Part of the La Madre Mountains looks down over the sprawling housing growth of Summerlin.

Wednesday, Feb. 17, 2010 | 9:54 a.m.

Related Document (.pdf)

A federal judge in New York on Tuesday rejected efforts by the heirs of Howard Hughes to gain more control over thousands of acres of land in Summerlin that are included in the massive General Growth Properties Inc. bankruptcy case.

A legal dispute involving the Hughes heirs erupted last year after Chicago-based General Growth, owner of five Las Vegas shopping malls and developer of the Summerlin planned community, filed for Chapter 11 bankruptcy reorganization. General Growth has about 750 subsidiaries including the companies developing Summerlin.

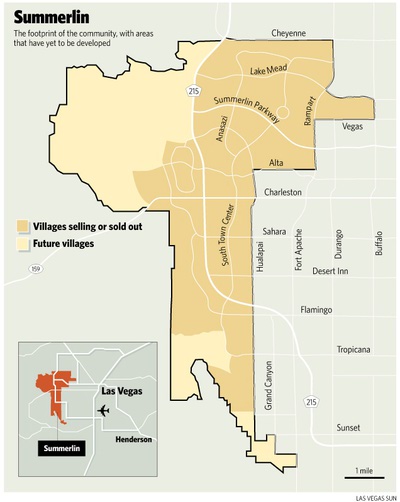

The billionaire Hughes had acquired 25,000 acres in western Las Vegas in the 1950s that eventually became Summerlin -- named for his paternal grandmother. His heirs over the years have been receiving payments from General Growth, subsidiaries The Howard Hughes Corp. and Howard Hughes Properties Inc., and their corporate predecessors as Summerlin land was sold off and developed.

The heirs were due to receive a final payment based on a 2009 appraisal, but that hasn't happened and General Growth has argued it has the right to cancel that deal because of its bankruptcy.

Last summer, a group of heirs appealed a ruling in the General Growth bankruptcy case in which Summerlin land -- estimated to be 7,400 acres -- was encumbered by liens so General Growth could obtain debtor in possession (DIP) financing. The heirs argued the land could not be used as collateral for the loan without their approval because that would jeopardize their interest in the property.

The heirs, organized as A&K Endowment Inc., charged in court papers: "The Rouse Co. (owned by General Growth) holds legal title to the Summerlin development but, until the purchase price is fully paid to the (sellers), does not have equitable title."

But in a ruling filed Tuesday, U.S. District Judge John Koeltl dismissed the appeal on both procedural and substantive grounds. Koeltl upheld bankruptcy court approval of General Growth's debtor in possession financing.

He noted that attorneys for the Hughes heirs had failed to raise several of their issues before the bankruptcy court and therefore were barred from doing so on appeal.

The judge also found that, contrary to A&K's arguments, Summerlin is benefiting from the debtor in possession financing as it's part of the larger General Growth enterprise.

"The appellant’s contention that the Final DIP Order creates a breach of fiduciary duties in connection with the Summerlin property is without merit. All of the properties used the central administrative services of the main debtor, and those administrative services depended on liquidity that could only be obtained through DIP financing," he wrote. "The Bankruptcy Court's finding that the Final DIP Order was necessary to preserve the value of and avoid immediate harm to the debtors' estates was not clearly erroneous."

Koeltl specifically upheld a finding by the bankruptcy court that "[a]s to the position of those creditors who are interested in the Summerlin properties, obviously they do not have a security interest. They are not entitled to adequate protection per se, and their interests are not being adversely affected in the bankruptcy sense by the lien being granted to the DIP lender."

The phrase "adequate protection" refers to financial assurances that courts may grant creditors whose interests may be compromised in bankruptcy cases.

As to the procedural issues in the case, the judge wrote: "Pursuant to this statute, the appellees (General Growth) correctly argue that the appellant’s appeal is moot because the appellant did not seek a stay of the Final DIP Order, the order was entered in good faith, and the proceeds of the DIP loan have been disbursed and the lien has attached to the Summerlin property."

Separately, General Growth on Tuesday rejected a $10 billion takeover offer from Simon Property Group, owner of the Forum Shops at Caesars and two Las Vegas outlet malls. General Growth indicated it's seeking a better offer or may continue reorganizing its finances with the goal of emerging as an independent company.

Here's the letter sent from General Growth to Simon responding to Simon's offer:

February 16, 2010

Simon Property Group, Inc.

225 West Washington Street

Indianapolis, IN 46204

Attention: Mr. David Simon, Chairman of the Board and Chief Executive Officer

Dear David:

Thank you for your letters dated February 8 and 16, 2010 in which you indicated Simon’s interest in acquiring General Growth Properties, Inc. (the "Company"). We appreciate that you took the time to meet in person with management, UBS and Miller Buckfire to explain your indication of interest, as well as provide your view on the timing and diligence process you require in order to convert your indication of interest into a fully documented definitive proposal. We have been discussing your letter with your financial advisors during this past week. Our advisors have also discussed our position with you as recently as yesterday. We and our board of directors have given considerable thought to your indication of interest and have concluded based on discussions with other interested parties that it is not sufficient to preempt the process we are undertaking to explore all avenues to emerge from Chapter 11 and maximize value for all the Company’s stakeholders.

As we indicated during our meeting, we are about to commence a process to explore several potential options for the Company’s emergence from Chapter 11, including a sale of the entire company as you have proposed as well as a capital raise. The company and its advisors have been working over the past several months to prepare the company to launch this process. We will be providing detailed information on the company, including a confidential information memorandum, financial projections, and asset level information to participants. We will also provide access to an electronic data room. As we are committed to fully exploring all potential options available to the company, we would like to include Simon as part of this process. We believe the information we would provide to you as part of this process will enable you to better understand the company, get to a higher valuation and provide a fully documented offer.

We understand from our meeting with you and the press release you issued this morning that time is of the essence. We feel the same, and intend to run our process in an efficient and expeditious manner. We are currently finalizing the information memorandum and plan to send materials to participants in the process by the beginning of March. We would expect to receive indications of interest within 4 weeks of the launch of the process. In order to expedite your participation and evaluation of due diligence information, we will be sending to you shortly a markup of the NDA you provided to us during our meeting in Chicago.

Again, we appreciate your interest and we recognize the potential value that Simon could bring as an option for the company to emerge from Chapter 11. The company intends to pursue the process described above and we look forward to your participation. However, we reserve the right to pursue any proposals that we receive prior to or after formally launching the process so that we can maximize value for all stakeholders of the company, and we reserve the right to change the process at any time we determine appropriate and without notice.

We would be happy to discuss this response further. To that end, you should feel free to contact either UBS or Miller Buckfire.

Sincerely,

Adam Metz

(General Growth chief executive)

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy