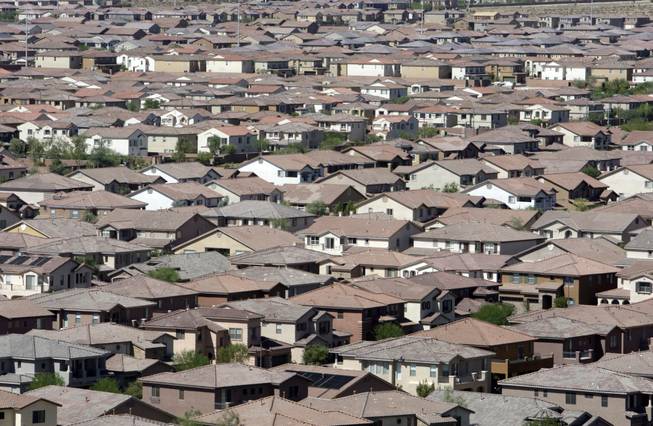

A view of the master-planned community Mountain’s Edge in the southwest Las Vegas Valley on Friday, Aug. 6, 2010.

Tuesday, Sept. 7, 2010 | 2 a.m.

Sun Coverage

- Investors’ suit over HOA fees headed to mediation (8-16-10)

- Regulators propose cap on HOA collection fees (3-25-10)

- HOAs suffer during recession (3-12-10)

- Investors irked by steep HOA fees tied to foreclosure homes (2-26-10)

- Foreclosure investors suing over HOA, collection fees (1-28-10)

- Henderson HOA to pay up for board member’s mistake (10-13-09)

The crippled Las Vegas housing market has triggered a legal battle pitting investors buying foreclosed homes against homeowners associations, with millions of dollars at stake.

This is no David vs. Goliath showdown, as the two groups are more likely viewed by the public with equal disdain.

The outcome, if the investors win and the more than 200 HOAs lose, could ultimately bump up monthly association fees throughout the valley.

The fight began when home prices started falling sharply in 2008 and 2009 and the valley had more than 20,000 foreclosures a year.

Investors locally and from elsewhere began swooping in and buying up foreclosed homes and condos Median prices have fallen about 60 percent since the market peaked in 2006.

Homeowners associations wanted to recoup the monthly dues lost when homeowners stopped paying and their homes went to foreclosure. They needed the money for pool maintenance, landscaping and other upkeep that sometimes was cut back because of tight budgets.

The associations used collection companies to get what state law entitles them to — up to nine months of past due HOA fees.

The key issue — and what will probably be dragged out all the way to the state Supreme Court — is collection companies tacking on their fees to the delinquent HOA dues they have been trying to collect, in many cases for longer than a year. If associations lose and can’t get past-due fees, assessments on paying homeowners will probably increase.

That additional charge for collections has run several thousand dollars in some cases and exceeded what the investors sometimes had to pay in delinquent HOA dues. With collection costs averaging about $2,000 per foreclosed home, investors said the amount owed could easily surpass $50 million.

This year, a group of 18 investors filed two lawsuits in District Court, one against HOAs and the other against collection companies.

Judges dismissed the lawsuits because state law requires that such disputes be mediated by the Nevada Business and Industry Department’s real estate division before there are legal challenges. Both sides expect new lawsuits in coming months because no settlement is likely.

James Adams, whose Adams Law Group sued homeowners associations and collection agencies, said supreme courts in other states have ruled that nothing can be collected beyond normal assessments.

With the additional charges, “every day this illegal activity occurs, the homeowners associations are racking up damages they are going to pay my clients,” Adams said.

David Stone, president of Nevada Association Services, a collection company, said investors are convinced they are right but the law isn’t on their side.

“We are fighting this tooth and nail,” he said. “These real estate speculators are upset, and it’s an emotional thing for them. They don’t want to pay the association anything. They just want to scare the association.”

Rutt Premsrirut, one of the investors behind the lawsuits, said the dispute is about more than protecting investors. It is about homeowners who face penalties from their HOAs and have to pay collection companies as well.

He said investors don’t want to hurt the association but don’t think the collection companies are entitled to money.

“The HOA is allowing the collection agencies to charge all of these fees, but the board never gets the bill and they don’t know if it’s $10,000 or $50,000,” he said. “We don’t have anything against the HOAs. It is the collection agencies. I don’t mind paying the HOAs their money.”

Stone said if collection companies aren’t allowed reimbursement for their expenses, associations couldn’t hire someone to collect what is owed to them. That, he said, is unfair to homeowners who pay their dues and would have to make up any shortfall.

“These speculators have it all wrong,” Stone said. “They think collection companies are making a ton of money but that is not the case.”

In agreement is Chris Yergensen, corporate counsel for RMI, a property management company, and its affiliate, Red Rock Financial, a collection company. He said some cases appear unreasonable, such as when there are $2,000 in fees on a $500 account. But, he argued, the collection process may take two years, including filing legal documents.

“They are greedy real estate investors,” he said. “They buy properties from banks for $30,000 and flip that property within a month for $60,000 and they complain about collection costs.”

Premsrirut said the collection companies don’t provide any community service. Not having to pay steep collection fees means money would be freed up for rehabbing homes, changing the carpeting and painting.

If HOAs lose the legal battle and become financially unsound, they could go into receivership.

“It would be a social crisis in this state for homeowners associations,” Stone said. “It would definitely raise the assessments.”

Investors appear to have already lost the struggle: The state Common Interest Communities and Condominium Hotels Commission is expected to approve a cap by the end of the year limiting collection companies to charging $1,950. The investors argue that’s too much and fear loopholes will allow them to be charged much more than that.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy