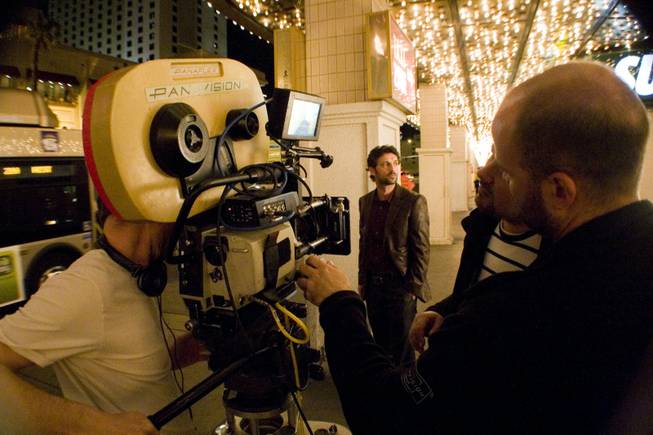

Seven Ft / Special to the Sun

Crews film a scene from the foreign film “The Gambler” at the Plaza in downtown Las Vegas.

Thursday, June 27, 2013 | 2 a.m.

It turns out big movie producers aren’t the only ones to benefit from Nevada’s new film tax credit law.

Large casinos or big businesses that owe insurance, payroll or gaming taxes to the state also win under the new law.

For the first time in Nevada, movie companies that get tax discounts can sell those discounts to other companies. So a casino that has a big state tax bill can buy the credits from a film producer and get a tax break.

“We’re subsidizing it because we’re reducing their costs,” said Francine Lipman, a law professor at the UNLV William S. Boyd School of Law. “We’re giving them these credits effectively to use as coin of the realm.”

While high-profile actors such as Nicolas Cage have crowed about the potential for the law to spur growth of the film industry in Nevada, create jobs, and inject money into the economy, few have noted who benefits when film companies take their excess transferable tax credits and actually transfer them.

The likely beneficiaries are gaming companies doing business in Nevada or insurance companies with a tax liability in Nevada for the insurance premium tax, said Carole Vilardo, executive director of the Nevada Taxpayers Association.

How does it all work?

First, the tax incentive attracts a film company to Nevada, which will spend money in the state — the whole point of the bill in the first place.

Then, the film company can get a tax credit worth 15 percent of production costs.

So a $1 million production can earn the film company a $150,000 credit. The film company might use $50,000 of that to offset its own payroll tax liability.

Unless the film company also has a Nevada gaming license or is an insurance company, it wouldn’t pay gaming or insurance taxes anyway. In fact, its overall state tax liability likely would be quite small.

That means the film company could then sell the remaining $100,000 — or even the entire tax credit — to another business. For the sale to have value, the film company will often sell the tax credit for 80 to 90 cents on the dollar, said John Restrepo, principal at Las Vegas-based RCG Economics.

“You buy the tax (credit) at a discount,” he said. “It’s often between 10 and 20 percent of a discount. You and I don’t have enough tax liability to warrant buying these, but a business may.”

So a large company that owes $100,000 in taxes to Nevada effectively pays $80,000 or $90,000, depending on the sale price.

When all is said and done, the film company gets $80,000 in cash and the casino gets a $100,000 tax break.

The new law anticipates that casinos and resorts will be customers in this new tax credit market.

Senate Bill 165 specifically references the state’s Gaming Control Board several times and directs it to administer some of these tax credits.

The bill’s sponsor, Sen. Aaron Ford, D-Las Vegas, has said many times that he believes the bill will help film companies and small businesses that could benefit from more film production in Nevada.

But nobody really knows if film companies will apply for the credits and whether there will be a benefit for the state.

“It is a very difficult thing to assess until the project is complete,” said Las Vegas Mayor Carolyn Goodman, who lobbied in support of the bill.

The 45 states that have film incentive programs report mixed results, so Ford built in audits and reporting requirements as well as a $20 million cap on tax credits awarded between 2013 and 2018. After that five-year trial period, legislators could decide whether to extend or modify the program during the 2019 legislative session.

“Everybody is looking at the success for bringing jobs and business to the state,” Lipman said.

“I think they’re really cognizant of that and really trying to maximize the benefit for everybody knowing that if they don’t, it won’t be extended.”

If film companies do use the credits, the new law may also have another beneficiary: investment firms.

Restrepo said the proliferation of state film tax credits has created a niche financial industry that pairs the buyer and seller of these credits.

“You would hire them for a fee to sell a tax credit to a buyer,” he said. “It’s almost how you would hire a real estate broker.”

The film company could also reduce its own Nevada tax liability using the credits it earns. For instance, if a production company employs Nevadans and pays payroll tax, the producer could pay the state payroll tax with the credit — but that’s not the real point of the new law. The big money for the production company comes from selling the credits.

But the credits aren’t just like cash or a prepaid debit card.

“They’re not going to walk into the mom-and-pop coffee shop and say ‘here’s some credits,’” Lipman said. “It’s going to have to be more sophisticated businesses that get how this works with a large enough bill to make it worthwhile.”

The Legislature hesitated in passing Ford’s bill, but it ultimately became law when the senator compromised and established the $20 million cap, the five-year limit and the audit.

Ford also said he negotiated with other lawmakers over which taxes the credits could be applied toward, describing it as a “quintessential example of compromise.”

In limiting the credit to the gaming, payroll and insurance premium taxes, the bill excludes anybody who would’ve taken advantage of a tax credit for gasoline, cigarette, liquor, sales, live entertainment or property taxes.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy