Thursday, Jan. 28, 2010 | 4:30 p.m.

Sun Archives

- Herbst’s bankruptcy plan draws ire of creditors, lenders (9-10-09)

- Herbst Gaming files for bankruptcy protection (3-22-09)

- Herbst Gaming seeking bankruptcy protection (3-10-09)

- Primm hotel rates for locals: free (12-09-08)

- Primm hotel closes rooms during midweek (10-30-08)

- Lenders give Herbst Gaming more time to repay debts (5-23-08)

Bondholders standing to lose $362 million in the Herbst Gaming Inc. bankruptcy case on Thursday appealed a Nevada bankruptcy judge’s approval of Herbst’s reorganization plan.

The appeal, which has been expected, was filed with the U.S. Bankruptcy Appellate Panel of the 9th Circuit by attorneys for HSBC Bank USA, trustee for holders of the bonds.

On Oct. 30, U.S. Bankruptcy Judge Gregg Zive in Reno orally confirmed Herbst's reorganization plan in which the $362 million in bond debt would be extinguished. Zive issued a written order confirming the plan Friday.

Under the plan, equity interests in Las Vegas-based Herbst would be canceled and the Las Vegas company would be turned over to secured bank lenders owed another $860 million. The new company would also assume $350 million in debt.

But attorneys for HSBC responded with an amended lawsuit in November charging that Herbst engaged in dubious acquisitions in 2007 and that, consequentially, secured lenders should share in the resulting losses.

Based on Herbst's current value, the bondholders demanded in November’s lawsuit that they recover $153.7 million and that the secured lenders' recovery be reduced by $549 million.

The bondholders' arguments have previously been disputed by Herbst and the secured lenders, led by Wilmington Trust Co. Herbst said it was driven into bankruptcy by the recession, not its debt-financed takeover deals.

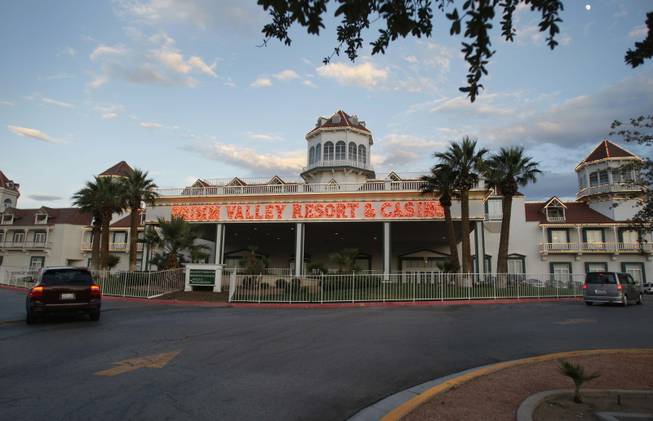

Attorneys for HSBC argue in the amended lawsuit that because of a smoking ban and other factors affecting the Herbst casino and slot route businesses, the company was either insolvent or was rendered insolvent by the acquisitions announced in 2007 of the Sands Regent casino operations in Northern Nevada and of Primm Valley Resorts at the California-Nevada border on Interstate 15.

"Despite the debtors’ insolvency or marginal solvency and decline in its slot route business, the debtors entered into two transactions in 2007 which increased their debt load by approximately $549 million and left the debtors deeply insolvent," HSBC charges in the lawsuit.

Some $149 million under Herbst's bank credit facility was used to finance the Sands Regent transaction and another $400 million was used for the Primm deal.

The bondholders charge that Herbst overpaid in both deals, that both deals immediately resulted in losses and deepened Herbst's insolvency, making them "fraudulent transfers" under the bankruptcy code -- meaning the debt associated with the deals can be canceled.

In a filing with the Securities and Exchange Commission on Thursday, Herbst said the reorganization plan is scheduled to be effective on Feb. 5.

On that date, payments to certain secured and unsecured creditors as spelled out in the plan are scheduled to be made.

The plan calls for Herbst to be managed by its existing officers and directors for the time being and says that the restructuring won’t be complete until the fourth quarter of this year.

Between now and then, directors and key employees must receive government and regulatory approvals and the court must rule on motions to accept or reject existing contracts Herbst is a party to.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy