Sam Morris

House flipping was a hallmark of last decade’s real estate bubble, when investors, backed by easy money, bought homes and sold them for profit a short time later. Few places got as crazed with flipping as Las Vegas.

Monday, Nov. 6, 2017 | 2 a.m.

Not all homes fly off this seller’s market

More expensive properties tend to have a longer shelf life, as more affordable properties enjoy a greater pool of potential buyers that continues to expand as interest rates hold near record lows. At the end of September, just less than 10,000 existing homes remained listed for sale in the greater Las Vegas area. The median asking price of those homes stood at $299,900, with an average list price of $448,060. Deeper inside that figure is the cold reality of Las Vegas home buying in 2017 — only half of those homes do not have an offer. The remaining half hold a median asking price of $350,000 and an average list price of $569,127.

The numbers tantalize leery minds: Housing prices, population growth and job creation in Southern Nevada all rebounded from the Great Recession over the past few years.

The same cannot be said for the battered psyche of a state staggered by the worst economic knockout punch in modern American history. A New York Times analysis showed the recession’s impact on Nevada caused the second-largest blow to a local or national economy of any crisis worldwide in the past four decades.

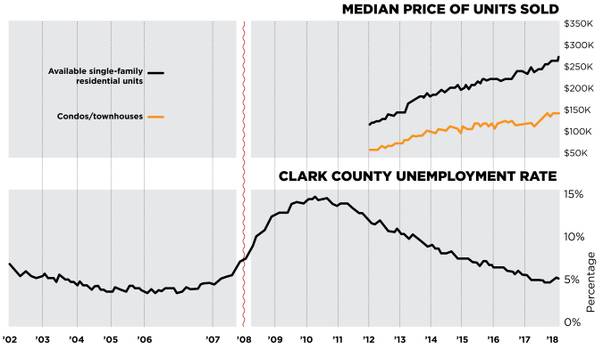

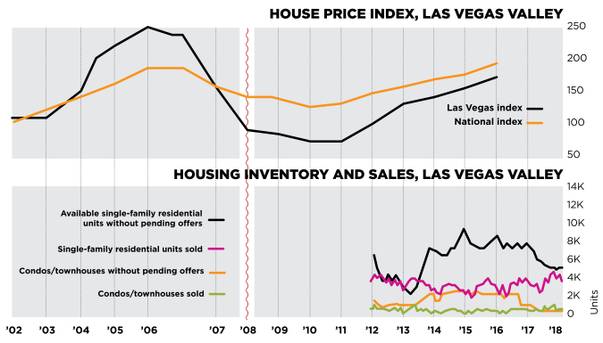

Southern Nevada housing cratered to a $118,000 median resale price in January 2012, while Nevada led the nation in delinquent mortgages and foreclosures for 62 consecutive months, from 2007 to 2012. As the economy righted, so did the local housing market. Both the median resale and new-home prices soared in the past two years, reaching their highest peaks since 2007 — just before forces beyond the control of most wrecked the American dream of owning a home.

“So many people are relatively new to the community, just based on pace of population growth, that they experienced the greatest economic prosperity in at least a generation, followed by the greatest economic decline,” said Jeremy Aguero, principal for research and consulting firm Applied Analysis. “It’s difficult for residents, for businesses, for employees to conceptualize.”

Fear of skydiving without a parachute again grips those struggling to believe in this housing surge, but local experts roundly agree that stronger economic fundamentals and refined lending practices will prevent another bubble.

“I don’t see any signal of that,” said Stephen Miller, UNLV economics professor and director of the university’s Center for Business and Economic Research. “The signals I’m seeing both locally and nationally are that the economy should continue its growth. If anything, the national economy is going to grow a little bit faster, at least through the end of next year.”

An unusual sustained shortage of new and resale houses on the market accounts for part of the sharp increase in prices, and few expect a significant upturn in supply through the slower winter buying season. Caution remains prudent and emotionally necessary.

Some lenders have gently eased requirements in the past three years, allowing down payments as small as 3 percent and permitting debt-to-income ratios up to 50 percent for qualified borrowers. Yet the subprime heyday of minimum-wage workers being lured or coerced into mortgages on $500,000 homes and neighbors owning four rental properties ended after the recession.

“Lenders have stricter guidelines; underwriters are really strict; appraisers are really careful in how they appraise,” said Scott Beaudry, owner/broker of Better Homes and Gardens Real Estate, which has offices in the District of Columbia and 36 states, including Nevada. “We’re still seeing properties underappraised. That’s just the way it is. The appraisal value has not yet met demand.”

That strong demand follows the region’s population and job growth, part of the compelling evidence Aguero lays out for trusting that Southern Nevada’s rebuilt foundation can withstand the next economic downturn.

He first points to steadily low unemployment, which has not exceeded 5 percent in 2017. Nevada led the country with 13.7 percent of its workers unemployed in November 2010. Statewide, 185,800 people in the workforce lost jobs from May 2007 to September 2010.

The state still relies heavily on tourism and construction but achieved recovery without adding back the bulk of the 110,000 jobs lost in those industries.

The Legislature created the Governor’s Office of Economic Development in 2011 with a goal of diversification to lessen Nevada’s vulnerability to fluctuations in the national economy. During the state’s subsequent upward bounce, the trade/transportation/utilities sector added 36,600 jobs, professional and business services increased by 34,100, and health care grew by 25,000.

“The employment base is much more diverse than it was before,” Aguero said.

When homebuilders retreated and Strip projects were mothballed during the downturn, Nevada lost 80,000 jobs in construction alone — the most of any industry in that period. By 2016, the state recovered to pre-recession employment levels, with only 30,000 of those jobs returning, though more could come online with the Raiders stadium set to break ground this month and Resorts World resuming construction. Aguero noted $15 billion worth of upcoming projects in the planning or execution stages.

Homebuilders still remain cautious, with about 9,000 new housing permits pulled this year in Southern Nevada compared with an annual peak closer to 40,000 in the boom years from 2004 to 2006. That more reasonable pace heartens economists.

“We really don’t want to go back to where we were in 2006, because we still have some empty buildings around that are our legacy for that period of time,” Miller said.

That legacy includes an unprecedented underwater housing market, but the steady decline in distressed sales involving foreclosures and short sales provides another encouraging sign for today’s environment. Nearly 73 percent of sales in Las Vegas involved distressed properties in 2011; by this year, that figure fell to just more than 8 percent.

With median resale prices bottoming out in 2012, investors snapped up undervalued homes before those buyers could get back into the market. Prices fell so low that the recent surge contained not only a reflection of today’s healthier market, but also a correction to that unsustainable depth.

“Even as a function of incomes, that (2012 price) is ridiculously low,” Aguero said.

The flipside: As the flood of cheap bank-owned homes dried up, housing supply shrunk just as people burned by short sales and foreclosures restored their credit and savings.

Some Realtors said they felt like the clock turned back a decade as the local housing market turned competitive over the past year before slowing slightly last month.

“I see multiple offers starting to slow down a little bit, which gives the regular homeowner a little bit better chance,” Beaudry said. “I just continue to see a very tight housing market. I don’t see inventory going up any time over the winter months. I hope to see it go up next year.”

David J. Tina, owner/broker of Urban Nest Realty and president of the Greater Las Vegas Association of Realtors, anticipates this seller’s market persisting. Investors might see how high prices go, keeping resales off the rolls. New homebuilders are likely to proceed slowly as they finish building out lots bought on the cheap during the recession while land prices go up.

“This is a correction that we’re dealing with now. Regardless of what happens in the economy in the next five years, we’re still not going to have enough houses,” Tina said.

At the end of September, fewer than 5,000 single-family homes without offers were available for purchase in the valley — a 33 percent drop from the same time last year. Such an ongoing shortage likely will keep local housing prices inflated until more supply appears, as demand shows little sign of easing with the positive economic indicators in job and population growth.

“That appreciation honestly may slow down slightly during winter months, which is normal, which I’m OK with,” Beaudry said. “I would like to see it go down a little bit because if it goes up too high, too fast, it creates a bubble.”

Tina is confident enough to buy a new home in Pulte’s Reverence development in Summerlin. He is readying to lower the selling price on his current house, which has sat on the market for two months — a rarity for a market in which 83 percent of homes sold inside of 60 days in September.

“Would I sleep with one eye open and be cautious and watch for the indicators? Absolutely,” Tina said. “It would be foolish not to. On the other hand, we’re not even close to the $315,000 median price of a few years ago. I believe we still have five, seven, 10 years (of growth).”

Impacts of the recession

What areas fared the best?

Current median home value as a percentage of peak in June 2006

• Summerlin: 87.5%

• Anthem: 81.6%

• Central valley: 68%

As home values in some of Southern Nevada’s priciest neighborhoods plunged during the recession, the dollar amounts were stunning, with some losses stretching into six figures. In a portion of the far west valley that includes master-planned developments in Summerlin, the median price plummeted by $222,500 from the height of the valleywide real estate market (June 2006) to the depth (January 2012). It was even worse across town in the area that includes the Anthem master-planned community, where the median price fell off $254,900.

But if you think those neighborhoods were the hardest hit, get ready for a surprise. Homes there actually held their value better than in any other parts of the valley. While the Las Vegas market at large saw a 62.5 percent drop, and some areas suffered losses of 75 percent or more, the median prices in Summerlin and Anthem dropped 54.6 percent and 55.4 percent, respectively. Not pretty by any means, but relatively not bad.

Why the disparity? Longtime Las Vegas Realtor David J. Tina said the same attributes that made the areas attractive to buyers before the recession were magnified during the downturn. As both buyers and lenders became more conservative in their investments, they looked for neighborhoods that offered long-term stability. So selling points like tight zoning codes and strict neighborhood covenants, which guard against commercial and industrial development incursion that would wreck resale potential, became more attractive.

“If you really want to be completely protected, you’ve got to be in a master-planned community,” Tina said. “People want to know what’s behind their property. In a master-planned community, you don’t have to worry about somebody building a Walmart behind you.”

Other factors in these outlier neighborhoods’ ability to retain value included high-performing schools and a relatively low crime rate. And while the recession prompted business closures in other parts of the valley, options for shopping, dining and entertainment remained relatively strong.

What areas fared the worst?

The central valley took an especially cruel pounding. No area was hit harder than the one bordered by Charleston Boulevard, Interstate 15 and Pecos Road, which includes downtown Las Vegas and parts of North Las Vegas. There, the median sale price went from $215,000 to $38,000, a plunge of 82.3 percent.

The key factors? With its higher crime rate, lower-performing schools and less restrictive zoning and covenants, the area was the opposite of outlying suburbia, magnified by the age of the homes — some of the oldest in the valley.

“People are generally going to want a brand-new car if they can afford one, and the same goes for homes,” Tina said.

Today, nearly six years after the market bottomed out, homes in the central area are lagging behind those on the valley’s edges in regaining lost value. But there’s good news for homeowners: Percentage-wise, no area has made a faster climb out of the recession. The sales price has increased 296 percent since January 2012, as investors and homeowners scooped up homes on the cheap.

“As inflated as the market was in 2008, it really overcorrected in 2012,” Tina said. “And those older areas in particular were very undervalued.”

Tina said he expected to see the central valley continue to gain, as rising home prices in the hot areas prompt buyers to look for less expensive fixer-uppers.

“In cities like New York and LA, you see this all the time: People going back to the older neighborhoods,” he said. “Then, you see the restaurants and shopping centers come back too. In Las Vegas, you’ve got pockets of areas that held their values fairly well — the Alta Drive corridor near the Springs Preserve, which is just a beautiful neighborhood, the Scotch 80s, places like that. Those are the anchors. People start putting money into them, and it takes off from there.”

Home buying/selling tips

Set a realistic timeline for when you want to move

For example, if you’re planning to move into a home that won’t be completed for several months, wait to place your current home on the market. “It all depends on how you price it and what your motivation is,” Greater Las Vegas Association of Realtors President David J. Tina said of how rapidly the market might dovetail with your needs.

Before listing your home, fix issues that might lower the asking price

According to Realtor.com, sellers see an average of 64 percent return on every dollar they spend on home improvement before listing. But not all investments will pay off. This Old House recommends updating appliances, refinishing floors, cleaning or replacing windows and fixing cracked tiles for maximum returns.

Interview three realtors before selecting the one who satisfies your requirements

“I like the rule of three,” Tina said. “You get three quotes and three different perspectives. You are looking for someone who is going to be an advocate for you and protect you.” You might love the first candidate and not need to see the other two, but Tina says it’s worth checking out multiple options, similar to getting a second opinion about a medical condition. One Realtor might promise big numbers and have the market stats to back up that boldness, while another is more conservative and offers an impressive sales record.

How do you know if a home is priced too high?

Tina says about 70 percent of all local homes go into escrow within 30 days of hitting the market, a benchmark missed in September. “So if your home is still on the market after 60 days or more, there’s a good chance it’s overpriced.” Among the reasons sellers shoot for the top of the market — or the moon — is the depth of emotion tied to the place they’ve called home.

“You’ve been in a home for 15 or 20 years; you think of all the memories you have and think it’s worth more than it is,” Tina said.

He and his wife, who’s also in real estate, are in the process of selling their home, and they knew they couldn’t see it clearly through their fond memories.

“We needed someone who could be tough and objective, so we called a colleague,” Tina said. “I told them to be honest and don’t worry about offending me.”

Does pricing a home low erode perceived value?

Tina said pricing to the lower end of a home’s market value could pay off. Besides selling faster, lower-priced homes tend to generate more interest from buyers, which could lead to bidding wars pushing the price well past where it was listed.

It’s good to keep in mind that even though values have bounced back considerably, selling a home won’t always yield a profit. According to the National Association of Realtors, home prices will increase nationwide by an estimated 5 percent by the end of the year. Yet many markets will see the cost of single-family homes decrease. Make sure your sense of the local market is actually based on that market and not national headlines about the health of real estate in America. Nevada no longer leads the nation in delinquent mortgages, but remember that many homeowners who rode out the recession remain underwater today.

Online pricing resources

These databases are a good place to start when trying to get a sense of pricing on both sides of a potential real estate transaction.

For current listings

Trulia often will mirror some of what is available through the Multiple Listing Service (MLS), though it likely will not be as current.

For comprehensive sales history

In addition to a home’s sales history, Blockshopper also allows you to look at an entire block or neighborhood for values, giving you a sense of how the area performed over time.

For ballpark pricing

Use Zillow to browse by price in desirable neighborhoods, noting that its algorithm might not take into account all the nuances that would be factored in by a Realtor on the ground.

For a variety of data

Realtor.com is a digital extension of the National Association of Realtors, so the data is robust. But the site insists nothing can match the level of detail offered by agents working within the market and responding to its fluctuations.

For more specific pricing

Local Realtors can provide comparative market analysis (“comps”) for your area or one where you would like to live, showing the specs and historical sale prices of homes to check against what you see online. And you can research such details yourself through the Clark County Assessor’s website.

1. Under Real Property Records, click address

2. Enter the information and select “show current parcel number record”

3. Click the corresponding parcel number to view the property’s assessed value and most recent sale date and price, as well as the specs of the lot and residential structure

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy