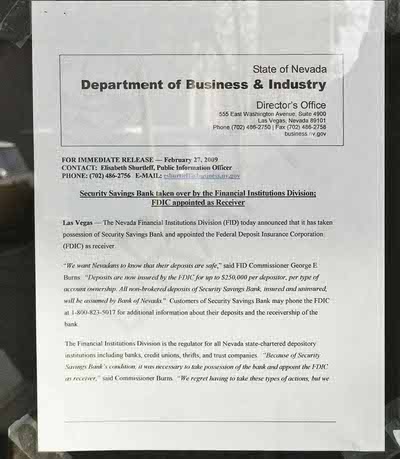

Security Savings Bank was taken over by the Nevada Financial Institutions Division on Friday. The Federal Deposit Insurance Corp. is the receiver.

Published Friday, Feb. 27, 2009 | 4:22 p.m.

Updated Friday, Feb. 27, 2009 | 5:16 p.m.

Henderson-based Security Savings Bank was seized by the state’s Financial Institutions Division today. The state appointed the Federal Deposit Insurance Corporation as receiver.

“We want Nevadans to know that their deposits are safe,” said Financial Insurance Division Commissioner George Burns said in a statement.

Security Savings Bank was the 20th largest bank in terms of deposits in Las Vegas, according to In Business Las Vegas' 2009 Book of Business Lists. This is the first bank failure in Nevada this year.

“Deposits are now insured by the FDIC for up to $250,000 per depositor, per type of account ownership. All non-brokered deposits of Security Savings Bank, insured and uninsured, will be assumed by Bank of Nevada.”

Bank of Nevada is a subsidiary of Western Alliance Bancorp. Its chief executive and chairman is Robert Sarver, owner of basketball team Phoenix Suns. Stephen Devernis was listed as president of Security Savings Bank until an amendment with the Nevada secretary of state in October changed it to Jesse Torres. Devernis was also previously listed as chief credit officer of the bank on Security Saving's Web site.

Bank of Nevada did not pay a premium to buy the deposits of Security Savings Bank, the FDIC said. The acquisition was the least costly option to the FDIC's deposit insurance fund. The seizure is costing the fund $59.1 million.

Bank of Nevada also agreed to purchase about $111.3 million in assets. The government will keep any remaining assets for later disposition.

As of December 2008, Bank of Nevada had 495 employees and $3 billion in assets, which includes $2.7 billion in deposits. Western Alliance has $5.4 billion in assets among its five subsidiaries and $3.7 billion in deposits.

The Financial Institutions Division is the regulator for all Nevada state-chartered depository institutions including banks, credit unions, thrifts, and trust companies.

“Because of Security Savings Bank’s condition, it was necessary to take possession of the bank and appoint the FDIC as receiver,” Burns said. “We regret having to take these types of actions, but we are committed to making sure Nevada’s banking system continues to be fundamentally safe and sound.”

Security Savings Bank’s customers will continue to have access to banking services over the weekend, and normal business hours and access to banking services will continue on Monday as branches of Bank of Nevada. Customers may phone the Financial Institutions Division at (702) 486-4120 for additional information regarding Security Savings Bank.

“We will continue to work closely with the FDIC to manage this situation as smoothly as possible,” Burns said. “Especially with the economic instability we are experiencing today, our goal is always to protect depositors while minimizing the disruption to business and preserving jobs as much as possible.”

Established in April 2000, the bank specialized in commercial lending. It had two branches, one each in Las Vegas and Henderson. It had 16 employees, as of Dec. 31. The year prior, it had 25.

Security Savings had total assets of $238.3 million, as of Dec. 31, 2008, according to recently released data by the Federal Deposit Insurance Corp. The year prior, in Dec. 2007, it reported assets of $273.3 million. Of those assets, its total loans, minus its loan loss allowance, was $119.1 million. Nearly half of its total loans ($58.9 million) were in commercial real estate. It reported $32.4 million in construction and land development loans, $24.4 million in 1-4 family residential loans, and, $7.1 million in commercial and industrial loans. In Dec. 2007, the bank reported $180.2 million in loans.

The bank also reported that 19.2 percent of all its loans are 90 days or more overdue. Of those, 63.3 percent were construction and development loans. A year ago, loans past due 90 days or more represented 7.5 percent of the bank’s loan portfolio.

The bank’s provision for loan losses -- how much it took out of income to cover loan losses -- was $10.8 million. Last year, the provision was $5.3 million.

The bank also reported $163,000 in foreclosed real estate. The year prior, it reported none.

The bank’s liabilities in December 2008 were $283.3 million. The year prior it was $273.3 million.

Of those liabilities, its primary deposits were $174.9 million, slightly down from the previous year ($179.5 million).

Its capital, which is how banks leverage loans, was $27.2 million. The bank’s interest income (year-to-date) was $12.5 million, down from $22.5 million in 2007. Of its interest income, $8.4 million came from loans. In 2007 it was $18.1 million.

Security Saving’s interest expense was $9.9 million, down from December 2007, which was $12.9 million.

Its expense on deposits was $6.3 million, down from December 2007 at $9.6 million.

The bank’s non-interest income was a loss of 0.4 percent. In December 2007 it was a gain of .02 percent.

Customers of Security Savings Bank may phone the FDIC at 1-800-823-5017 for additional information about their deposits and the receivership of the bank.

Security Savings Bank is the sixteenth bank to fail in the nation this year. The last bank to fail in Nevada was Henderson-based Washington Mutual Bank on Sept. 25, 2008.

Clarification: In the March 6-12 edition of In Business Las Vegas, an article about the failure of Security Savings Bank referred to Stephen Dervenis as chief executive of the bank as of June, according to In Business' 2009 Book of Business Lists published in December. Further research by In Business indicates that Dervenis was the president of Security Savings, according to Nevada secretary of state filings. A filing in October changed the president listing to Jesse Torres. Dervenis was also listed as the bank's chief credit officer on the bank's Web site at least until January 2008.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy