Sam Morris

House flipping was a hallmark of last decade’s real estate bubble, when investors, backed by easy money, bought homes and sold them for profit a short time later. Few places got as crazed with flipping as Las Vegas.

Wednesday, Aug. 17, 2016 | 9:45 p.m.

Las Vegas’ distressed housing problems continue to improve but remain among the worst in the country, new reports show.

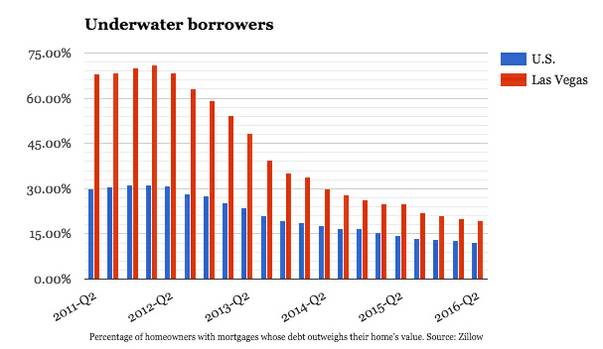

An estimated 19.5 percent of Las Vegas-area homeowners with mortgages were underwater — meaning their debt outweighed their home’s value — in the quarter ending June 30, according to listing service Zillow.

That’s down from 25 percent in the same period last year and far below its peak of 71 percent in early 2012. But Las Vegas’ current rate was highest among the 35 metro areas listed in Zillow’s report.

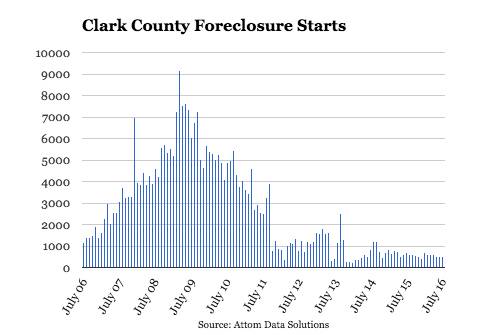

Meanwhile, one in every 718 homes in the Las Vegas area was hit with a foreclosure-related filing last month. That’s down 23.5 percent from July 2015 but still 10th-highest among large metro areas, according to Attom Data Solutions, parent of RealtyTrac.

Atlantic City, rocked by casino closures the past few years, was No. 1, with one in every 332 homes hit with a filing.

Attom tracked default notices, scheduled auctions and bank repossessions for the report.

Las Vegas was ground zero for the housing boom and bust last decade — rapid construction and soaring property values followed by a near-stop in development, sweeping foreclosures and underwater borrowers on practically every block.

Lenders repossessed about 4,000 homes per month in the Las Vegas area at various times during the recession, according to RealtyTrac, and Las Vegas’ peak rate of underwater borrowers was more than double the top U.S. rate, Zillow says.

Here’s a look at foreclosure starts — when lenders file papers to begin the repo process — and underwater borrowers over the years:

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy