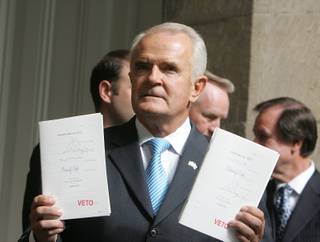

AP Photo/Brad Horn, Nevada Appeal

Gov. Jim Gibbons vetoes bills on the Capitol steps in Carson City at the Nevada Legislature on Thursday.

Published Thursday, May 28, 2009 | 5:18 p.m.

Updated Thursday, May 28, 2009 | 10:34 p.m.

Reader poll

Related story

Sun Coverage

The Senate overrode Gov. Jim Gibbons' veto of a $781 million tax package Thursday night.

After the clerk read Gibbons' veto message, where he warned the Legislature of setting a "dangerous precedent," the Senate voted 17-4 to pass the bill anyway. It was the same vote the Senate had when it passed the tax package.

Sens. Barbara Cegavske, Maurice Washington, Mark Amodei and Mike McGinness all voted against overriding Gibbons' veto.

Senate Minority Leader Bill Raggio, R-Reno, and Sen. Warren Hardy, R-Las Vegas, both said Gibbons did not try and get them to sustain his veto.

The Legislature still has to override some of Gibbons' vetoes of portions of the spending bill, and is scheduled to meet again Friday morning. The session ends at midnight Monday.

The tax plan increases sales taxes, business levies and license fees, and vehicle registration fees. A "sunset" clause would allow most of the increased taxes to be erased in 2011.

The Republican governor had long said he would reject the plan.

"It is a sad day, but a historic day for the citizens of Nevada," Gibbons said in a statement Thursday evening. "I appreciate the hard work a handful of conservative legislators did, with some success, trying to control the 'out of control spending' and crushing tax hikes of the liberal leadership in the Legislature."

The governor vetoed 20 bills Thursday -- many that called for additional fees -- bringing the total for this session to 31 vetoed bills.

Also Thursday, the Legislature finalized language to lessen public employee pensions and retiree health benefits, as well as to change the rules over collective bargaining. The passage of the bill was necessary for Republican votes to override Gibbons' veto of the tax increase.

Senate Bill 427 was heard and passed out of the Senate Finance Committee on Thursday. It passed the Senate at about 8:35 p.m. Thursday. It then passed the Assembly and now heads to the governor, where he's likely to sign it.

Coffin and Sen. Maggie Carlton, D-Las Vegas, voted against it. She praised those who negotiated the changes, but said she was taught that the next generation should have things better.

"Something inside me tells me this just isn't right," she said.

Sen. Warren Hardy, R-Las Vegas, who was the Republicans lead negotiator for most of the session, said the reforms were necessary to protect the pension and health benefit funds.

"Both parties, both houses, worked hard to keep these systems whole, to make sure we can keep systems we can count on in the future," he said.

Sen. Bob Coffin, D-Las Vegas, said he supported the changes to the pension system - called PERS - but worried that increasing the requirement that new hires work for 15 years before qualifying for a health benefit would hurt higher education recruitment.

"This retards our young growing universities at a time they need help," he said. "God knows we’ve kicked them in the teeth enough this session."

Senate Majority Leader Steven Horsford, D-Las Vegas, pointed out that the changes only affected new hires.

"First and foremost, we protected the programs for actives and current retirees," he said. "For new employees, it’s going to be a major shift. Young people that we're trying to get into public service, I hope in future sessions we can show these jobs are still available and valuable. We still need teachers, health and education professionals."

Only employees hired after January 1, 2010, would be affected by the Public Employee Retirement System and Public Employment Benefit Program changes.

The key provisions are:

- State workers would have to work 30 years to accrue the full benefit. Currently, they have to work 28 years.

- Cost of living increases would be lowered to 4 percent, from 5 percent.

- The health insurance subsidy for retired state workers was scaled back. Instead of new workers beginning to qualify for the benefit after five years, they would have to work for 15 years to start qualifying.

- During contract negotiations for local government employees, arbitrators would have to look at state workers' pay. Local governments would also be required to hold full fiscal hearings.

The Associated Press contributed to this story.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy