Cathleen Allison

The Nevada State Legislature building is shown in Carson City, Nev., Thursday, March 31, 2005.

Sunday, May 19, 2013 | 2 a.m.

Democrats may have fallen short of crafting a comprehensive tax reform plan to address Nevada’s wobbly revenue structure, but that doesn’t mean there aren’t a bevy of bills to raise taxes floating around the Legislature this year.

The measures have varying degrees of support, from declarations of “dead on arrival” to broad support from Republicans and Democrats.

Many of the bills are targeted for specific purposes — gas taxes for road construction in Clark County or property taxes for school construction in Washoe County, for example.

Gov. Brian Sandoval has come out against most of the specific measures so far, meaning even if two-thirds of the Legislature votes to pass them, they’d have to muster another two-thirds vote to override a veto.

Still, as the Legislature heads into the final stretch of the session, there is plenty of potential for lawmakers to increase what Nevadans pay into government coffers.

Here’s a look at which tax bills are still alive and kicking in Carson City:

-

The much-maligned “fun tax”

Perhaps Speaker Marilyn Kirkpatrick should have been prepared for the political blowback on her proposal to levy an 8 percent tax on admissions and memberships to nearly every type of recreational activity in the state.

But Kirkpatrick seemed a bit flummoxed by the strident opposition, harkening back to early in the session when a broad swath of lawmakers voiced support for reforming the current live entertainment tax.

But Assembly Bill 498 ended up being more sweeping than many lawmakers had expected. They are now contemplating levying a tax on everything from movies to mini golf to strip clubs.

Kirkpatrick is undaunted in her attempt to see the bill through to the governor’s desk, where it would meet Sandoval’s veto pen.

-

The less-maligned payroll tax

Senate Democrats, arguing that education needs additional funding now, have floated a proposal to increase the payroll tax.

Under Senate Bill 514, small businesses — those with payrolls of less than $250,000 a year — would continue to pay no tax. Larger businesses, however, would see their rate increase from 1.17 to 1.5 percent, and mining operations would see an increase to 2 percent.

Although Democrats have voiced support for the measure, Republicans don’t particularly like it.

Senate Minority Leader Michael Roberson told Majority Leader Mo Denis that the bill is dead.

-

To the ballot they go

The specter hanging over the session is the margins tax that the teachers union has succeeded in qualifying for the 2014 ballot.

Regardless of what lawmakers do in Carson City, Nevada voters will be able to decide whether to pass a measure that would levy a 2 percent tax on the revenue of businesses that make $1 million or more per year.

Neither Democrats nor Republicans have much fondness for the ballot initiative. Republicans have dubbed it a “job-killing tax,” and Democrats decided not to bring it up for a vote.

The rate is double what Democrats proposed in a similar tax two years ago.

-

The most popular tax of the session

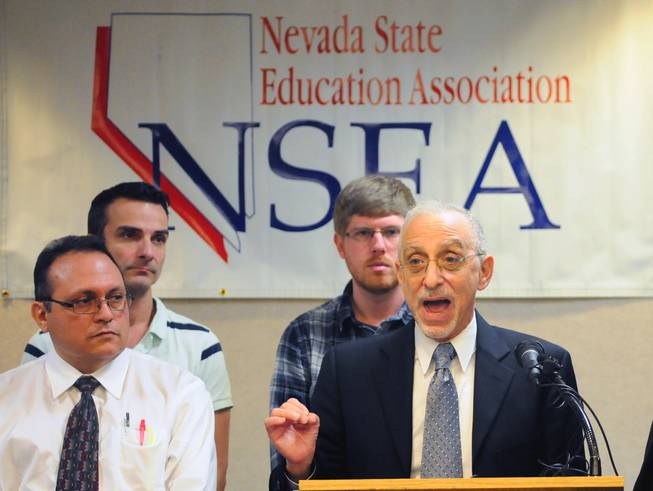

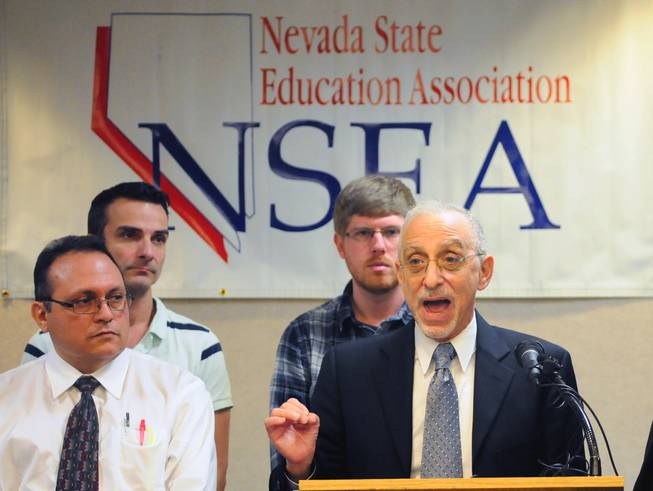

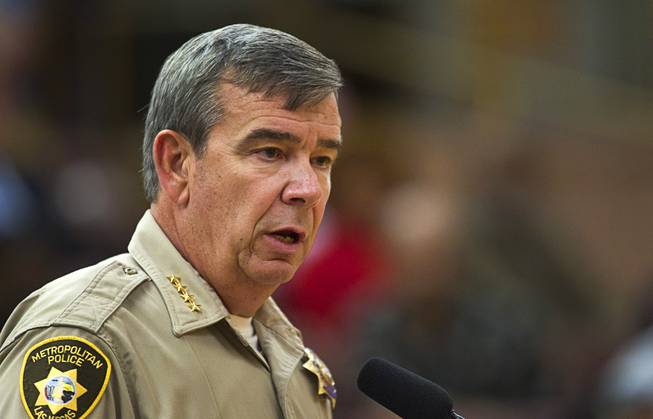

One tax bill has managed to win a majority of votes from the Nevada Assembly, with support from Republicans and Democrats alike: the “More Cops” measure.

Assembly Bill 496, which would allow the Clark County Commission to increase the sales tax by a quarter-cent to hire more police officers.

The bill was passed out of the Senate Revenue and Economic Development Committee late last week and awaits a vote on the Senate floor.

Sandoval has indicated he would sign the bill if it reaches his desk, largely because voters approved the concept in 2004.

-

The Washoe County school construction tax

Assembly Bill 46 would allow the Washoe County Commission to impose a property tax and sales tax increase to fund school construction and rehabilitation projects.

The measure, which is the top priority of the Washoe County School District, has had a rough go of it in the Legislature.

It has yet to make it out of the Assembly, where it is stuck in the Ways and Means Committee.

Sandoval has said he would veto the bill.

-

Higher gas taxes for road construction

Assembly Bill 413 would give the power to the Clark County Commission to increase fuel tax revenue by allowing the 9-cent gas tax to grow with inflation.

The Regional Transportation Commission estimates the tax would increase by 3 cents per gallon, adding $16 to the average motorist's yearly gasoline expense.

The measure hasn’t made it very far at the Legislature. Although it passed the Assembly Taxation Committee, it has yet to see the Assembly floor for a vote.

Instead, it’s stuck in the Ways and Means Committee.

-

The most popular taxing target: mining

The mining industry — which is booming because of a strong gold price — has had a target on its back since the start of the recession.

Lawmakers have repeatedly gone to the industry to get more revenue, working several minor deals since 2009 to eke more money from gold mines.

This session, a measure to remove the mining industry’s tax protections from the constitution appears to be on its way to the ballot. The measure survived the Senate on a 17-4 vote and made it through a key Assembly committee last week. If the full Assembly passes Senate Joint Resolution 15, it would appear on the 2014 ballot.

Senate Minority Leader Michael Roberson also is sponsoring legislation that would give voters the chance to double the tax rate on mining if SJR 15 passes.

The measure, Senate Bill 513, has little support outside of the six Senate Republicans who sponsored it and has yet to be given a hearing.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy