Sunday, June 21, 2009 | 2 a.m.

Enlargeable graphic

Sun Archives

- Premium concern (8-20-2004)

- Eliminating 'double-dipping' rule could reduce rates (8-20-2004)

Sun Coverage

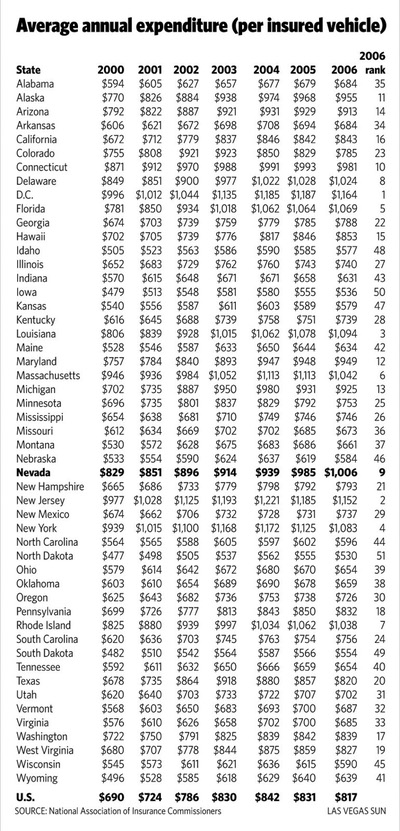

Nevadans are burdened with some of the highest auto insurance premiums in the country, according to a Sun analysis.

The state’s residents spent a bit more than $1,000 per year, per vehicle, in 2006, the most recent year for which statistics are available. The figure is 23 percent higher than the national average and ranks the state ninth in the nation, behind high-cost states such as New York and New Jersey.

The above-average premiums amount to hidden taxes on residents.

Like other phenomena in Nevada, the cause comprises irresponsible decision-making by Nevadans and failed public policy, according to insurance industry experts and state officials.

The formula for setting premiums is fairly simple: The rate of incidents — meaning accidents and car theft — and the severity of the incidents, or dollar amount per claim.

“Higher the claim frequency and higher the settlement, the higher the cost” of insurance, said Rajat Jain, an actuary for the Nevada Division of Insurance.

Jain cautioned that state-by-state comparisons of premiums per car can be inexact and ultimately misleading because of different conditions in each state. For instance, premiums would be higher in states with more new and expensive cars whose owners buy more expensive coverage. Still, few people would dispute that car insurance is expensive for Nevadans, and experts say it’s because we have more incidents, and more expensive incidents, than other states.

Why is that?

Michael Geeser, president of the Nevada Insurance Council and spokesman for the driving club AAA, pointed to a number of factors.

We have lots of accidents because we are too often distracted. We live a 24-hour lifestyle that allows us to work and play at all hours, leading to tired driving. We have 24-hour access to alcohol and easy access to illicit drugs.

Our laws allow cell phone use and texting by drivers. We don’t have a law making the failure to wear a seat belt a primary offense. Police officers can ticket a driver for not wearing a seat belt only after they have made a stop on a separate violation such as speeding. And we don’t have enough police officers to be a visible presence at intersections where there are frequent accidents.

Couple those factors with the fact that our accidents are more expensive than crashes elsewhere.

We drive drunk, which leads to more severe accidents: Alcohol was a factor in 36 of percent of our traffic fatalities compared with 26 percent nationwide, Geeser said.

Health care here is more expensive. Our hospital inpatient cost per day is $1,875; the national average is $1,696. If a driver gets hurt, insurers must pay for costlier care.

Nevada exceeds the national average for uninsured drivers, even though the law mandates coverage — Geeser said one estimate put the rate of uninsured at 17 percent, compared with 14.6 percent nationally.

Uninsured drivers push costs onto the rest of us and drive up premiums.

Nevadans also love their personal injury lawyers. According to the Insurance Industry Institute, Nevadans file 39.7 injury claims for every 100 auto accidents. The national average is 24.5.

“Those guys are looking for work,” Geeser said of the lawyers. “They have their ads blasting, and as soon as you get in an accident, call one of these guys, and somebody is gonna pay.”

And, with more claims come more overhead and legal fees.

(Bill Bradley, a prominent Nevada trial lawyer, said poor claims handling by insurance companies is a significant cause of high premiums in Nevada. Rather than promptly and fairly compensating innocent accident victims, insurance companies delay payments or offer unfair settlements, which requires victims to hire lawyers, delays eventual settlements and drives up costs, Bradley said.)

Finally, Las Vegas is home to a lot of car thieves. Las Vegas criminals led the nation in 2006 with more than 22,000 car thefts, or 1,265 per 100,000 residents; that number dropped to 13,000 in 2008, or 732 per 100,000 residents.

That’s good news, but any attendant reduction in insurance premiums has been more than offset in other areas such as rising health care costs or a recession that has given drivers more incentive to file bogus medical claims.

To sum up, “all of those could be contributing factors in the cost of auto insurance here in this state,” said Scott Kipper, Nevada’s insurance commissioner.

Nationwide, 77 cents of every premium dollar go to pay claims; in Nevada, it is 95.5 cents, according to the Insurance Industry Institute. Factor in overhead, and auto insurance companies have a difficult time turning any kind of profit in Nevada, which explains the steep premiums.

So what can be done?

The answer is not complicated, though it may cost some money.

Essentially, Geeser said, Nevada needs to look at all the areas where it is falling down and do the opposite.

• Hire more police to patrol dangerous intersections and prevent drunken driving and car theft.

• Alert drivers to the most dangerous intersections.

• Adopt a cell phone and texting law, at least for teenage drivers.

• Add to drivers education classes in high schools and get young drivers more training hours on the road.

• Put cameras on traffic lights to issue tickets to reckless drivers who run red lights, a frequent sight in Las Vegas.

• Adopt a primary seat belt law.

• Reduce health care costs, though this is driven by national trends to a large degree.

Reducing the number of lawsuits is a thornier problem because our litigious nature appears to be in large part cultural — we claim injuries and sue because we like suing, not because of any perverse incentives to do so.

Some of these solutions would require higher taxes. But they would lower insurance premiums.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy