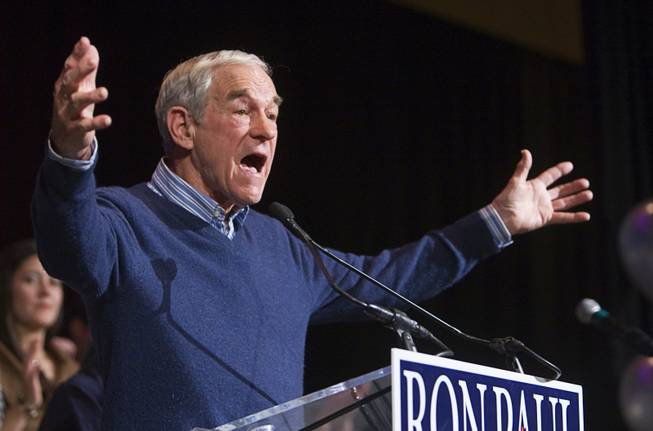

Republican presidential candidate Rep. Ron Paul, R-Texas, speaks during a rally at the Green Valley Ranch Resort in Henderson on Tuesday, Jan. 31, 2012.

Wednesday, Feb. 1, 2012 | 2 a.m.

Sun archives

Reaction to Rep. Ron Paul usually veers from mild amusement at the crotchety uncle or respect for his consistency. Sure, he wants to do away with Medicare and Social Security, but hey, he hates all the wars and would legalize pot, so go Ron Paul.

In a brisk 10-minute speech at Green Valley Ranch Resort in Henderson Tuesday, Paul laid out his message of personal freedom, asking Americans to “assume responsibility for themselves and the consequences of their actions.” The crowd, some 400 strong, roared.

In the end, we tend not to engage his often dangerous ideas. But we should.

The conservative echo chamber is relentless — Valerie Plame wasn’t a covert operative, Barney Frank caused the housing meltdown, global warming is a hoax. If you don’t debunk the errors, before long you’re at Thanksgiving and your eyes are popping out of your head after you hear, “Well, everybody knows Obama is a fascist. Someone forwarded me an email telling me all about it!”

Paul would like to do away with the nation’s central bank, the Federal Reserve, and return to the gold standard, which means we could only issue as much money as we have in gold to back it up.

Paul claims this would stop the problem of inflation.

When Paul called for new monetary policy at Tuesday’s rally, the crowd broke out into a chant: “End the Fed! End the Fed!”

The argument is that the Federal Reserve, which has the greatest influence over the money supply, has given us inflation, thus destroying our purchasing power.

To start with, inflation is not a problem right now. The Fed has effectively controlled inflation since Paul Volcker, who was appointed by President Jimmy Carter, began to rein in inflation 30 years ago. (Most important, inflation rates have been stable and predictable, which allows for economic planning by firms and households.)

Since the 2008 financial crisis, the Fed has tripled the money supply. And ever since, gold obsessives like Paul have been predicting rapid inflation. But it hasn’t happened — inflation has been about 1.5 percent per year — because the economy has been so depressed.

The real risk after the financial panic of 2008 was deflation, a rapid decline in prices and wages that would have stifled economic activity even more, which is why the Fed fought it with aggressive action.

Second, Paul is mistaken about how rosy things were before the Federal Reserve, which was created in 1913, or before President Franklin Roosevelt took us off the gold standard.

Here’s Elliott Parker, a UNR economist: “It’s an absurd argument because before the Fed prices were unstable in the short term, and long term there was a long period of deflation.”

Parker’s data from the 19th century show that inflation and deflation rates swung wildly, which stifled economic activity because of uncertainty. There were frequent financial panics, exacerbated by the lack of a stabilizing hand like the Fed. (You think 2008 was bad? The world would have collapsed without aggressive action by the Federal Reserve.)

Also, Parker points to what’s known as the “Long Depression,” which lasted from the mid-1870s to nearly 1900. The problem was that to bring about more economic activity required more money, but there was a limited supply of gold so the amount of money stayed the same. As a result, prices kept falling. (You have 100 widget firms chasing $100. Then you have 200 widget firms chasing $100. Each dollar is now more valuable, and prices fall.)

Soon there’s less incentive to build widgets. Factories produce less, requiring fewer workers. With fewer workers earning money to buy goods demand falls and prices continue to decline. The economy grinds to a halt.

“Prices falling may seem attractive for consumers, until they realize that wages and everything else are all falling, too,” Parker says.

Is the Fed perfect? Of course not. In fact, its policies helped contribute to the Great Depression — though in that case it failed to deal with deflation, not inflation.

And as Paul points out, after the tech bubble and 9/11 recession, the Fed left interest rates too low for too long, which helped fuel the housing bubble. The even bigger failure of the Fed in the run-up to the financial crisis, however, was its failure as a key banking regulator to scrutinize the banks. But of course, Paul doesn’t believe in regulation, so he can hardly complain about that.

Here’s Parker again: “Criticize the Fed all you want, and perhaps even propose improvements. But there is no evidence that getting rid of the Fed and replacing it with private banking along the lines of a gold standard would help the economy at all. None. In fact, the idea scares the hell out of me.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy