Tuesday, Jan. 20, 2015 | 2 a.m.

AT THE PUMP

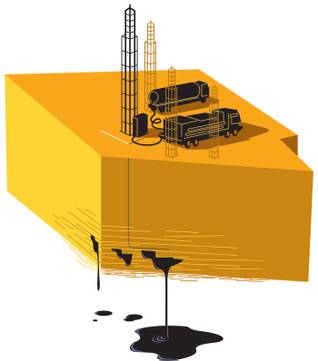

You’ve probably seen the effects of fracking and other new drilling techniques at the gas pump. The technologies are fueling a domestic energy boom unseen in the United States since the early 1970s.

Average price of gas in Las Vegas, Jan. 7, 2015: $2.41

Average price of gas in Las Vegas, Jan. 7, 2014: $3.24

Number of barrels of oil produced daily in the United States, December 2014: 9 million

Number of barrels of oil produced daily in the United States, December 2009: 5.4 million

Of 31 oil producing states, Nevada ranks No. 26. Texas is No. 1. Nevada produced 335,000 barrels of oil in 2013, while Texas produced more than 920 million.

Oil derricks and drilling rigs define landscapes across the West. But they seldom are seen in the dusty, wind-swept basins of Northern Nevada.

Those days, though, soon may be over.

Discoveries of untapped oil, coupled with new drilling technologies such as hydraulic fracturing, or fracking, have two energy companies hedging the potential for Nevada to become an oil-producing state.

Those prospects, however, come with sharp criticism from environmental advocates who fear that increased drilling could jeopardize the state’s water supply and propel the nation’s dependence on fossil fuels.

Talk of Nevada oil production comes as a domestic energy boom is undercutting oil prices but providing jobs to U.S. workers and tax revenue to state, local and federal coffers. If energy producers could make Nevada gush, the state also would see more jobs and a new stream of taxable revenue.

Fracking, which is the catalyst for the drilling debate and a major factor in low gasoline prices, is the centerpiece of Nevada’s controversy.

It is a relatively new word in the American lexicon, but the process has been around for decades. Energy producers blast chemicals, water and sand a thousand or more feet below the ground to break loose rocks encasing deposits of oil and natural gas.

Industry giant Noble Energy applied for at least 18 fracking permits in hopes of tapping an underground oil deposit east of Elko. Noble surveyed the deposit, known as the Wilson play, along with Wyoming-based Kirkwood Oil and Gas.

In Nevada, Noble’s plans include spending $16 million to $32 million to drill four wells to transport fossil fuels from below ground to above ground, according to the company’s earnings reports.

Noble’s arrival signals major potential in a state not known for fossil fuel production. But it doesn’t guarantee a boom.

One setback for Nevada’s production is the global price drop. Cheap gas means less revenue for producers such as Noble and discourages exploring and drilling in unproven areas. Instead, it’s easier for companies to stick to hot spots with a track record.

But producers assume prices won’t remain low forever. So Noble and Kirkwood are treating Nevada as a backpocket asset for when the glut wanes and prices rise.

Nevada never has been much of an oil producer. Of the 31 oil-producing states, Nevada ranks 26th, having produced 335,671 barrels in 2013. Texas, the No. 1 state, produced almost 300 times as much — about 923 million barrels.

There are huge resources in Northern Nevada, said Steve Kirkwood, a partner with Kirkwood Oil and Gas. But hard-to-reach shale formations cradling the oil have made it difficult for the company to start pumping large quantities, he said.

“It’s still a science project,” Kirkwood said of extracting oil from the rocks.

A new horizontal drilling technique, now used across the country, allows producers to drill vertically (the traditional method), then after digging hundreds or thousands of feet below the ground, laterally, to access geologically hard-to-reach oil deposits that once were impossible to access. The technology’s marriage with fracking sparked the recent energy boom and will be the technique that will make or break Nevada as an oil-producing state.

Nevada’s underground geology, though, is unlike other areas in the country. Noble remains uncertain whether it’s worth the effort to access what’s underground, said Mike Visher, deputy administrator for the Nevada Division of Mineral Resources.

“We’re still a frontier state for these unconventional plays,” he said.

Noble did not return multiple requests for comment. But at an investors meeting in October, company officials said initial wells have proven the “productive nature” of the Nevada project.

Environmental advocates intent on weaning the nation off fossil fuels aren’t rosy about the prospects in Nevada. They have concerns about water contamination and consumption, emissions and prolonging a dependency on fossil fuels in Nevada and nationwide.

Gov. Andrew Cuomo banned fracking in New York in 2014. Towns in Colorado and Ohio have done the same, despite facing lawsuits from energy companies questioning the legality of the bans.

Lawsuits to ban fracking in Nevada are in the works, said Bob Fulkerson, state director of the Progressive Leadership Alliance of Nevada.

Fulkerson said a cohort of activists, ranchers, farmers and tribes have banded to oppose Noble. He said their biggest concern is fracking fluids leaking from wells into underground aquifers.

“It’s not just legal opposition,” Fulkerson said. “You will see much greater outcry about turning Nevada into an industrial wasteland and threatening the state’s most precious resource.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy