ASSOCIATED PRESS

The eBay logo.

Wednesday, Jan. 22, 2014 | 6:15 p.m.

NEW YORK — EBay said Wednesday that its earnings and revenue grew in the last three months of 2013, driven by a strong holiday season for its e-commerce site and its fast-growing payments business, PayPal.

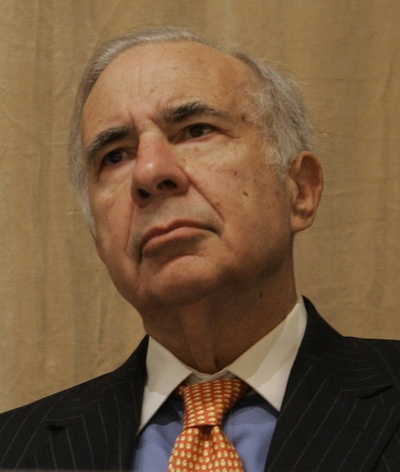

The company also said activist investor Carl Icahn is seeking a nonbinding shareholder resolution to spin off PayPal. EBay said the billionaire investor has nominated two of his employees to the company's board and now owns a stake of 0.82 percent in the San Jose, Calif.-based company.

Shares of eBay rose $2.99, or 5.5 percent, to $57.40 in extended trading.

But eBay said it has looked into a split and does not believe it would be the best move for shareholders. CEO John Donahoe said in a letter to employees that spinning off PayPal is also not a new idea, and that "we must not let Mr. Icahn's proposals become a distraction."

In an interview, Donahoe said eBay has helped propel PayPal's success, by not only generating new users, but by sharing data that helps PayPal manage risk. EBay also accounts for more than half of PayPal's profits, which helps it pursue innovation and new opportunities.

Icahn offered little detail why his proposal made sense, Donahoe said.

"I wouldn't say there is any in-depth articulation of rationale other than splitting apart the company will create shareholder value," he said. Donahoe said he will pass on the Icahn's nominations to the board, but said they'll be held up against its already "world-class" members.

Icahn did not immediately respond to messages seeking comment.

PayPal, which eBay bought for $1.3 billion in late 2002, is now growing faster than the company's core marketplaces business. Payments revenue of $1.84 billion accounted for about 41 percent of the quarter's total revenue. Recently, PayPal has been expanding into brick-and-mortar stores from serving solely as an online payments service.

Overall, eBay Inc. earned $850 million, or 65 cents per share, in the October-December period. That's up 13 percent from $751 million, or 57 cents per share, a year earlier.

Adjusted earnings were 81 cents per share, beating analysts' expectations by a penny.

Revenue grew 13 percent to $4.53 billion from $3.99 billion. Analysts surveyed by FactSet had expected revenue of $4.55 billion.

For the current quarter, which ends in March, eBay is forecasting adjusted earnings of 65 cents to 67 cents per share on revenue of $4.15 billion to $4.25 billion per share.

Analysts were expecting higher earnings of 72 cents per share on revenue of $4.3 billion.

Business Writer Ryan Nakashima in Los Angeles contributed to this report.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy