Associated Press File

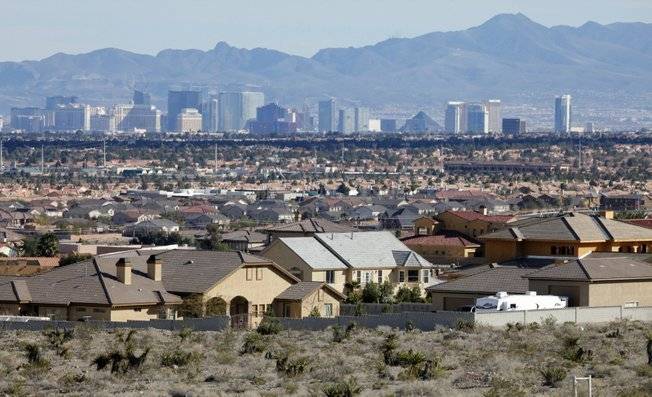

A new UNLV report shows Las Vegas isn’t expected to fully recover from the economic downturn for several years.

Published Tuesday, June 15, 2010 | 11:14 a.m.

Updated Tuesday, June 15, 2010 | 2:35 p.m.

Mary Riddel on the economy

Sun Coverage

Southern Nevada’s economy will continue to struggle for the remainder of 2010, won’t begin a rebound until the first quarter of 2011 and won’t fully recover for several years, according to a report released Tuesday by UNLV economists.

The turnaround in 2011, however, will be tepid at best, according to the Center for Business and Economic Research, which released its mid-year forecast. There is even a risk of a nationwide double-dip recession because recent employment and retail sales reports show the existing U.S. recovery is losing traction, said Mary Riddel, the interim director of the Center for Business and Economic Research.

UNLV economists forecast job losses will continue to mount the rest of the year, personal incomes will decline and gaming revenue will remain weak.

In Nevada, taxable sales dropped 20 percent during May and overall this year have dropped 8.1 percent compared to the same time last year, Riddel said.

“Overall, the Las Vegas economy continues to show mixed signals, which leads us to conclude that a recovery is not yet under way,” Riddel said. “On the other hand, all signs point toward nearing a bottom in 2010 and beginning recovery in 2011. ... The dramatic drop in gaming revenue and taxable sales means that new growth will begin from a very low level. It will likely be years before we see the same level of economic activity in Nevada as we enjoyed in 2007.”

More than gaming has to recover for the Las Vegas economy to rebound, Riddel added. Residential and commercial construction needs to bounce back and both sectors show no signs of doing that, she said.

Although applications for residential and commercial construction permits are up, they are 15 percent of what they were during the boom between 2003 and 2006, she said.

The stoppage of such major Strip projects as the Echelon, Fontainebleau, St. Regis Condo Tower and Wyndham Desert Blue led to lost construction activity of $1 billion in 2008 and $2 billion in 2009 and that still reverberates in the economy, Riddel said.

Since 2004, the region has lost about 120,000 jobs, and during the past year has lost 24,000 construction jobs, the report said.

The number of home construction permits will remain flat in 2010 and even fall slightly, Riddel said. The permits should increase 1.5 percent in 2011, she said.

“A definitive road to economic recovery in Southern Nevada cannot take place unless new jobs are created to offset the current continued bleeding of jobs in the construction sector,” Riddel said.

Given sentiments in the gaming industry, Riddel said she doesn’t expect any casinos to be built on the Strip until 2015 at the earliest and that could be further extended if more casino bankruptcies emerge.

In the forecast for a 2011 rebound, Southern Nevada faces some risks not only if the national economy slows but the international economy slows as well, Riddel said. If the financial crisis in Greece spreads and the value of the euro falls and causes U.S. exports to Europe to decline, that could impact tourism to Las Vegas, Riddel said.

In December, while some observers had touted CityCenter as a panacea for the economy, UNLV economists predicted the Southern Nevada economy would remain weak in 2010 and that the opening of CityCenter would cannibalize other gaming properties and cause discounting of rooms.

Riddel pointed to gaming companies’ lower profits in the first quarter, including how the Stratosphere owners blamed excess rooms on the Strip for its $2.7 million in losses.

“The addition of the 6,000-room CityCenter complex in December has meant an even more competitive environment for the hotel gaming industry,” the report said. “Hotel occupancy rates continue to fall even as hotels offer deep discounts on midweek room rates. ... In the near term, the tourism sector is likely to continue to struggle.”

UNLV economists forecast moderate growth in gaming revenue and visitor volume in 2010. Their forecast predicts gross gaming revenue will rise 1 percent for 2010 as a whole and visitor volume will increase 2.5 percent.

Occupancy rates should remain below historical averages for the remainder of 2010, but by the end of 2011, the low room rates should help boost visitor volume and bring occupancy rates closer to historical averages, Riddel said.

For 2011, UNLV economists project gross gaming revenue will rise 1.2 percent and visitor volume will rise 2 percent.

The report said Southern Nevada should expect continued job losses through the end of 2010 because the construction industry and retail sector continue to struggle because of falling visitor spending and cancellation of planned hotel projects. It puts the decline at 0.5 to 1 percent through the end of the year and overall, employment dropping 5 percent in 2010. Total personal income as a result will fall 1.5 percent in 2010, the economists predicted.

The unemployment rate may even rise in 2011 at first because more people who are out of the labor market will re-enter it, the report said. But as 2011 progresses, the rate will fall slowly as jobs are created in the hotel and gaming sector, retail industry and health sector. The rise in employment, however, is projected at 0.5 percent in 2011.

Economists said the planned construction of a wind-turbine plant in Southern Nevada will create 1,000 jobs and much-needed diversification in the local economy. Questions still remain about what can be done to boost economic growth, Riddel said. “The answer to those questions hinges on the will of the state and political leaders to create new avenues for economic diversification,” she said.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy