comparing it with expected revenue.

States across the nation are facing budget cuts and considering raising taxes to fill similar budget gaps, estimated by the survey at more than $350 billion. But economists and lawmakers say Nevada’s dubious distinction is a reflection of a state with a government that leans heavily on sales tax and gaming tax, and an economy that is too dependent on one industry.

Elliott Parker, a University of Nevada, Reno, economics professor, said Nevada’s position is a reflection of two things: with such a small general fund as a percentage of the state’s economy, any economic drop is going to increase that percentage; second, with Americans saving more, “people are cutting back on vacations, their gambling and their durable purchases, and that hurts Nevada more than other states since our tax base is so unbalanced.”

Joe Edson, a field organizer and lobbyist for the Progressive Leadership Alliance of Nevada, said the state has long needed a broader-based tax system to prevent deep cuts in services during economic downturns. He said the state lets most businesses off without paying taxes as they do in other states.

“Nevada’s tax structure has been broken for decades,” he said.

But Assembly Speaker Barbara Buckley said she won’t support a corporate income tax, one of the frequently mentioned ways to broaden the tax base. “In conversations with business leaders and lawmakers, there doesn’t seem to be much support for that,” she said.

Asked whether she supports a corporate income tax, she responded: “No.”

Rather, she said, the size of the deficit highlights the need to diversify the economy.

Some economists noted that other states with large budget gaps are perceived to have broader tax bases. Arizona, for example, has personal and corporate income taxes, said John Restrepo, a Las Vegas-based economist and consultant.

Yet Arizona’s unemployment rate is at 7.4 percent and Nevada’s is at 10.1 percent, according to the most recent data.

“We’re starting to see now how important a diversified economy is,” Restrepo said. “The downturn may have been mitigated some had our economy been more diversified.”

Nevada’s projected budget hole outpaces California’s (25.6 percent) and New York’s (24.3 percent), according to the study.

Assistant Majority Leader Marcus Conklin, D-Las Vegas, who co-authored a report on Nevada’s tax system last year, said gaming and sales taxes during good times make up 65 percent of state revenue.

Many necessary items, such as groceries, are exempted from the sales tax.

The exemptions, along with reliance on gambling, have made the state depend on discretionary spending, he said. “When there are bumps in the economy, people cut out discretionary spending.”

“If we’re going to look at changing our tax structure, we should look away from things that are discretionary,” he said.

Conklin said it is too early to tell whether this is the year lawmakers try to change the tax structure.

Sen. Bill Raggio has a bill that would require the state to study its tax structure.

But Conklin said such studies always reach similar conclusions — the state is too dependent on gaming and visitors spending money here. “What do we expect to find out of a new study that we don’t already know?” Conklin said.

Nevadans have, for the most part, opposed raising their taxes. Except for rare occasions, such as in the 1950s when the gaming tax was doubled and the state’s first sales tax was instituted, it has been seen as political suicide for politicians to favor new or higher revenues.

Gov. Jim Gibbons submitted a budget on Jan. 15 that included an increase in the room tax in Washoe and Clark counties, a hike that voters had approved, but otherwise relied on cuts to balance the budget.

“Clearly everyone knows we’re in an economic crisis,” Gibbons spokesman Dan Burns said. “It would be disappointing, if true, to be ranked 50th. But it would be another piece of proof that action needs to be taken. I know you’ve heard it before, but the action is not to raise taxes and make government bigger.”

Democrats and Republicans are working behind closed doors to finalize a list of Gibbons’ cuts they want to restore. Then, they say, they will release a plan to raise enough revenue to pay for it.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy