Published Friday, May 15, 2009 | 3 a.m.

Updated Monday, May 18, 2009 | 10:58 a.m.

Related story

Reader poll

Sun Topics

Sun Archives

For all the foreclosure problems confronting homeowners in the recession, developers of master-planned communities are facing their own issues.

The bankruptcy reorganization filing last week by the developer of Park Highlands in North Las Vegas is the latest example.

Credit Suisse foreclosed on Lake Las Vegas, which under its new ownership filed for bankruptcy protection. Last fall, Wachovia Bank foreclosed on 1,710 acres of Kyle Canyon Gateway before a single home was built after Focus Property Group and its homebuilder partners paid $510 million at a federal auction.

Homebuilders in Inspirada in Henderson are in default on loans from J.P. Morgan Chase & Co. after paying $557 million to the Bureau of Land Management for 1,940 acres Developers of Park Highlands plan to build nearly 16,000 homes once they emerge from bankruptcy protection, their attorney Richard Holley said last week. The development is fronted by the Olympia Group, which paid $639 million to the Bureau of Land Management for 2,675 acres in November 2005.

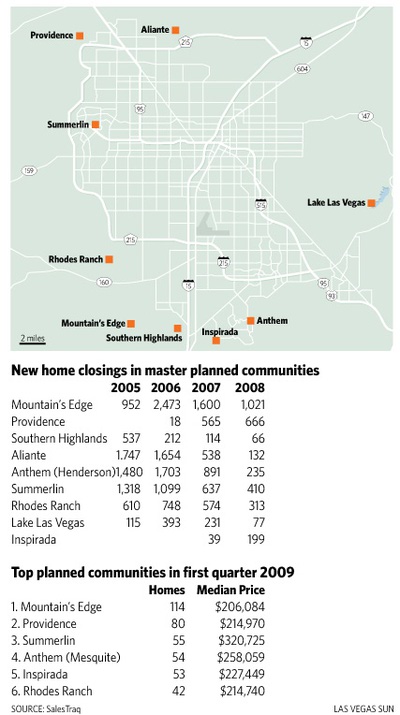

The master-planned communities are being stung by the sharp drop in demand for new homes. In 2006 — the end of the building boom — 35,406 new homes sold. But the numbers have been dropping since, and fewer than 5,000 new homes will be sold by year’s end, based on the current trend.

“The BLM hit the jackpot as they sold all of these parcels at the top of the market, and the new buyers and their lenders are all suffering as a consequence,” said Frederick Chin, president of Lake Las Vegas.

Despite these problems, master plans will continue to garner a significant market share of homes sales, Chin said, if they respond to the market and moderate prices.

Foreclosures are driving down prices of existing homes, which by median price are $83,000 cheaper than new homes. Still, planned communities are taking a bigger chunk of the overall sales than a year ago.

In 2008, 45 percent of new-home closings were in planned communities. In this year’s first quarter, 54 percent of the closings were in planned communities.

Sales have increased at a few new-home developments — but at significantly reduced prices.

At Inspirada, the new-urbanism style community with its narrow streets, front porches and pedestrian orientation, sales have increased from 32 in 2008’s first quarter to 53 this year. The median price, in the meantime, has fallen from $293,522 in 2008 to $235,823 this year.

“We certainly hoped it would be further along than we are at Inspirada. We opened as the market was slowing, and the timing was not great,” said John Ritter, CEO of Focus, the developer of Inspirada, Mountain’s Edge and Providence.

At Mountain’s Edge in the southwest valley, the median price has fallen from $265,300 in 2008’s first quarter to $206,084 this year. At Providence in northwest Las Vegas, the median price has fallen from $274,250 to $214,970 — $530 lower than the median price for new homes sold outside planned communities. There were 80 sales in Providence during the first quarter, down from 117 in the first three months of 2008, but that’s still better than in non-planned areas where sales in the first quarter are less than one-third of their total a year ago.

Despite the housing slowdown, by one measure Mountain’s Edge kept its No. 1 sales ranking in the country in 2008 — though it was half what it was the previous year. Providence jumped from No. 5 in 2007 to No. 4 in 2008.

“My opinion is that when sales slow citywide, the sales in master plans tend to hold up better because buyers are drawn to the added benefits and value of being in a well-planned community with good amenities,” Ritter said. SalesTraq President Larry Murphy said it’s not surprising planned communities are faring better than non-planned areas, given the larger builders’ greater investment and commitment to the projects.

“Projects like Providence have been geared up for some time, and they have marketing campaigns that have momentum,” Murphy said. “It is easier to maintain that than trying to start up alone. There is strength in numbers.”

Builders in master-planned communities have been able to lower prices through such cost-cutting measures as the elimination of interior walls, said Steve Bottfeld, executive vice president of Marketing Solutions who has consulted to the housing industry. They have redesigned models to make them more attractive to buyers.

“Everything is more competitive in terms of prices than in the past, and maybe that is a factor today,” said Jim Widner, KB Home’s regional president.

Despite the recession and that buyers prefer existing homes over new ones, builders and developers remain optimistic. In March, sales of existing homes in Las Vegas outnumbered sales of new homes by more than 3,000, a much wider disparity than during the housing boom.

“I don’t get frustrated,” Widner said. “I am encouraged because it shows that (with) a certain price in the market, there is tremendous demand. That supply of (foreclosed) houses is getting worked through and at some point some portion of that business will shift (to new homes).”

That’s what Tom McCormick, president of Astoria Homes, is waiting for, as well. Astoria, a private builder, stopped construction because of its inability to get financing. The company will have to wait until the demand for new homes returns, he said.

Decreasing the inventory of existing homes is the key, and that will prompt banks to lend again for new-home construction, he said. The median price for existing homes was $134,900 in March compared with $218,000 for new homes.

“There is not much demand for brand-new homes when used homes are well below the cost to build the same home,” McCormick said. “We builders have to wait until these smoking deals work their way off and prices come up. Talking to Realtors, there are a lot of people back in the market buying ... Maybe the worst is behind us.”

With the recession continuing and job losses continuing to mount, it is going to take some time for the new home market to recovery, Ritter said.

“I still think we have a few tough years ahead of us just because of the foreclosures,” Ritter says. “While the sales (of existing homes) have picked up, so have the number of defaults. We are in this deeper and longer than people could have imagined. I don’t think we are out of the woods yet.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy