Co-owner Paul Goldberg looks out the door of his Maui Wowi franchise. He doesn’t see many customers at the Spanish Trail Business Park, which has been experiencing a cycle of declining business and store closings. If things don’t get better after the holiday season, Goldberg says, his store is likely to close.

Monday, Nov. 24, 2008 | 2 a.m.

Without close inspection, you could chalk up the receding monthly sales at the Maui Wowi smoothie shop to cooling temperatures. But slumping sales began in April. You could argue that fewer people today can afford a $4 or $6 smoothie. But Maui Wowi also sells 99-cent coffee.

Co-owner Paul Goldberg has a different theory: declining foot traffic at Spanish Trail Business Park, on Rainbow Boulevard near Tropicana Avenue.

In recent months, four stores near Maui Wowi vacated the 14-month-old marketplace: Jersey Mike’s sub shop, Manhattan Pizza, Mail Trail and a Hurricane Grill and Wings. Only two remain open, the Maui Wowi franchise and LT Nails & Spa.

And it doesn’t help that most of the new office suites in the rear of the complex still don’t have tenants — another source of smoothie and spa customers.

At the nail and spa salon, co-owner Tina Geller, 30, says: “We still have regular customers, but we need walk-ins. If you’re next to a market, there are a lot of walk-ins. To get walk-ins now, we have to advertise and we have to lower the price.”

LT Nails is making enough to pay the $4,000-a-month rent, but Geller isn’t saving any money.

This is not a phenomenon unique to Spanish Trail. Across the valley, stores — including regional and national chain stores — are turning up vacant at a quickening pace as the economy plummets.

As a result, a kind of unprecedented commercial blight in what for decades had been a boomtown is creeping over retail centers like a cancer, stigmatizing the struggling businesses that remain. Who wants to move into a shopping center where an increasing number of stores are closing and any retail synergy that might have existed has collapsed?

In the third quarter, the vacancy rate valley-wide topped 5 percent, nearly double from a year earlier, according to a report by analyst John Restrepo of the Restrepo Consulting Group.

The vacancy rate may be higher, said Rob Moore, managing director of investment sales and leasing at Gatski Commercial, which handles leasing of the Spanish Trail storefronts.

Applied Analysis, a market research firm, pegs the vacancy rate at 6.3 percent.

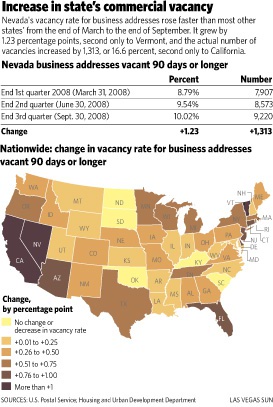

A Sun analysis of U.S. Postal Service records found that the number of business addresses in Clark County vacant 90 days or longer jumped by more than 16 percent from the end of March to the end of September — by 965 addresses in Clark County and 1,313 statewide — the second highest percentage increase of any state. Nevada also had the second highest growth rate of vacant businesses, 1.2 percentage points, from 8.8 to 10 percent.

Paco Underhill, founder of international market research firm Envirosell, predicts the national retail vacancy rate will creep to 20 percent — and higher in some markets. The age, location and branding of shopping malls will dictate which ones have the best prospects of surviving the worsening recession.

Spanish Trail may not have the traction in its neighborhood to attract customers.

On the other hand, “Fashion Show Mall on the Strip isn’t going to have a hard time finding tenants,” Underhill said, even though it may have to lower rents.

Mike Krien, president of the National REO Brokers Association, said “retailers are having a heart attack. Everybody’s scared because no one’s spending money.”

Landlords are struggling to find replacement tenants, offering handsome incentives to little avail: rent discounts of up to 10 percent; a few months of free rent in exchange for three- or five-year leases; and site improvements.

Winston Lee, who owns the Spanish Trail Business Park storefronts facing Rainbow, says he’s offered a rent reduction to the smoothie shop, to account for the slumping economy. He’s noncommittal about whether he could — or would — offer more incentives, but noted: “Their survival means I survive. Why would I want them to leave after one year?”

But Lee also believes the tenants share responsibility for their struggles: “It is store owners’ incentive to market their product.”

Not that the folks at Maui Wowi haven’t tried. And still its future isn’t bright. The shop probably will push through the holiday season, but co-owner Goldberg, 60, expects the franchise to close soon after if a troubling trend doesn’t reverse.

The store has been averaging just 25 shoppers a day in recent months. In an hour last Monday afternoon no one visited the smoothie shop. Only three visited during the lunch hour Thursday.

For three days in June Goldberg posted free-coffee signs on the street, but only two dozen motorists took up the offer. He offered free smoothie samples curbside on a hot day a few weeks ago, but only seven people were lured inside to buy one.

The lesson: The bulk of his business had been from walk-ins who were visiting neighboring stores. With those businesses gone, his is drying up.

“I don’t know what it will take to get people in the store,” Goldberg said.

Sun reporter Alex Richards and researcher Rebecca Clifford contributed to this report.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy