COURTESY of las vegas government

Las Vegas plans to build a 303,000-square-foot city hall at First Street and Clark Avenue. The project would require that $267 million be raised through public bonds.

Thursday, Jan. 22, 2009 | 2 a.m.

Sun Archives

- Old opinion could bite union with ballot issue (1-13-2009)

- Culinary chief has no eyes for City Hall (1-10-2009)

- Referendum faces legal hurdle (1-9-2009)

- Culinary flexing its renewed muscle (12-11-2008)

- Culinary moves to block LV redevelopment & city hall project (12-9-2008)

- Mayor gives Culinary a piece of his mind (11-20-2008)

Culinary Union officials say they will file two petitions today with at least twice as many signatures as necessary to force June 2 ballot questions aimed at not only stopping Las Vegas from building a new city hall but limiting its options for spending redevelopment money.

One ballot question would ask voters to support a referendum preventing the city’s redevelopment agency from authorizing new projects, arguing that too many tax dollars are diverted from police, schools and other operations to foster redevelopment. The union cites a $50,000 redevelopment grant to Olympic Garden strip club and $32 million to Neonopolis as examples of “misused” taxpayer dollars.

“Other cities with redevelopment agencies have supported affordable housing and other projects that actually help taxpayers,” said Pilar Weiss, Culinary Union’s political director. “Our redevelopment agency, as it currently stands, is an open candy store for developers of strip malls and condos and strip clubs.”

Signatures were also collected to support an initiative, the “Las Vegas Taxpayer Accountability Act,” that would force the city to gain voter approval for lease-purchase agreements worth more than $2 million. That’s aimed squarely at the plan for a new city hall that Las Vegas Mayor Oscar Goodman has been angrily defending.

Weiss said the union’s hand was forced by the city’s push — during a recession and at a time when government services to the public are being slashed — to build a $150 million city hall, which would require the city to raise $267 million through public bonds.

The union’s message appeared to be resonating with the public Monday in front of the Albertsons grocery at Buffalo and Vegas drives.

Petition signer Andreas Borowiak, 30, a tennis operations manager and not a union member, figured the city should make do with what it has, as so many families are having to do these days. What’s so wrong with the current city hall? Borowiak wondered.

He admitted he knew little about the issue, but no matter the details, common sense told him: “It doesn’t seem like a good idea. Everybody’s worried about the economy right now.”

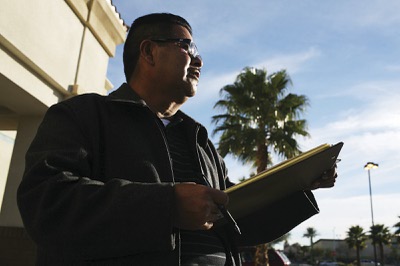

Holding a clipboard for signatures, Floyd Williams, Culinary Union director of training and education, approached a man in a Pittsburgh Steelers jersey for his next signature.

The man signed right away.

“It’s too expensive,” said James McDermott, 30. “Not the right time, with all the budget problems we have.”

The city hall financing hinges on an agreement with developer Forest City Enterprises, which would build and develop the 303,000-square-foot building at First Street and Clark Avenue. After construction, the city would lease the building for up to 30 years.

The city intends to sell bonds to finance construction. After finishing the building, Forest City would collect lease payments from the city, which it would use to pay off those bonds.

The deal also includes a one-time payment to Forest City of $7.5 million, equal to 5 percent of the building’s expected construction cost.

But a multimillion-dollar land swap is key to the deal. In exchange for giving the city a block upon which to build city hall, Forest City would get a plot of land in the highly touted Union Park development. The developer wants to build a casino on that plot.

Scott Adams, city redevelopment director, added that the city also benefits from the swap by not having to put up a large cash payment to purchase that city hall site.

According to Adams, the land Forest City would get is worth about $40 million; the city would get land worth about $33 million. The $7 million difference, Adams noted, would be made up by Forest City through one of several options being discussed, including the construction of a sky bridge over nearby railroad tracks.

Forest City also intends to redevelop three downtown blocks with commercial and residential construction sandwiched between the proposed city hall and a new Regional Transportation Commission bus terminal, Adams said.

All of it, he emphasized, would bring jobs to the city and significant tax revenue to depleted city coffers.

“People are losing sight that as a city, our job is to look at how we can best manage redevelopment of the existing city, and our valuable real estate assets to generate more income and jobs for the city,” Adams said. “They are losing sight of the big picture.”

The city’s financial guru, Mark Vincent, interim deputy city manager, contends the city’s financing deal is a very good one. The benefits lie in the way lease-purchase deals are structured, he said.

With a lease-purchase agreement, the city could refinance its debt if the economy improves and money becomes cheaper and easier to obtain. The city can’t do that if it financed and built a new city hall on its own with general obligation bonds, he added, a situation that would also require the city to raise property taxes.

Another benefit of the deal is that for the first seven years, the city would pay $2 million per year in rent. After seven years, payments would rise to about $21 million per year.

During those first seven years, if the city realizes it can’t go forward, Vincent said, it has the option of getting out of the deal and leaving Forest City to lease the building to someone else.

Adams called that scenario “unlikely,” but it’s in there in case the economy gets a lot worse.

The Culinary Union is unmoved by proclamations of the city’s good business deal.

“Forest City had already purchased the land downtown. They weren’t just going to let it sit, they were going to do something with it,” Weiss said. “This whole idea that land downtown will not get developed unless we give them money is crazy.”

The union contends that the city’s real motivation for the lease-purchase agreement is to do an end run around letting voters decide whether they want to take on the debt for a new city hall.

The city’s own financial adviser made that case in a Dec. 9 letter. Andrew Artusa, managing director of public finance for Nevada State Bank, advised the city not to use general obligation bonds for the new city hall because those would require voter approval, which could delay the redevelopment.

“Waiting for the next election cycle would unnecessarily postpone the City Hall project which is expected to be a significant catalyst for the development/redevelopment of Downtown Las Vegas,” he wrote.

A public hearing on the city’s financing of the project is slated for the Feb. 18 council meeting.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy