LAS VEGAS SUN

Friday, March 28, 2008 | 2 a.m.

New Frontier Implosion

The New Frontier was imploded Tuesday, Nov. 13, 2007. The 65-year-old casino, the second property built on the famous Las Vegas Strip, was the venue where Elvis Presley made his Las Vegas debut in 1956. It also housed entertainers like Siegfried and Roy, and Wayne Newton; was once owned by eccentric billionaire Howard Hughes, and featured one of the longest union strikes in U.S. history.

If you missed out on last year’s $1.2 billion sale of the New Frontier, now is your chance to snap up 27 acres of land just south of the Sahara — one of only two major Strip-facing parcels listed for sale.

But it’s going to cost you — a lot.

You’ll be dealing with developers Christopher Milam and Australian casino giant Crown Ltd., which have plans to build a $5 billion, 1,064-foot-tall resort there called Crown Las Vegas.

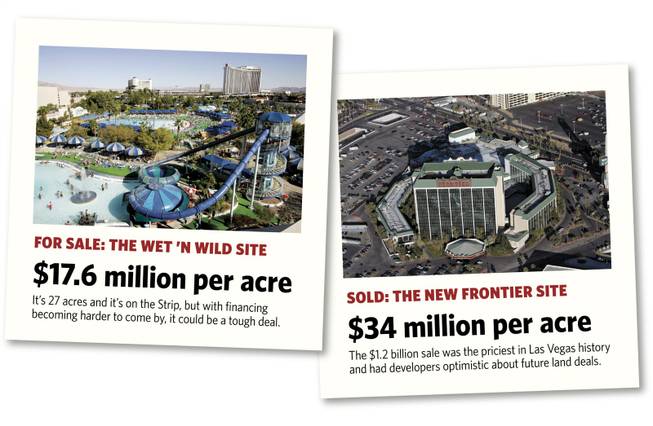

LVTI, a joint-venture company involving Milam, Crown, IDM Properties and York Capital Management, has an option that expires June 30 to buy the property — the site of the old Wet ’n Wild theme park — for $475 million, or $17.6 million per acre. So you can expect to pay more than that for the land, especially because LVTI needs to at least make back its investment and would hope to make a profit.

That’s a tall order right now, especially because the rising cost of land on the Strip, at least over the past few years, has been driven by easy access to financing at low interest rates. Now the opposite is true, and Wall Street banks, responding to the mortgage crisis and the soft economy, are unwilling to finance major projects in Las Vegas and elsewhere.

Then there’s the condo market, where demand and prices have fallen significantly from the boom years and potential buyers are holding off. As banks stay away from big condo projects, developers no longer can use condo sales to help finance their resorts.

Milam, Crown and Archon Corp., which owns the land, could not be reached for comment. Broker C.B. Richard Ellis, which is marketing the land, declined to comment.

This isn’t the best time to sell land. And yet the Strip — home to the biggest building boom in Las Vegas history, with more than $35 billion in resort development over the next few years — seems to defy economic rules. Las Vegas Boulevard has always drawn more than its fair share of speculators and dreamers.

“For those operators who are not in Las Vegas and who still want to put their shingle on a storefront, they may have the opportunity to buy rather than build,” Deutsche Bank bond analyst Andrew Zarnett said in a research note to investors Thursday.

But there are developers and there are speculators.

Investors who flipped Strip land for easy profits a few years ago are less likely to sit on land now, making payments and earning no income while waiting for the financing markets to improve.

Some developers have more financial flexibility than others to wait for the most opportune moments. Entire gaming empires, in fact, have been built upon a few skillfully timed deals.

Boyd Gaming Corp. is moving forward on its $5 billion Echelon resort complex because the company received financing commitments from banks last year, before the market soured. The same is true for the $3 billion Fontainebleau Las Vegas resort, though it is raising additional equity. Developers El Ad and IDB Group, however, don’t have commitments to finance the more than $5 billion it will cost to build a resort resembling El Ad’s famed Plaza Hotel in New York.

Developers who can afford to wait will reap more rewards for their patience, experts say.

LVTI, which has paid more than $50 million in deposits since acquiring the option in June 2006, has extended the option period multiple times and is facing higher option payments. If the option can be further extended, that would mean millions more dollars that need to be recouped from a sale or development.

Australian billionaire and media magnate James Packer, who controls publicly traded Crown, has deep enough pockets to wait for the banks to come around. But even the richest developers in Las Vegas have been unwilling to spend much of their own money on such big gambles. Facing off against tens of thousands of new hotel and condo units as tourism slows in Las Vegas is not for the faint of heart.

Packer’s Crown already is forking over $1.8 billion to buy locals casino operator Cannery Casino Resorts and is investing in the $3 billion Fontainebleau resort, under construction just south of the Wet ’n Wild site.

That said, the closest to a sure thing in Vegas has been Stripfront property, a rapidly diminishing commodity as luxury resorts replace outmoded hotels and other buildings.

It’s unknown whether LVTI or anyone else will be able to sell land for about $34 million an acre, the price that El Ad and IDB Group paid for the 35-acre New Frontier site last year. That $1.2 billion sale was the priciest in Las Vegas history and had developers starry-eyed about future land swaps.

Some call this market slump a welcome, and entirely logical, reality check.

“It will be interesting to see whether the price El Ad paid for the New Frontier will translate to some of these other sites,” said David Atwell, a Las Vegas broker involved in the New Frontier sale.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy