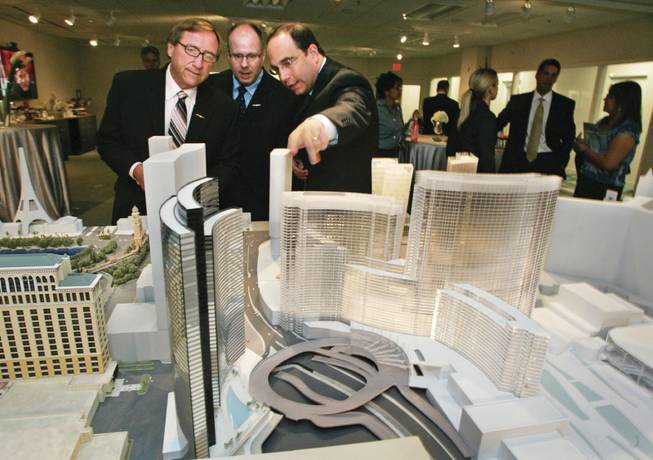

Tony Dennis, right, CityCenter’s executive vice president, shows the elaborate plan to Las Vegas Convention and Visitors Authority President Rossi Ralenkotter, left, and Vince Alberta, the authority’s vice president of public affairs in 2006. MGM Mirage would begin construction on CityCenter without all financing in place.

Saturday, March 28, 2009 | 2 a.m.

Related letter

News release

Document

Sun Archives

- Letter sent to MGM Mirage employees from CEO James Murren (3-27-2009)

- MGM MIrage payment keeps CityCenter on track (3-26-2009)

- MGM lending pitch from Ensign, Reid so far on ethical up-and-up (3-25-2009)

- CityCenter partner might want more say (3-25-2009)

- Lawsuit clouds future of CityCenter; MGM responds (3-23-2009)

- MGM Mirage gets debt waiver, swings to quarterly loss (3-17-2009)

- MGM Mirage's cash crunch (3-3-2009)

- The state of our engine (3-1-2000)

- MGM Mirage wants to tap $4.5 billion credit (2-27-2009)

- MGM, Dubai World said in talks with Deutsche Bank (2-23-2009)

Beyond the Sun

CityCenter lawsuit

Viewing video requires the latest version of Adobe's Flash Player

MGM Mirage’s $200 million injection in CityCenter Friday answered questions about the project’s immediate fate.

But the long-term future of the joint venture — and of MGM Mirage itself — remains in doubt as the company struggles with massive debt and a suddenly uncooperative partner, Dubai World.

MGM Mirage’s payment, which included $100 million that was to be provided by Dubai World, allows construction to continue on the project billed as an unprecedented urban metropolis on the Las Vegas Strip — at least until the remaining $800 million in construction funding is due.

But uncertainty about MGM Mirage’s ability to obtain financing has increased the likelihood the project could tip the company, Nevada’s largest employer, toward bankruptcy or lead to it being sold off in pieces.

CityCenter’s troubles are a dramatic turn from five years ago, when it was announced to almost universal praise, and can largely be traced to a key decision made at the time: to begin building before the billions in financing needed to complete and open it were in place.

•••

At its 2004 announcement, CityCenter was hailed as the type of forward-thinking attraction that would raise the bar in the resort industry and burnish the city’s cultural prestige. It was also considered a financial masterstroke that would leverage emerging demand for high-rise condominiums along the Strip to help lower the project’s cost by more than a billion dollars, boosting the return on investment.

That was before the recession.

Even critics of MGM Mirage acknowledge that none of gaming’s titans could have foreseen the depth of the downturn, which has squeezed consumer spending and dissipated demand for condos.

However, MGM Mirage’s position — it is saddled with $13 billion in debt accumulated during the boom and plummeting earnings — is all the more precarious because the company, in effect, doubled down on its CityCenter bet.

MGM Mirage elected to build CityCenter over five years — all at once instead of in phases — to fulfill the vision of interlocking buildings working in concert architecturally and functionally. The opening of 18 million square feet, including more than 6,000 rooms, would maximize the project’s draw as a tourism attraction, MGM Mirage executives said.

But it also complicated things for MGM Mirage.

The ambitious deadline was one reason the company began construction before it had locked in all the necessary financing.

The complexity and scale of the project have yielded frequent design changes that increased the budget and delayed the execution of crucial final-price agreements with its contractors. CityCenter has ballooned in cost by as much as $5 billion within four years, virtually doubling the initial projection.

The company’s quarterly reports repeated: “The design, budget and schedule of CityCenter are still preliminary, and the ultimate timing, cost and scope of Project CityCenter are subject to risks attendant to large-scale projects.”

By the time the final-price contracts were struck in late 2008, financial markets had crumbled and banks had pulled back on financing.

•••

MGM Mirage began discussing financing for CityCenter in 2007, about two years after the company broke ground on the project. The company expressed confidence that banks would open their vaults for its urban marvel.

That assumption didn’t seem unrealistic at the time, even though the subprime market had begun to crack. Many analysts were wrongly predicting that the housing slump would be contained and not lead to a global banking crisis.

MGM Mirage hedged its bet by securing a wealthy business partner in Dubai World, a government-controlled conglomerate in the United Arab Emirates that had profited from the oil and real estate boom. As a 50 percent owner of CityCenter, Dubai World has contributed $4.3 billion to the project, in addition to acquiring a 9.5 percent stake in MGM Mirage.

The deal, however, wouldn’t solve MGM Mirage’s financial worries.

More than a year passed before the company, in October 2008, secured $1.8 billion in bank financing for CityCenter. It was still $1.2 billion short of the $3 billion in financing needed to finish it.

The company’s inability to get the remaining piece of financing showed how dramatically the world had changed. A land of growth and riches during the boom, Las Vegas had become a risky bet in a matter of months as consumers cut back on discretionary spending.

•••

As banks began to pull back in 2008, MGM Mirage eschewed other options for raising cash, such as selling off pieces of its massive gaming empire and selling stock.

In early 2008, executives said banks were eager to lend to CityCenter because of MGM Mirage’s good credit, successful track record and relationship with Dubai World.

There’s another reason why MGM Mirage didn’t secure financing earlier: The company, analysts say, had not locked down the budget for the project.

The first official figure for CityCenter, $5 billion, surfaced in a second quarter earnings report dated August 2005. In subsequent years that figure swelled with escalating materials and labor costs as well as design changes.

Construction began in 2005 on an employee parking garage behind the Bellagio. Foundation work began in 2006 and buildings began to take shape in 2007.

Design modifications were magnified because of the scope of the project. With dozens of design firms and layers of architects overseeing the work of other firms and implementing others’ designs, even small changes could become expensive and time-consuming, according to contractors and designers affiliated with CityCenter.

MGM Mirage spent much of 2008 attempting to secure so-called guaranteed maximum price contracts, or GMPs, with CityCenter’s general contractor, Perini Building Co. Such agreements require that contractors execute a certain amount of work at a specified price, a protection for developers.

The pacts also protect contractors by requiring that the developer pay extra costs resulting from design changes. For that reason, developers commonly sign such contracts only after detailed plans are finalized.

Maximum price contracts also serve a secondary purpose — banks are reluctant to lend money for a project unless they have a firm estimate of what it will cost.

As of Sept. 30, 2008, MGM Mirage secured eight contracts for the majority of construction work at CityCenter. The largest of those contracts, according to CityCenter President and CEO Bobby Baldwin, was several thousand pages long and took months to review.

CityCenter’s $1.8 billion in bank financing came through the following month — money contingent on MGM Mirage and Dubai World investing a certain amount of cash into the project beforehand.

By then, banks in general were reluctant to lend to risky projects, despite MGM Mirage’s successful track record.

Had CityCenter’s costs been contained, MGM Mirage might not have needed additional financing, analysts say. In 2004, MGM Mirage lined up $7 billion in bank loans within two weeks of announcing CityCenter, including a $5.5 billion revolving credit line and a $1.5 billion term loan.

•••

Some analysts say MGM Mirage will be forced to file for Chapter 11 bankruptcy protection. A Chapter 11 filing by MGM Mirage could put the CityCenter partnership with Dubai World into bankruptcy.

But there may be other options. MGM Mirage is looking to sell casinos to raise cash. Its majority shareholder, Kirk Kerkorian, could bail out the company using his personal fortune. And Dubai World, which filed a lawsuit against MGM Mirage this week alleging it had mismanaged the project, could take over CityCenter if MGM is unable to make payments on it, and vice-versa for MGM Mirage.

In a bankruptcy filing, CityCenter could end up in the hands of lenders or sold to one or the other partners or a third party.

Financial experts think, regardless of who ends up in the driver’s seat, CityCenter, which is mostly built and funded, will be completed as soon as possible so it can begin generating what money it can.

“Both parties have every incentive to finish the project at this point,” C.B. Richard Ellis gaming analyst Jacob Oberman said.

“We are ready, willing and able to fund our obligations,” MGM Mirage spokesman Alan Feldman said Friday.

According to experts familiar with CityCenter’s financing, bank lenders will be calling the shots over the next several months by deciding whether to sign off on subsequent contributions made by MGM Mirage. Given that the company would likely have defaulted on bank obligations had lenders not agreed to waive those requirements until May 15, these banks have the authority to force immediate repayment of outstanding debts, which could trigger a bankruptcy filing, the experts say.

In hindsight, CityCenter is the kind of project that could happen only during a flourishing economy in a place like Las Vegas, which had enjoyed a record-breaking run for more than a decade.

The stage was set for Nevada’s largest casino operator, coming off the successful acquisition of Mandalay Resort Group in 2005 and its most profitable year ever in 2007, to shoot for the moon.

“Getting money was a matter of calling up the banks,” Macquarie Capital stock analyst Joel Simkins said. “I think everyone believed that time was on their side.”

MGM Grand, a AAA Four Diamond resort, offers 5,044 rooms and suites.

MGM Grand features KÀ by Cirque du Soleil; Brad Garrett’s Comedy Club; and world-class entertainment at the Grand Garden Arena and Hollywood Theatre.

The resort offers signature restaurants by celebrity chefs including Tom Colicchio’s Craftsteak, Emeril Lagasse’s New Orleans Fish House, Wolfgang Puck’s Bar & Grill and Michelin three star and Forbes Five Star restaurant, Joël Robuchon.

As part of its ongoing “Grand Renovation,” MGM Grand has remodeled all rooms and suites in its main tower and is adding several new experiences to its lineup including Hakkasan Las Vegas Restaurant and Nightclub, a new upscale dining/nightlife concept (coming in April 2013).

MGM Grand also features a state-of-the-art, non-smoking conference center, the Grand Spa, Cristophe Salon, "CSI: The Experience" and an inviting pool complex featuring the tantalizing daylife of Wet Republic.

Upscale accommodations include The Mansion, an exclusive hotel within the hotel; the luxurious two-story SKYLOFTS at MGM Grand; and The Signature at MGM Grand, a luxury all-suite, non-gaming hotel located adjacent to the main resort.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy