Thursday, Aug. 2, 2012 | 2 a.m.

Sun coverage

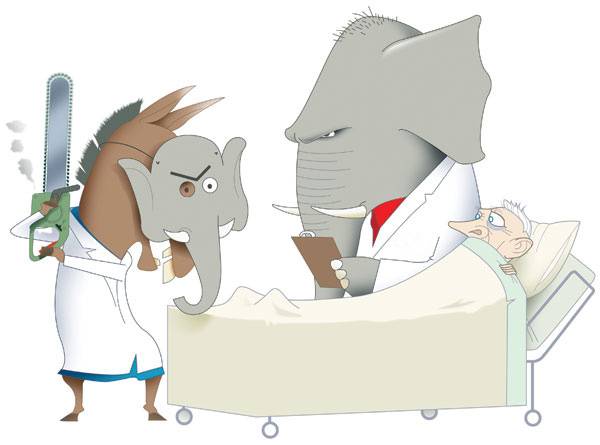

If the only information for you to judge Nevada’s U.S. Senate candidates came from attack ads on television, you’d probably think Republican Dean Heller wants to “end Medicare” and Democrat Shelley Berkley thinks nothing of chopping $500 billion from the program.

Indeed, so far, both candidates have been content to let the debate over Medicare be distilled into attack ads, wielding the program as a convenient political weapon rather than putting forward detailed plans for addressing the financial issues confronting the government-run health insurance plan that covers the nation’s senior citizens.

In response to requests from the Las Vegas Sun, representatives from both candidates have offered a broad description of how they would approach Medicare reform.

On some questions, the foes actually agree in philosophy, even if their voting records sometimes contradict those philosophies. Both oppose raising the eligibility age — even though Heller did vote for a plan that included a provision to do just that. Neither is a fan putting Medicare spending decisions in the hands of an appointed board — even though Berkley voted for a health care law that did just that.

On the larger question of how to deal with the financial stability of the program, the two come from different philosophies.

Heller believes a major overhaul of the program is needed to address the spiraling cost of health care in general. Berkley favors an incremental approach to finding efficiencies and savings within the budget.

According to the most recent trustees report, the Medicare trust fund is expected to be insolvent by 2024 — a date that was pushed back from 2016 because of changes enacted in the new health care law.

A further cause for concern is the growing cost to provide care. As a percentage of gross domestic product, Medicare spending will grow from 3.2 percent to 6 percent in 2040. Expenditures have exceeded income since 2008.

The path, analysts agree, is unsustainable.

Although the per-person cost to provide care is growing more slowly under the Medicare program than it is under private health insurance plans, the sheer number of people aging into Medicare is straining the program.

“Medicare has a financial challenge in financing care for a growing aging population,” said Tricia Neuman, senior vice president of the Kaiser Family Foundation, an independent health care policy think tank.

The urgency of the problem is relative, Newman added.

“In 1995, the fund was projected to be insolvent within six years,” she said. “Congress took steps at that time to slow the growth in spending. By that measure, it’s not as urgent a situation as now. But if you look at the demographics and the number of people coming into the program, there is some justification to ... figure out what to do about it.”

The choices aren’t simple and generally involved deciding who should shoulder the increasing costs.

In a budget put forward by U.S. Rep. Paul Ryan, Medicare recipients would shoulder a growing share. Instead of the traditional fee-for-service plan, individuals would be eligible for a certain amount of money to pay for private insurance. Unlike a voucher, the payment would be made directly to the insurance company.

But any gap in the cost would be borne by the individual.

Heller twice voted for that budget and once against it.

His spokesman, Stewart Bybee, said Heller “is not married to that specific proposal.” But he sees it as an option for addressing the fundamental problems facing the system.

“Whether it’s a premium support model or another system, the system itself needs to be addressed or it will essentially go bankrupt,” Bybee said.

Bybee stopped short of offering alternative proposals, other than saying the overall cost of health care must be addressed. Heller believes that can be done by addressing medical malpractice reform and giving individuals more control over their health care choices.

Berkley opposes premium support models.

But if the patient doesn’t shoulder more of the cost, who does?

Under the health care legislation supported by Berkley, an independent appointed board is tasked with finding savings in the program. The board can’t increase premiums or cut benefits.

Many experts believe the only option left is to address reimbursement rates for doctors.

Both Berkley and Heller have voted for annual legislation to protect reimbursement rates from being cut, the so-called “doc fix.” Such congressional intervention only places further financial stress on the system, according to the trustees report.

Although she voted for the bill, Berkley doesn’t necessarily support the Independent Payment Advisory Board.

“Like Dean Heller, Shelley Berkley believes that Congress is better equipped to address patient care than an independent board,” her spokeswoman, Xochitl Hinojosa, said.

In favoring incremental measures aimed at efficiency and cost cutting, Berkley supports many proposals put forward by the Center for American Progress, a liberal research group. They include stronger measures to prevent fraud and abuse, finding administrative cost savings through electronic records and processes, and allowing Medicare to negotiate drug prices.

“Shelley Berkley believes this is a good start to make the program stronger, but there’s definitely more to be done,” Hinojosa said. “She is open to examining more proposals and is dedicated to improving care for American families while controlling rising costs.”

This story has been edited to correct the dollar figure in the first paragraph. The headline also has been changed to better reflect the story.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy