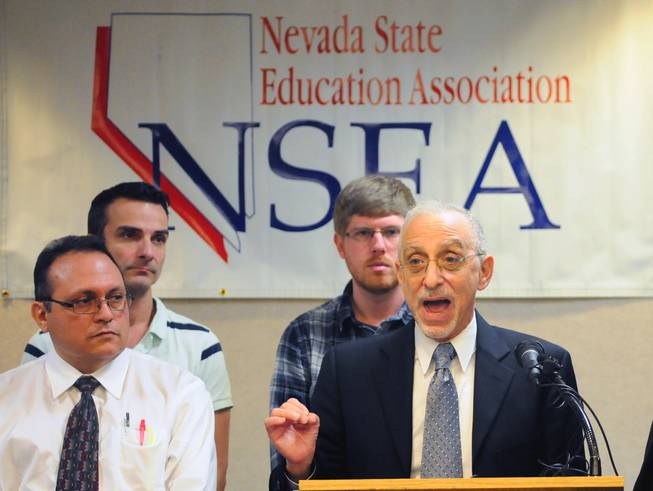

Gary Peck, the executive director for the Nevada State Education Association, argued for a 2 percent margins tax on businesses making more than $1 million during a press conference on Thursday, Jan. 31, 2013. Earlier in the morning, the Nevada Supreme Court overturned a lower court decision that invalidated the petition initiative.

Thursday, Jan. 31, 2013 | 5:05 p.m.

Nevada's teachers union rejoiced in the Supreme Court's decision Thursday to uphold a margins tax proposal to fund education.

The state teachers union has been pushing for a 2 percent tax on businesses that make more than $1 million a year after deductions, such as for payroll and cost of goods sold. The union estimates the tax could raise about $800 million in additional funding for K-12 education.

Thursday's unanimous Supreme Court ruling overturned a lower court's decision last year that invalidated the initiative on the grounds that the petition's 200-word summary was vague, misleading and incomplete.

"We are thrilled that the court saw fit to not thwart the obvious will of the people," said Gary Peck, executive director of the Nevada State Education Association. "That the courts said unequivocally there was nothing misleading, nothing confusing, nothing argumentative about the description of effects of this initiative."

The business tax now heads to the Legislature, which has 40 days from Monday to decide whether to enact it, according to the state constitution. If lawmakers decide not to approve the initiative, it will go to voters in 2014.

Peck argued the business tax would ensure that large corporations "pay their fair share," and would create "a dedicated stable source of funding for K-12 education so that every kid in our state genuinely has an opportunity to learn and succeed."

"That's just not a civil rights issue, that's an economic issue," Peck said. "The failure to invest in our public education system adequately carries with it very real fiscal costs, because kids who don't succeed academically are less likely to be employed, more likely to need public health assistance and are more likely to be incarcerated."

The union's initiative petition — which garnered more than 147,000 signatures — has been opposed by a coalition of business interests. The Committee to Protect Nevada Jobs argued the tax would hurt companies recovering from the recession.

Committee spokesman Paul Enos said his constituents were disappointed by the Supreme Court ruling. The committee had argued the petition was vague because it didn't outline how businesses not making a profit would be subjected to the tax, and that "not one dime is guaranteed to go to education."

Enos said he was worried the business tax would raise living costs for ordinary Nevadans and hamper job growth in Nevada. Business groups are now planning to take the tax fight to the Legislature and the public, Enos said.

"We think (the margins tax is) unfair because it affects every single Nevadan," Enos said. "This tax will hit everyone."

Gov. Brian Sandoval also maintained his opposition to the margins tax, pointing to his biennial budget that calls for $135 million in additional education funding.

"I believe that raising taxes at this time is the wrong thing to do because businesses are still struggling, unemployment is still unacceptably high and raising taxes would harm our fragile economic recovery," Sandoval said, echoing his comments on the tax during his State of the State address earlier this month.

Peck applauded the governor's plans to increase spending for full-day kindergarten and English-language learners. However, Peck said $135 million in additional funding "doesn't make up for the hundreds of millions of dollars that have been cut from the education budget" since the recession.

Peck pointed to studies that recommended that Nevada spend $135 to $150 million per year on English-language learners. Sandoval has proposed to spend $14-20 million in funding over the next biennium.

"That is inadequate; that is too meager," Peck said, calling Sandoval's proposed budget worse than that of former Gov. Jim Gibbons. "It will leave too many kids behind."

Peck remained optimistic that the Legislature will enact the margins tax within the 40-day timeframe set by the state constitution. The union has spoken with many lawmakers, none of whom has outright rejected the proposal, Peck said.

If the Legislature doesn't approve the margins tax, Peck said he is confident about its chances in the voting booth.

"We have no doubt that it will be passed by the people of the state of Nevada," Peck said.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy