Sunday, Sept. 28, 2008 | 2 a.m.

If there was any lingering doubt among bankers and investors about a years-long hiatus of resort construction on the Strip, the recent meltdown on Wall Street — highlighted by the Lehman Brothers bankruptcy, bank consolidations and thousands of layoffs — has cemented that outlook.

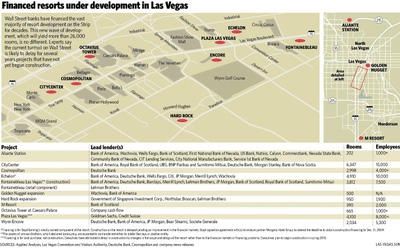

Like the strong aftershocks of an earthquake, the latest shaking won’t necessarily topple projects under way. But it will mean a longer wait before others, such as Boyd Gaming’s Echelon resort, the proposed Plaza Las Vegas resort and land intended for the now-scrapped Crown Las Vegas resort, can get in the game, analysts say.

It’s the corporate version of what’s playing out in the housing market, only with casinos instead of homes: Banks are reluctant to take on new loans because they can’t resell them, and they are taking losses on existing ones.

What it will mean for Southern Nevada’s economic landscape, experts say, is fewer job-creating casinos will be built. When lenders do put cash down in Las Vegas, they will be more cautious, sticking with established companies.

“The financial community needs to clean their balance sheets before they can begin to lend to corporate America,” bond analyst Dennis Farrell Jr. of Wachovia Capital Markets said. “Banks are lending money, but the standards have tightened dramatically.”

Banks have more reason to be cautious about Las Vegas resorts than your average home lender, even in the nation’s home foreclosure capital. Although many industries, such as retail, have suffered more than casinos, the effect of the economic downturn on Las Vegas has been more dramatic than expected. Gambling was once believed to be resistant to recessions, but that theory has been disproved on an unprecedented scale, with the latest Nevada figures showing slot machine play off by more than a billion dollars from a year ago.

In many cases tourists are spending less on everything else, including rooms, entertainment and food. It has also become more expensive for visitors to get here.

Investment banks — from Wall Street giants to smaller, regional banks — have financed every major resort in Las Vegas for decades. In this post-meltdown world, the investment banks that remain are converting into traditional bank companies anchored by cash deposits rather than corporate loans.

Banks will eventually lend to new projects but likely at higher interest rates, Deutsche Bank stock analyst Bill Lerner said. Their overall tolerance for risk will be low “for some time,” especially now that other avenues for financing major resorts — selling off condo units and retail centers, for example — aren’t working right now.

Also dampening Wall Street’s appetite for Las Vegas: disappointing early results from the Palazzo, which opened in January as the newest Strip resort. The Palazzo has an impressive customer list from its neighboring Venetian resort and sister properties in Macau as well as one of the top management teams in the business. With the Palazzo’s challenges, bankers are questioning the prospects for new resorts without those advantages.

Meanwhile, other unknowns loom large for the state’s primary economic engine, especially in 2009, which is expected to be another difficult year. Will the airline industry recover, bringing new flights at lower rates to Las Vegas? Will consumers loosen their purse strings?

Some executives and financial experts are pinning their hope on a turnaround in 2010, in time for several new resort openings.

Officials of Boyd and Plaza’s El Ad Group are responding differently. Boyd is hoping banks will rebound next year so it can resume construction on Echelon, and El Ad executives say they are delaying construction at the Plaza site until spring 2010 to retool their plans for the resort rather than because of market instability.

It’s not all bad news in the fallout on Wall Street. Removing additional competitors from the pipeline will cushion the blow for casinos combating this downturn, such as MGM Mirage, Harrah’s Entertainment, Wynn Resorts and Las Vegas Sands. These companies had once contemplated an epic battle to fill more than 40,000 new hotel rooms in the next few years. They will now have more time to generate demand for about 26,000 new rooms.

The giants won’t escape this retrenchment on Wall Street without a scratch or two. Gaming companies emerged from the credit boom more leveraged than ever. Some have violated loan agreements as their cash-to-debt ratios have soared. Some companies will need to refinance their debt, most likely at higher interest rates. MGM Mirage faces higher rates as it attempts to secure the final piece of its CityCenter financing.

Projects that might have made sense a couple of years ago, Farrell said, aren’t going to fly. “How is someone supposed to pay more than $10 million an acre for land, borrow the money they need (to build a resort) and then compete with a $9 billion destination resort like CityCenter?”

This wave of conservatism on Wall Street will hurt speculative projects the most.

In a town where questionable designs such as the Stratosphere and the Aladdin lured millions from Wall Street, “speculative” used to mean eccentric ideas from entrepreneurs lacking a background in casino management. Today, analysts say, it more likely means projects that aren’t backed by companies with established track records.

With the primary source of Las Vegas’ casino financing running dry, more insiders are looking for cash in the Middle East, and specifically, the business-friendly, tourism-driven emirate of Dubai. Wealthy from oil and real estate, Dubai has made multiple investments in Las Vegas companies, the largest being Dubai World’s half interest in the $9.2 billion CityCenter.

Dubai’s interest in Las Vegas — its unofficial sister city in desert megaresort development — is clear. Yet, even a part of the world little affected by the U.S. downturn won’t be rash with money during an uncertain time in Las Vegas, analysts say.

Dubai World is raising money for CityCenter, after which the government-controlled conglomerate may acquire more shares in its CityCenter partner MGM Mirage, Farrell said. “As oil continues to trade higher, their purchasing power only increases,” Farrell said.

Largely lost in the news about project cancellations is the long list of under-construction megaresorts financed just before the blowup on Wall Street. They represent, in cost and scope, the most formidable competition to hit the Strip. The money stakes have never been higher.

Easy money from Wall Street made possible the biggest building boom on the Strip. Now, Wall Street conservatism could make the gaming industry more like the movie industry, with fewer experiments by newcomers and more variations on a theme from the usual suspects.

That, some say, could be bad for a town that was built on entrepreneurial visions.

During these leaner times, Farrell says, investors may choose to renovate existing properties rather than build new ones. This has happened in turbulent markets such as Miami, where developers have bought and refurbished older hotels.

All this will likely mean fewer jobs.

Each Las Vegas hotel room generates about two jobs directly, according to research firm Applied Analysis. When the broader economic effect of resort building is considered, as many as seven jobs across the Las Vegas Valley can be traced back to construction of a single hotel room.

But it will take time before the state’s gaming engine has enough momentum to pull off another growth spurt, Applied Analysis partner Jeremy Aguero said.

Until then, banks will be “hunkering down, building their reserves.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy