Las Vegas Sun

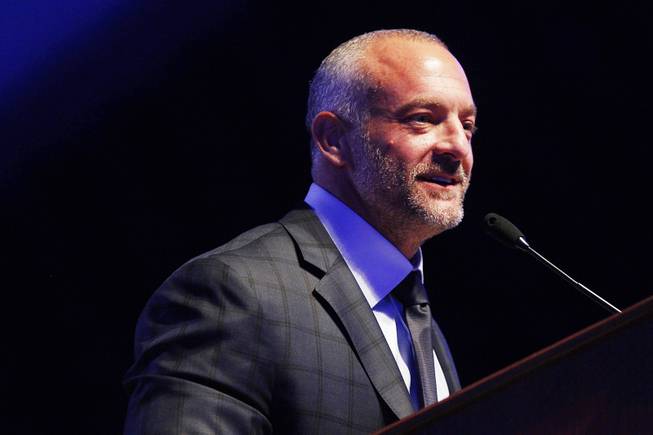

Lorenzo Fertitta, shown in 2013, and his brother Frank this week announced the launch of Fertitta Capital, a private investment firm seeded with $500 million of personal money.

Wednesday, May 3, 2017 | 2 a.m.

Less than a year after selling the UFC, the Fertitta brothers officially launched their latest business, Fertitta Capital, employing some of the same people with whom they worked in the mixed martial arts company.

Monday was the official launch for Fertitta Capital, an investment company that will be led by CEO Nakisa Bidarian.

Frank and Lorenzo Fertitta will be throwing in the first $500 million to fund the company’s investments. It’s a sizable investment, but it pales in comparison to the $4 billion they received when they sold the UFC to an investment group composed of WME | IMG, Silver Lake Partners and KKR.

As the CFO of the UFC, according to a press release announcing the launch, Bidarian helped organize the sale of the mixed martial arts company and also of Fertitta Entertainment, Inc., a gaming and leisure management company.

“We have known and worked side by side with Nakisa for almost a decade,” said Lorenzo Fertitta in the release. “His understanding of corporate finance and operational strategy and how both translate into building businesses is something we’ve witnessed firsthand.”

In addition to his role with the UFC, Bidarian held positions at Accenture, Citi, Morgan Stanley and the Mubadala Development Co.

As a private investment company, Fertitta Capital will be funding technology, media and entertainment companies.

In the release, Fertitta said Fertitta Capital will invest in companies throughout their business cycles, focusing on the needs of the businesses asking for the funds and not the time lines of investors.

Bidarian will primarily be responsible for deploying the firm’s money, the release said, but Lorenzo Fertitta will be sitting on the panel that meets to review possible investment choices and decisions, a company spokesperson said.

Sam Bakhshandehpour, formerly the CEO of sbe Entertainment, will be a managing director of Fertitta Capital. Bakhshandehpour was previously at J.P. Morgan, where he was global head of gaming and West Coast head of real estate and lodging investment banking.