Thursday, May 6, 2010 | 2 a.m.

Sun archives

- Earnings Preview: MGM Mirage (5-5-2010)

- Wynn Resorts sees profit in first quarter (4-29-2010)

- MGM Mirage CEO Jim Murren paid $13.75 million in 2009 (4-21-2010)

- MGM Mirage shares drop on earnings news (4-15-2010)

- Sheldon Adelson says Asia holds Las Vegas Sands’ fortunes (2-19-2010)

- MGM Mirage, Las Vegas Sands earnings show Strip competition heating up (2-18-2010)

Almost all the key indicators point to Southern Nevada’s economy remaining stuck in the ditch.

But stock investors appear convinced that its economic engine, the Las Vegas Strip, will soon be running at full speed again.

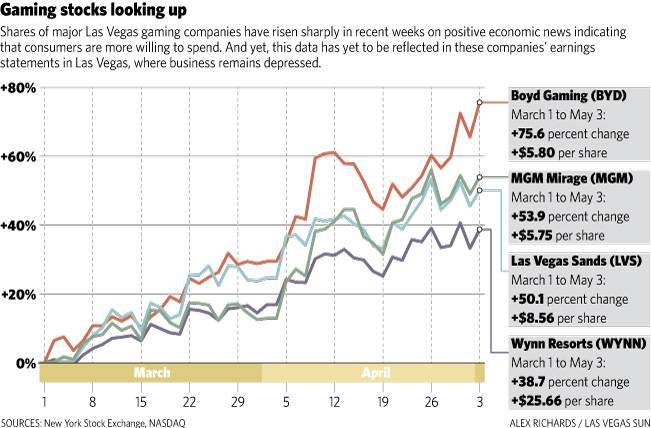

Shares of MGM Mirage hit a 12-month high in April, while shares of other major gaming companies in Las Vegas have also soared in recent weeks despite depressed earnings and little evidence of a tourism rebound.

The disconnect is attributed to investor optimism that a national recovery is well under way. The Las Vegas Valley, however, has long been pegged as one of the last places that will recover. The most recent reiteration was in a report from UNLV’s Center for Business and Economic Research.

And, of course, the valley economy rises or falls with the fortunes of the Strip — where the numbers have been nothing to write home about.

According to the Las Vegas Convention and Visitors Authority, visitor traffic rose 2 percent for January and February combined versus a year earlier. Strip gaming revenue rose 13 percent for the same period, but that was largely thanks to increased losses from high-rolling baccarat players rather than from the gambling masses.

Convention attendance fell 14 percent, while average hotel and motel occupancy rates for both months combined fell nearly 3 percentage points, to 75 percent. More significantly, average daily room rates were 4 percent lower than they were a year ago — the latest sign that visitors still aren’t spending as much these days.

Such data points are hardly the stuff on which to build a recovery — nor enough to help cash-strapped gaming giants dig themselves out of debt.

And yet, stock investors — which no doubt include savvy forecasters along with spendthrift gamblers — are betting that economic recovery is already at hand for the gaming companies.

One of the biggest beneficiaries of this big-picture focus is Strip giant MGM Mirage, which last month reported a first-quarter loss driven by declining earnings at each of its Las Vegas casinos and an estimated operating loss of $255 million at CityCenter.

MGM Mirage stock fell on the news but rebounded again, despite the company’s dominant position in one of the country’s most depressed gaming markets.

MGM Mirage stock has soared by more than 50 percent since March 1, faster even than competitors Wynn Resorts and Las Vegas Sands. Those companies are benefiting most from gambling profit growth in Macau because they have bigger and more established operations in China than MGM Mirage and its MGM Grand Macau resort.

MGM Mirage stock has traded upward in part because of the success of the company’s competitors in Macau, where first-quarter gambling revenue rose 57 percent and the potential for future growth is massive, says Dennis Forst, a stock analyst with KeyBanc Capital Markets.

The company’s ability to sell bonds to make future debt payments, as well as postpone payments due on $5.6 billion in debt by more than two years, has also made investors more comfortable betting on MGM Mirage, Forst said.

In general, however, Forst thinks the biggest benefit to MGM Mirage and other Las Vegas gaming stocks lies with macroeconomics.

“Consumer stocks in general have been going up on expectations of rising consumer spending and confidence levels,” he says.

For economists eyeing leading indicators, the latest trends couldn’t be better for Las Vegas.

The nation’s gross domestic product has risen over the past two quarters — a major sign of economic recovery. Also, consumer spending rose in the first quarter as the savings rate fell. In other words, people spent more, and not necessarily because they had more money to spend.

“Consumers are starting to loosen their wallets a bit more,” says Stephen Miller, chairman of the economics department at UNLV’s College of Business.

It’s a positive sign for Las Vegas, which needs a national recovery for business to bounce back, Miller says.

The Federal Reserve Bank of St. Louis, among others, has indicated that the recession ended last year. But the official call of the beginning or end of recessions falls to the National Bureau of Economic Research, which hasn’t yet made an announcement. (In typical conservative fashion, the bureau, comprised of pre-eminent economists, declared the recession a year after other experts did.)

That might explain why neither Miller, nor Forst nor gaming executives in Las Vegas are popping open the champagne.

“Everyone is very pessimistic about the future, and it’s causing pundits like myself to be cautious,” Miller says. “So we’re going to be cautious and that’s going to lower our expectations.”

Forst thinks people are more optimistic about the future of Las Vegas, “which could be real or wishful thinking.” Forst says there’s still plenty of concern about how quickly improved business will trickle down to the bottom line given the thousands of new hotel rooms that need to be filled at CityCenter and Cosmopolitan, a megaresort next to CityCenter expected to open in December.

While caution may be appropriate for people paid to offer advice, that’s not how investors make money.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy