iStockphoto.com

Sunday, Dec. 20, 2009 | 2 a.m.

In Today's Sun

Beyond the Sun

The Obama administration is publicly pressing banks to modify more mortgages after a Treasury Department report showed dismal results in a federally funded foreclosure prevention program — including only 16,000 mortgages being reworked in Southern Nevada.

Lenders have appeared unable or unwilling to tap into the $50 billion that President Barack Obama made available this spring to rewrite loans to stem the tide of foreclosures, which some estimate will hit 13 million nationwide.

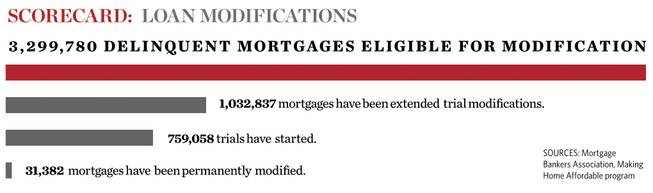

In the first of what are planned to be monthly public assessments from the Treasury Department, data through November show lenders have begun writing down the interest or principal on just 23 percent of the 3.3 million delinquent home mortgages nationwide.

Of those nearly 760,000 trial mortgage modifications nationwide, just 31,000 have been converted into permanent, five-year agreements, a performance that disappoints Treasury officials.

Lenders say they’ve had lackluster results in making trial loan modifications permanent because homeowners have failed to file paperwork in a timely manner or have since lost their jobs and no longer qualify.

But the administration said banks must do more.

“Our challenge now is to keep the pressure on,” William Apgar, a senior adviser for mortgage finance at the Housing and Urban Development Department, said in a statement released with the report.

Under the Making Home Affordable program announced in the spring, the Obama administration unleashed $50 billion from the bank bailout, the Troubled Asset Relief Program, to encourage banks to rework mortgages for those in “imminent risk” of foreclosure. (Another $25 billion was made available to refinance loans, including those that are underwater.)

Homeowners qualify for the mortgage modification program — which is named the Home Affordable Modification Program and is part of Making Home Affordable — if more than 38 percent of their gross household incomes go toward their mortgages, they can no longer afford the monthly payments and are at risk of foreclosure.

If the bank agrees to write down the mortgage so monthly payments equal 38 percent of income, the government will meet the banks halfway and partially subsidize a further write-down to 31 percent.

To sweeten the offer, the Treasury Department is offering banks $1,000 for every loan they modify, with additional bonuses totaling up to $3,000 if the loans remain modified.

Borrowers also get $1,000 a year toward their loans for staying current with payments for the initial years.

Nevadans stand to benefit

The program could be crucial for households in Nevada with adjustable interest rates that are resetting to higher levels and where the state’s 12.3 percent unemployment rate has left many families unable to afford their monthly payments.

Those receiving unemployment insurance can qualify for the program if their unemployment checks are guaranteed for nine months.

Nearly 70 percent of homeowners in Las Vegas are underwater, according to First American CoreLogic — meaning their mortgages are more than the homes’ current value — essentially trapping residents in their homes even if they can no longer afford them.

Nevada has had the highest foreclosure rate in the nation since January 2007. Yet the data show that statewide, just 19,000 mortgages have qualified to begin the loan modification process.

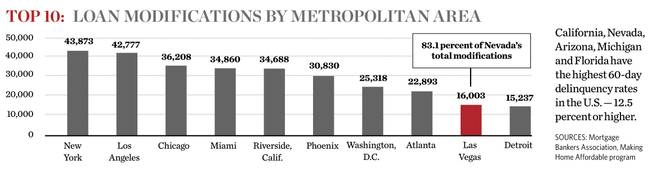

The Las Vegas metropolitan area ranked ninth in the nation for mortgage modifications, accounting for 2.2 percent of the write-downs using the federal program — 16,000 Las Vegas area loans.

The New York-New Jersey metropolitan region was No. 1, with 6 percent of the federally backed cases.

Late-filed paperwork

Bankers say they are doing their part, but complain homeowners are missing deadlines on paperwork for modifications.

Similar to buying a home, that paperwork can be a cumbersome collection of payroll stubs, past tax returns and asset statements.

Plus, industry leaders say skyrocketing unemployment rates overtook the program, disqualifying borrowers who otherwise would have been eligible.

Scott Talbott, a vice president at the Financial Services Roundtable, which represents the nation’s top banks, said all parties bear responsibility for the program’s shortcomings.

“There are challenges with all these parties to making this program a success,” Talbott said.

“The industry is committed to working on the (Home Affordable Modification Program) and other administration programs for keeping families in their homes,” he said. “We are going to do a better job.”

Pressure from lenders

Borrowers, however, tell consumer watchdog groups that they are being kicked out of the program and put into foreclosure even before they have a chance to complete the paperwork.

The Treasury Department is pressing the industry to ensure that 375,000 trial modifications that are set to either convert to permanent fixes or expire by year’s end are not deemed ineligible without a thorough review.

Julia Gordon, senior policy counsel at the Center for Responsible Lending, a consumer protection group, said lenders and borrowers share blame for the program’s shortcomings.

Gordon said it is clear banks’ loan servicers do not have the capacity or competence to handle the flood of applications from across the country.

Small states such as Nevada are especially hurting, she said, because they lack the civic infrastructure of housing aid and nonprofit legal organizations that exist in bigger states. New York, California and Illinois, for example, have a greater supply of aid organizations that provide assistance to help borrowers navigate the often confusing requirements.

But banks, she said, have failed to step up.

“They still don’t seem to be able to handle it,” Gordon said. “The real question is: Are they unable or unwilling? I think it is a little bit of both.”

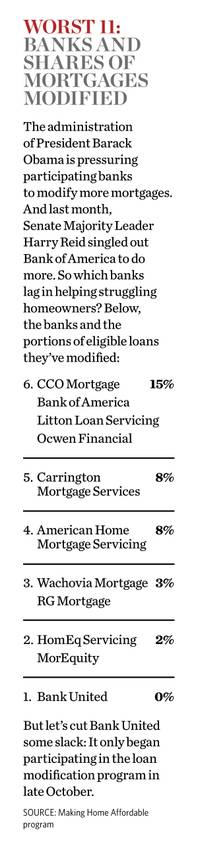

Senate Majority Leader Harry Reid singled out Bank of America this month, saying the bank’s “reputation will suffer” unless more is done in Nevada. He requested that the bank establish an assistance center in the state and assign staff to represent the company in cases before Nevada’s new foreclosure mitigation program.

Bank of America responded it is “committed to helping as many customers as possible stay in their homes during these difficult times.”

Treasury data show Bank of America was modifying 15 percent of its eligible mortgages in November, placing the banking giant among the bottom 10 banks nationwide. Also in the bottom 10 is Wachovia. Wells Fargo ranked 19th with 30 percent of its mortgages being modified.

Pressing banks to act

The power of the bully-pulpit may nudge banks to do more, but it may only go so far.

Gordon of the Center for Responsible Lending is among those who have long argued that politicians need to rely more on sticks than carrots. Consumer groups have long pressed Congress to pass a law to allow bankruptcy judges to write down mortgages — a bill that has passed the House this session, but failed in the Senate under opposition from bankers.

Congress could require lenders to conduct loan modifications before foreclosure proceedings to give homeowners a chance to make new, lower payments on time.

“It seems the speak-softly-and-carry-a-big-stick might work better than speaking loudly,” Gordon said. “No one is going to persuade these banks by their eloquence. They will change their behavior when there’s an economic reason to do so.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy