From left are Dennis Smith, Dale Gibbons, Jeff Hardcastle and Jeremy Aguero. Gibbons is chief financial officer for Western Alliance Bancorporation, parent company of Bank of Nevada. Smith is president of Homebuilders Research Inc. and a member of the Southern Nevada Homebuilders Association. Hardcastle is the state demographer and Aguero is a principal analyst with Applied Analysis, a financial advisory and economic consulting company.

Sunday, Aug. 3, 2008 | 2 a.m.

Economic Roundtable

Local experts discuss the state and future of Las Vegas' economy.

Reader poll

Sun Topics

For those of us who thought we lived in Boomtown U.S.A., the dramatic downshift in the economy has been unsettling at the least, jarring for many.

On Friday, Boyd Gaming paused work on Echelon — eight floors above the ground — until it can figure out how to pay for its $4.8 billion hotel-gaming complex on the Strip. Just that fast, 800 construction workers were sent scrambling for other jobs.

MGM Mirage has run into delays in financing a remaining piece of its $9.2 billion CityCenter project.

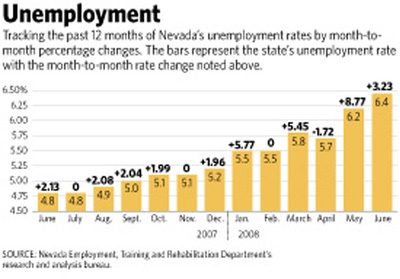

The jobless rate in Nevada climbed to 6.4 percent in June, the highest rate in more than 14 years.

Airlines are questioning the need for a third terminal at McCarran International Airport, unsure whether they can sell enough seats as fares go up and flights are cut back.

Tourist spending is down. Nevada’s gaming revenue is down 15 percent, the worst in more than a decade.

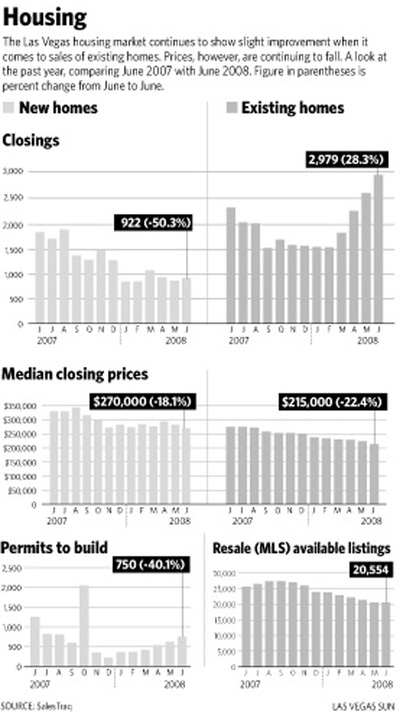

New-home construction remains stalled, and the median price of a home is about $270,000, down from $329,000 two years ago.

Nevada leads the country in the rate of home foreclosures.

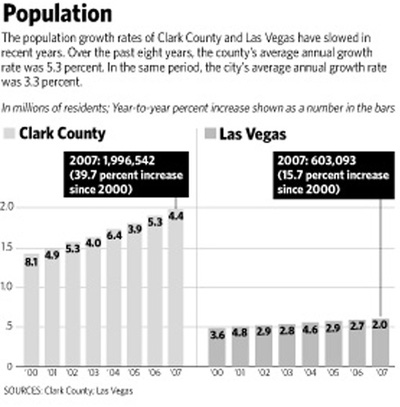

We’re no longer holding the pace of 5,000 new residents a month. The school district is reexamining how many schools to build.

Bottom line: We’re in the midst of the worst economic downturn in several decades.

Las Vegas will recover, but it won’t be as soon as we’d like.

That’s the consensus of four economic and home construction experts gathered by the Sun to discuss challenges facing Southern Nevada — what’s gone wrong and where we’re headed.

The participants for our Sunday conversation:

• Jeff Hardcastle, the Nevada state demographer.

• Jeremy Aguero, a principal analyst with Applied Analysis, a financial advisory and economic consulting company.

• Dale Gibbons, chief financial officer for Western Alliance Bancorporation, parent company of Bank of Nevada.

• Dennis Smith, president of Homebuilders Research Inc. and a member of the Southern Nevada Homebuilders Association.

The discussion was held Wednesday — before Boyd’s decision to pause construction on Echelon for up to a year, which will only exacerbates the economic challenges faced by Southern Nevada.

The remarks by our roundtable participants have been edited for space and clarity.

Jeremy Aguero, with Applied Analysis: The economy is the worst it’s been in 30 years. It’s reminiscent of the economy of the early 1980s.

The question is whether this is part of a cycle, or have we hit some mythical tipping point? If you look over the history of Southern Nevada, it’s pretty clear that we run in very well defined cycles. We have for the past 30 years. The cycles are dictated mostly on the opening of major hotels and casinos.

Although we have diversified, we are among the narrowest economies in the United States. One in every 10 jobs created (has) been in the hotel-casino industry, and 50 percent of our employees are dependent on two industries: tourism — including hotels and casinos — and construction.

Both of those are cycling down concurrently, and that’s creating a unique circumstance.

Dale Gibbons, chief financial officer for Western Alliance Bancorporation: Clearly there was a situation where we were riding quite high. If you look at any five-year period, going back three decades, Nevada has been the fastest growing state in the country.

Now we’re No. 1 in the foreclosure rate, and we’ve recently shown the steepest declines in home values. So I concur that things are on the downside. But we still have population growth in excess of 3 percent, which is extraordinary compared with the national average.

Jeff Hardcastle, state demographer: The fact that we have a monopolistic industry, gaming, plus housing, available water and easily developed land, especially in contrast to California, is important.

Job diversification is also important because it helps cushion the loss of residential construction jobs. We’ve seen 15,000-plus jobs lost in the Las Vegas economy in the last few years, primarily in the construction sector.

Aguero: We’ve lost 10,000 jobs in the private sector. That means we’re going to have less in-migration. It happened during the early 1970s, the early 1980s, the 1990s, and during the time leading up to Sept. 11.

The reality is, fewer people are moving into Southern Nevada today and more people are moving out of Southern Nevada. And the reality is, we have a less robust economy.

We’re developing office space, industrial space and retail space for the next 100,000 people moving here. But if those 100,000 people don’t come, we’ll see rising vacancy rates, like the office market that’s currently almost 17 percent vacant.

Dennis Smith, president of Homebuilders Research: The homebuilding industry is in hibernation. Homebuilders have not given up on Las Vegas. They’re just adjusting to the current situation. The housing cycle is nothing new.

But this situation may be unique because first we had a housing oversupply, and then we had credit problems.

The Las Vegas situation seems much worse than it likely is. Because if you look at some of these other so-called hot markets around the country, you’ll find that most of these other markets are in much worse shape than we’re in, in terms of supply.

We’ve got people who are moving away from Las Vegas for strictly economic reasons. They’ve lost the wealth they believed they had in their houses.

Things will change here, but it’s going to be a longer fix than most people in Southern Nevada are accustomed to. I see an extended recovery period.

Gibbons: We’re being affected because we’re a high-growth market but now fewer people are moving here.

Aguero: We got to an inventory of 30,000 unsold new homes when we should have had only 13,000. The worst case scenario would have been if we had gone up to 50,000 to 60,000 available homes.

If homebuilders had continued along with that production pattern, and it ended up there wasn’t enough demand for those excess houses, we would have had a much worse problem than we now have.

Smith: I think the new home segment has pretty much bottomed out, and it will stay flat for months to come. And the resale segment is softening somewhat, and will continue to soften. As a result, prices will lower in that segment.

Frankly, the prices for new homes are as low as they’re going to get. Builders can’t build them and sell them for any less. It’s that simple.

The supply of new, unsold homes in Vegas is low — less than 1,000 units. You can’t say that about resale. The resale segment is going to continue to grow because of the credit situation we have today.

I don’t think the housing turnaround that Las Vegans are accustomed to seeing is as close as most would hope.

Aguero: But we have something in our hip pocket. Unlike other markets in the United States, we have $36 billion worth of construction going on in our core industry, gaming.

Encore is going to open up here by the end of the year — that’s 5,300 jobs. CityCenter is worth another 15,000 jobs. You have Fontainebleau — another 8,000 jobs, plus or minus, coming down the pipeline.

I’m not here to suggest that every one of those jobs will necessarily materialize. But I don’t think you can point to many other markets with that level of investment in their core industry.

Hardcastle: You do have projects for job creation that will be coming on line. But I think there are a few things that could throw a big monkey wrench into the whole thing.

To fill those jobs, you need to see some serious in-migration in the next year or two, or have unemployed people move into those jobs. And we have a fairly high unemployment rate right now, so some of those people may be absorbed.

So you’ve got this potential drag on getting workers in, plus you’ve got an uncertainty with fuel prices and airline prices, which is discouraging travel.

The big question is, what comes after the big projects underway are concluded? What happens to those people with construction and other building-trade jobs?

Gibbons: I think the amount of projects going on the Strip is a huge pull. And that pull will be met. These are going to be relatively well-paying jobs. I don’t expect our unemployment rate to rise more than what we’re facing today.

Granted, we will see a reduction in construction jobs at that point. But once these projects come on line, I’m pretty sanguine about the future.

Aguero: And as bad as it is right now, you’ve got to be encouraged about the number of applications that (Steve) Wynn’s already receiving on his Encore project.

I think we should look at the lulls that we had before the opening of the Mirage in 1989, before the opening of MGM Grand in the mid-1990s, and before the Bellagio and Venetian opened.

You can compare what’s happening now to the lulls in any of those periods, though they may not have been as deep.

Gibbons: At the same time, I think you’re going to see some pent-up demand in terms of housing. And I think the rental market will end up being stronger.

Aguero: There is no community that has added as many employees to the market in the past decade, or that has added as much population per capita in the past decade. Likewise, there is no community that built the number of houses per capita in the past decade.

There is no community in the United States that added more personal income from the past decade. That’s where we are today.

We’ve got an attractive tax structure, and we’re still marketable to retirees. I don’t think there’s another market with the same level of per capita in-migration of retirees.

These fundamentals all still apply. Nationally, it’s still gloomy, and people are taking fewer vacations than has been the case in a long time.

But if the perception is that we’re at this tipping point, that we’re no longer a great place to live, or to come and visit — I think it would be wrong to draw that conclusion.

Smith: As far as bottoming out, I think we are seeing that as far as the housing market.

One realtor said that while foreclosures are happening, the type of properties that are for sale are “good properties,” and have had multiple offers.

I’ve heard about lots of situations where properties are being sold for more than list price. I spoke to a person yesterday who said he made an offer at list price but lost out to a person who offered $30,000 over that price.

So while we have properties that are selling for list price, it appears we are starting to establish a higher price level for those properties.

If you want to gamble on prices still dropping, go ahead. But today I know that the prices are as low as they’re going to get in most instances. And I also know that the interest rates are going up.

I would rather take a lower interest rate and get a low price that I know is a good price today, than wait to see if it might go still lower. It could go lower because some of the foreclosures in the resale situation, I agree. But I would suggest that now is as good a time as any. I can’t say it’s going to get better.

The market will take care of it. Let the business cycle go. It will take care of it itself.

Aguero: I sort of have a free market attitude like Dennis. We have the ability to see that we’re in a cycle and bring the fire trucks up to the front, understanding that the other side is worse.

If you’re sitting in the shoes of the state Legislature or the government at large, I think the reality is that cycles run. I think the government needs to recognize two things: One, that revenues increase very rapidly, and two, they decrease very rapidly.

If we can recognize that, I think we can be better prepared the next time it happens, because it will happen again.

Smith: Hopefully someone, somewhere can learn from history. Have we learned enough? Probably not.

Aguero: Is Las Vegas recession-proof? That was the question everybody asked for a long time. And the answer to that is “no.” That’s never been true.

If you look at our history, we’ve been resilient and resourceful through a handful of recessions. And I think locals would argue that we’ve come out stronger each time – something that’s unique to Las Vegas.

Southern Nevada’s narrow economy, dependent on two industries, tourism and construction, was uniquely positioned to be hit hard.

So, we ride it out by relying on what made us the most successful economy in the United States in the past 20 years. We build on these fundamentals and we try to take steps to mitigate the pain of the downturn while we can.

The market is fixing itself. It will take time, but it will fix itself.

Population shifts are another thing. Twenty four months ago, Dennis and I were in front of a committee on housing, and they were berating us for a lack of affordable housing.

But the answer is not going to be affordable housing. It’s going to be housing prices if we can’t sustain growth. What will that mean in terms of a loss of equity?

Hardcastle: There are questions regarding wages, not just housing prices. National Public Radio had a story recently saying that Las Vegas was the mortgage default capital of the country.

The problem is not just pricing got driven up by speculation — but also wages.

For casino workers looking to make a good wage, to get into a Mirage or a Bellagio, say, you have to work your way up.

The El Cortez, the type of place where lots of casino workers start out, doesn’t pay as much as the Mirage. So we’ve got an imbalance of income.

Aguero: But you are going to get paid more in the construction and tourism industry in Las Vegas than almost anywhere else in the United States. And the cost of living is substantially higher in other places, too.

Hardcastle: There are people moving here who think they can easily make a great wage, but in reality there’s a wide range of incomes here.

We hope people continue to move here. If you don’t have workers who are trained or the capacity to train them, we’re going to have to import those workers and have the facilities to train them.

Aguero: I’m bullish on Las Vegas. I don’t have a crystal ball, but if history is any kind of a guide, I like our chances in the next five years.

Smith: The optimism in Las Vegas is not as shiny as it was, but it’s still there.

We know there are “X” number of casino hotel rooms to be completed. I don’t know if 2011 is the date. It could be 2015, or 2018. It depends on the financial markets.

When money starts to flow again, when that situation starts to improve, we’ll have a clearer picture of how long it’s going to take.

I think we need to realize in Las Vegas that we have a limited supply of land. So as long as you have finite resources, is it safe to say that sometime in the future there will be a run-up in prices again? Yeah, sure it can happen again, assuming those dynamics of limited supply are still there.

I think it’s unrealistic not to be somewhat bullish on the long-term growth of Las Vegas. Now, short term, sure there are going to be some spots in the road. But we’ll get through this.

Hardcastle: I’m not saying that I’m not bullish. But look out beyond the Las Vegas Valley.

Look nationally. Because the question is: Is the hotel-casino business structure sound? Regarding the airlines, the industry has been underpricing tickets for some time and that has finally been catching up with them.

Thirty percent of our visitor volume on a good day comes from California. And some of that comes from flying, not just driving. But the other 60 or 70 percent are from Colorado, Utah or Arizona — and a large chunk of those people are flying in.

And there are other challenges.

More people went to gamble in Macau for the New Year than Las Vegas. That’s the first time that ever happened. We’re now having to compete harder for international tourists.

Aguero: That’s not new. Macau is certainly a new and different location. But we were warned in the early 1970s that all the high rollers would go to Atlantic City.

We heard in the mid-90s that gross casino revenue from California tribal gaming had exceeded that of Las Vegas.

But the reality of it is, in regard to tourism, it seems to me that it is always a growing pie. We may be getting a slightly smaller piece, but we’re getting a piece of a slightly larger pie.

In regard to Macau, the vast majority of people traveling there never had the opportunity to come to Las Vegas.

Having brands like Wynn and MGM throughout the United States will make those brands stronger. One question we have to ask as these markets develop is, should these companies, with gas prices being what they are, invest more in various satellite facilities rather than strictly in Las Vegas? I think that’s a fair question.

The Sun: In investment terms, is Las Vegas a safe investment, a somewhat risky one, or is Las Vegas volatile?

Smith: I think if you’re going to invest long term, Las Vegas is a pretty safe bet. I think the volatility is always going to be there, but I think it will be lessened because of the growth of the area.

Aguero: I agree that gaming stocks are undervalued. I believe that investment is the right one.

Smith: To me, the number one issue is the lack of financing that is curtailing construction.

Gibbons: I’d call it economic malaise. Gaming revenues are down 16 percent, McCarran is down 5 percent.

At the end of the day, it comes back to the notion that we are in a slump.

And I think we’re going to get out of it, but again, there’s not a lot that can be done.

Aguero: I think the biggest issue for Southern Nevada is making sure not to turn our community into a cash cow.

It’s as though we think that we no longer have any responsibility to invest in our long-term health as a community. If we can’t learn to invest in things like transportation or public education, I think we’ll have real problems.

The reality is that we’ve created an economy that basically relies on two industries, construction and tourism. Diversification is necessary. Tourism will always be part of our future, but it can’t be the only part.

Sun reporter Mary Manning transcribed this conversation.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy