Monday, June 19, 2017 | 2 a.m.

By Attorney Judah Zakalik, Esq., Partner, Peters and Associates, LLP

Question: When I was growing up, no one taught me how to handle my finances and it got me into trouble as an adult. Now I’m a father, and I want to teach my children good money habits so they won’t face the same problems I did. How can I do this in a way they’ll understand?

Answer: Teaching your kids financial skills when they’re young is one of the best ways to prepare them for the responsibilities they’ll encounter as adults — and the earlier you start this process, the better.

However, as a father myself, I understand these lessons can be difficult to navigate.

Learning is an ongoing process, and there’s no master class that will equip your child with all the financial skills he or she will need over a lifetime. Our goal as parents should be to create a foundation of knowledge that our children can continually build upon.

While a 5-year-old isn’t going to grasp the complexities of compound interest, for instance, he or she can begin learning how to save money. Implementing a series of ongoing lessons can help give your kids the necessary tools to become financially savvy adults.

Young children

Lead by example

Children learn by example, and even during infancy they’re observing your behavior.

Paying with cash is a great way to introduce them to financial basics. Simply seeing you use and exchange cash, rather than using plastic, begins to visually familiarize them with how money is used.

Make it an activity

Get a toy cash register and play “store” at home. Price objects around the house for them to buy or sell, teach them how to count money and determine what they can and can’t afford. Show them how to count change following a purchase.

You also can have them help you with real shopping. Make a grocery list together, explain how much each item costs at the store, compare prices and look for coupons, etc.

Be smart about allowances

An allowance can help teach children how to manage their own money. Rather than a piggy bank, give your child three jars labeled “spend,” “save” and “share.”

1. The “spend” jar should be used for spending money.

2. The “save” jar can be used when saving for something specific (to establish the importance of setting financial goals) and/or reserved for a rainy day (to illustrate the advantage of having money saved to cover unplanned expenses).

3. The “share” jar is for charitable giving, which can help children better understand the value of money beyond just purchasing.

Preteens and teens

Make a budget

After getting comfortable with spending/saving and doing exercises like grocery shopping with you, your child has likely begun to understand how budgeting works. The next step is helping them create a budget of their own.

Have them list out how much money they have coming in, how much they need to cover essential expenses and any savings goals they might have. From there, show them how to crunch the numbers and map out what their weekly budget should look like.

Open a bank account

The early teen years are an opportune time to open a bank account. Start with a savings account and explain how interest works.

Depending on age and spending habits, it might be a good idea to open a checking account too. If your teen isn’t ready for that responsibility yet, a prepaid debit card can be helpful to prepare him or her for the real thing. A prepaid card can help teens learn to monitor their spending when using a card, and unlike a traditional debit card, it usually doesn’t have additional fees and it can’t be overdrawn because it’s not attached to a checking account.

Explain debt

Older teens are likely preparing for college and applying for student loans, so it’s necessary they understand exactly what that means.

Having a loan is a big responsibility, so carefully walk them through the process of managing it — explain how much they’ll owe, when they’ll need to start paying it off, what their monthly minimum payment will be and how interest accumulates over time.

It’s also an opportunity to explain credit and loan worthiness, because once they turn 18, they’ll be flooded with credit card offers. Stress the importance of only using credit in advantageous ways, to pay off the balance monthly and to budget based on actual cash.

Financial literacy learning in classrooms

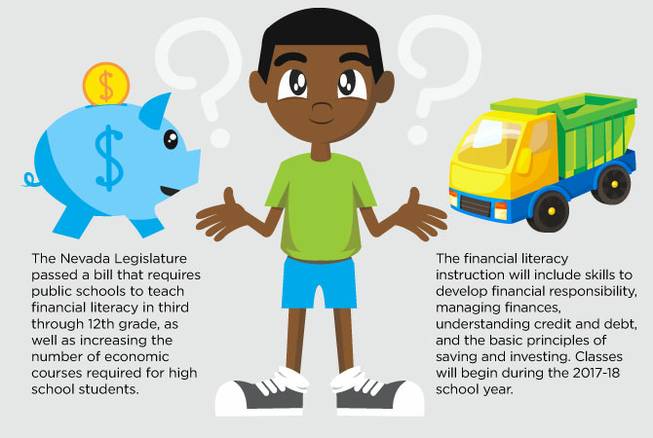

This year the Nevada Legislature passed a bill that would require public schools to teach financial literacy in third through 12th grade, as well as increasing the number of economic courses required for high school students.

The financial literacy instruction would include skills to develop financial responsibility, managing finances, understanding credit and debt, and the basic principles of saving and investing. The bill has been signed by Gov. Brian Sandoval, and financial literacy classes will begin during the 2017-18 school year.

°°°

If you have a question you’d like to see answered by an attorney in a future issue, please write to [email protected] or visit PandaLawFirm.com.

Please note: The information in this column is intended for general purposes only and is not to be considered legal or professional advice of any kind. You should seek advice that is specific to your problem before taking or refraining from any action and should not rely on the information in this column.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy