Friday, March 13, 2009 | 2 a.m.

$3 million

Yearly sales tax a study estimates would be generated in the Tourism Improvement District adjacent to the now-vacant Lady Luck, above, an area that includes the site of the proposed mob museum.

THE PROBLEM: The county argues the tourism district would draw tourists from existing downtown properties. The district would monopolize the sales tax revenue it generates, and the county, the School District and others could lose $60 million to $90 million over 30 years.

Sun Archives

- Council OKs up to $100 million in redevelopment bonds (3-4-2009)

- Golden Nugget runs against economic winds (2-18-2009)

- Mob museum walks on public tightrope (2-3-2009)

- Goodman stays positive despite tough economy (1-23-2009)

- Mayor: Las Vegas will 'rise again' (1-13-2009)

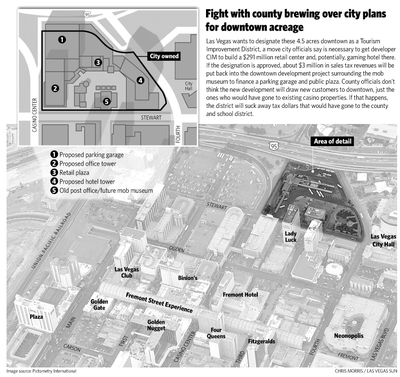

As if Las Vegas didn’t have enough critics of its downtown redevelopment moves, some members of the Clark County Commission are set to argue against the city’s plan to create a Tourism Improvement District on 4.5 acres of land surrounding the forthcoming mob museum.

Under that designation, roughly 75 percent of taxes from sales would be funneled directly back into the district for 20 to 30 years. The city says it intends to use that money to create a public parking garage and public open space or a plaza.

According to an analysis commissioned by the city last year, yearly sales taxes generated from a $291 million planned development in the district would amount to $3 million.

If the tourism district is approved, Los Angeles-based developer CIM Group is expected to construct not only retail space, but also a 350,000-square-foot hotel and casino.

For months, the matter has been swirling around the upper offices of Clark County government. State law requires the city to notify the county about plans to create business incentive districts. The city is also required to take the county’s views into consideration.

So what does the county think?

Its main argument against the district boils down to this: The retail stores and the new casino that CIM is expected to build will draw existing tourists away from, say, the Golden Nugget or Fitzgeralds, which pay their full share of sales taxes to the state, which then divvies it up among the local entities, including the School District and county. If tourists instead spend that money at stores or casinos in the Tourism Improvement District, it will siphon away $60 million to $90 million in sales taxes from the shared coffers over the next few decades.

In addition, the 4.5 acres are already within the city’s redevelopment district, so the increases in property tax revenue are already getting funneled back to the city’s redevelopment agency.

So what the city wants to do, opponents say, amounts to a kind of “double dipping.”

It is not illegal, though. A 2005 state law specifically allows for overlaying existing redevelopment districts with tourism improvement districts.

In this case, that kind of overlay is necessary, Scott Adams, the city’s redevelopment director, says. Adams argues this district will push developer CIM to build a development that draws a net increase in visitors and tourists downtown, resulting in tax revenues that would not have existed otherwise.

As for the argument that the project will only lure tourists away from properties paying their full share of sales taxes, Adams counters: “The more you get, the more you get.”

“You build up retail,” he said. “It is competitive to some extent, in that if we build a better mousetrap, there’s going to be a lot of people coming here that might not be going somewhere else.

“We see this all as one new big attraction. The mob museum with the retail, with the hotels — it all creates more reason for people to come to downtown Las Vegas.”

County officials, however, are skeptical about whether this will generate new revenue or increase tourism downtown. Some say they don’t think it will do either.

If the project is worthwhile, “then the developer would build it without these incentives,” Commissioner Chris Giunchigliani said.

“We shouldn’t have to subsidize a parking lot,” she added. “The city already owns a parking lot that’s half-empty.”

She was referring to the parking garage under Neonopolis, which the city funded about a decade ago as an incentive to developers of the retail center. Once full of stores, Neonopolis is almost empty today.

“Would someone from, say, Asia come solely for this development?” Giunchigliani asked. “If no, then we should not be doing it.”

Also lining up against the project is the Culinary Union.

The Tourism Improvement District is the third incentive given to CIM, argued Chris Bohner, the union’s research director.

“It’s in a redevelopment district, they already let the developer buy property at cut-rate prices and now there’s this incentive,” he said.

Last summer, the Sun reported that the city’s own analyst recommended against selling about 4.5 acres to CIM for about $25 million, because it was appraised at $52 million to $60.8 million.

In addition, Bohner added, the city is investing $50 million in the mob museum, which is expected to draw 600,000 people annually.

“When does it end?” Bohner said.

The union’s interest, he added, stems from concern for the funding of public services, such as schools.

“We’re talking about massive deficits in the city budget, school budget, in the state, and our members depend on those services,” he said. “That’s the bottom line, but it affects everybody, whether you’re a Culinary member or not.”

To fulfill statutory requirements for creation of the district, the city hired Applied Analysis, a local firm, to study its potential economic impact. The study predicted that negative impacts on retailers and adjacent property owners would be “negligible.”

“In fact, the impacts are likely to be positive,” it says.

For retailers in the general area, the report concludes, the development “will spur demand by tourists, and residents to some degree.”

In the end, the county doesn’t have the final say. The city doesn’t need the county’s approval.

It does, however, need the state Tourism Commission to conclude that most of the money collected within the district will come from tourists. Then the governor has to find that the development will contribute significantly to tourism and economic development. So the county’s stance could come into play at the state level.

At Tuesday’s meeting, the County Commission is expected to schedule a public hearing on the matter for April 7.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy