Streamline Towers in downtown Las Vegas has closed on only 10 percent of its 275 units, according to Las Vegas research firm SalesTraq.

Friday, Feb. 6, 2009 | 2 a.m.

Sun Topics

The credit crunch and economic downturn are taking their toll on the Las Vegas high-rise market.

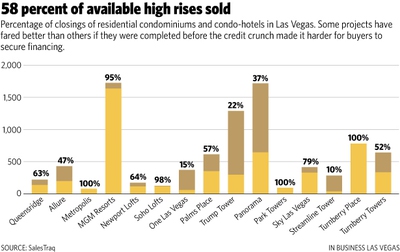

Las Vegas research firm SalesTraq reports that of the 15 high-rise projects in the valley, nearly half have less than 60 percent of the units sold. And of those already sold, a growing number are in foreclosure proceedings.

The state of the condo market and inability of developers to close out units are expected to lead developers to rent units until the market rebounds.

The condo-hotels are probably the hardest hit, but in the best position to deal with it, SalesTraq President Larry Murphy said. The reason is properties such as Palms Place, which has 57 percent of its units closed, can use units nightly because it’s part of the Palms, Murphy said. Trump Tower, because of its locale and proximity to casinos, is in a good position to lease units on a monthly basis, Murphy said.

“The ones that are going to have the biggest issues are those farther off the Strip and not connected to anything,” Murphy said. “I think it is going to be harder renting rooms if they are not next to a casino.”

Streamline Towers in downtown Las Vegas, for example, has closed on only 10 percent of its 275 units, according to SalesTraq. One Las Vegas, which is south of Interstate 215 on Las Vegas Boulevard, has closed on 15 percent of its units.

Condominium sales have slowed because the credit crunch has prevented many buyers from securing financing. Others have simply walked away from their deposits because the opportunity to flip the units is gone as the units have decreased in value.

SalesTraq reports that 58 percent of the high-rise residential condominium and condo-hotel units have been closed on in the valley. Those who have fared the best, such as Signature at MGM Grand, a condo-hotel, had their projects completed before the deep slide in the housing market.

Streamline is at the bottom.

“What that tells you is that we have a pot load of inventory left,” said Steve Bottfeld, executive vice president of Marketing Solutions. “It definitely is a challenge.”

Many developers are trimming prices to lure buyers. Newport Lofts, a downtown Las Vegas residential condominium project that has closed on 64 percent of its units, has slashed prices in half in some cases with units going for under $200,000, Murphy said. The reason in part is developers are competing against their own buyers who are selling their units as part of short sales to ward off foreclosure.

In its most recent condominium report in November on resale closings, Restrepo Consulting said the median square feet of residential condos were down more than 35 percent and condo-hotel units were down in price by 30 percent compared with the year before.

“We have homeowners who for the most part bought as an investment and intended to flip them to make a profit,” Murphy said. “The first ones in were those who had success, but we are seeing a substantial amount of foreclosures for (the second wave) buyers who paid higher prices. We are seeing foreclosures in the high-rise market just like the rest of the housing market. It is not immune.”

With only 58 percent of the condominium units closed in Las Vegas, passers-by see plenty of unlit rooms at night, Murphy said. That already is a common occurrence because many condominium buyers are purchasing second homes and spend only part of the year here, he said.

What stands out in the statistics is that Trump has closed on only 22 percent of its 1,282 units while Palms has closed on 57 percent even though both started closing about the same time, Bottfeld said.

As the credit market was drying up, properties with a higher number of closings had better programs in place to retain buyers and help them obtain financing, Bottfeld said.

“The question you have to ask yourself is what went wrong,” Bottfeld said. “I think (Trump is) the poster child for what went wrong in high rises (because of the credit crunch).”

Eric Trump, vice president of development and acquisitions for Trump, said the condo-hotel tower has closed on more than 400 units — more than 30 percent.

Trump said that number is growing, but said it’s no secret it’s been much tougher for buyers across the country to secure financing. Trump has been working with its buyers and has done better than most because of its brand, he said.

“I think we have done well in comparison to the harsh reality in a market like Las Vegas,” Trump said. “I feel sorry for projects coming on later in the year and next year.”

Trump has yet to institute an already-publicized leasing program despite developing a brochure touting rentals of its condo-hotel units as apartments.

“We are considering it, but we have not rolled it out,” Trump said. “Quite frankly, we may never do it. We are still evaluating whether it is right for us.”

Rental of high-rise units makes a lot of sense for any developer who has outstanding loans and doesn’t want to give the units back to the lender, Bottfeld said. It’s also for those who would rather generate revenue than eat through their reserves, he said.

“You don’t have a whole lot of options here; that’s the critical issue,” Bottfeld said. “There are not a lot of investors who can get loans today. And I think it is going to be spring at the earliest before banks begin to lend again. I think the problem is going to remain right where it is for at least another three to six months.”

For now, many developers are biding their time hoping buyers can close and taking steps such as rentals to cushion any blow.

Panorama has just started closing on its 373-unit third tower and that accounts for the developer closing on only 37 percent of its complex. About 75 percent of the tower was presold, officials said.

Sarah Prinsloo, executive vice president of sales for Allure Las Vegas, said her complex is approaching 50 percent closure and more units are in escrow.

The tower was sold out initially but some buyers walked away from their 20 percent deposits because they couldn’t obtain financing or no longer felt the price they were paying was worth it, she said.

Allure has cut prices as much as 30 percent to 50 percent as part of its strategy to sell 30 units below construction costs, Prinsloo said. Only a limited number are being sold at those prices so the developer can pay off is construction loans, while the rest will be held in reserve and leased until the market recovers, she said.

“We are lowering our prices to compete with the short sales in the market,” she said.

Others, such as Sky Las Vegas and Turnberry Towers, aren’t offering discounts but renting out units and waiting to sell them when the market returns, analysts said.

“They are holding back because they know it is going to be several years before high rises are going to be built again, and they are not going to give them away because of the current market situation,” luxury high-rise Realtor Bruce Hiatt said. “They know once they are gone, they are gone.”

Prinsloo remains optimistic that the high-rise market is poised for a comeback because there is a limited number of residential condominium towers near the Strip. They include Sky Las Vegas, Allure, Panorama and Turnberry. CityCenter will add to the residential mix when it opens later this year.

“This is still some of the most valuable property in Las Vegas,” Prinsloo said. “Nobody is building anything new. I don’t look for any new luxury high rise for a minimum of five years and maybe longer than that.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy