Carolyn Kaster / AP

The sun rises behind the Capitol in Washington on Wednesday, Oct. 2, 2013. The political stare-down on Capitol Hill shows no signs of easing, leaving federal government functions — from informational websites, to national parks, to processing veterans’ claims — in limbo from coast to coast. Lawmakers in both parties ominously suggested the partial shutdown might last for weeks.

Friday, Oct. 11, 2013 | 2 a.m.

You’ve heard the warnings about the debt ceiling. Treasury Secretary Jack Lew calls it “catastrophic.” Moody’s economists call it “cataclysmic.” Senate Majority Leader Harry Reid, D-Nev., simply calls it “the big one.”

And yes, there are some Republican lawmakers trying to shrug it off as really nothing at all.

But as the country hovers within days of hitting the congressionally mandated debt limit, lawmakers are either warning or wondering aloud about the consequences of such an unprecedented moment.

Will hitting the debt ceiling mean the United States starts to default on its debts to foreign countries? Stiff seniors of their Social Security checks? Send the stock markets straight into another recession? And how will that affect Nevadans at home?

“We’re not certain,” said UNR economics professor Elliot Parker. “And the reason we’re not certain is that the U.S. has never gone through this before.”

If the country hits the debt ceiling, only one thing is for sure: Absent an act of Congress or a constitutional workaround by President Barack Obama, the only revenue the government can count on to cover its obligations are tax collections. As we already know, that’s not enough to cover all the costs of keeping the country running.

Here’s a sampling of how you might feel the effect of a default close to home. How much and how severely the following areas of the economy are affected depends on how long the country has to go on without a raised or suspended debt limit, and how the president decides to prioritize which bills to pay first.

-

Social Security and Medicare

Retirees who depend on Social Security and Medicare escaped the government shutdown largely unscathed, save for those unlucky individuals who have recently turned 65 and found their applications lost in the shutdown shuffle. They may not be so lucky, however, in the case of a default.

Social Security, Medicare and defense spending may be “mandatory” spending programs, but they also make up the lion’s share of the government’s annual expenditures — about 60 percent. Because of this, economists believe it will be impossible to absorb the loss of the government’s borrowing ability in the discretionary spending budget (aka, everything else the federal government pays for). That means Grandma and Grandpa might not get their monthly Social Security check. If the default starts to affect Medicare, it’s possible people's doctors will refuse to treat them because the government won’t cover the bill.

-

Talk among Don Shreffner, from left, Cippy Valle and her husband, Aurelio Valle, at the Henderson Senior Center on Thursday focuses on the economy. "I learned at an early age to save and prepare myself," said Aurelio Valle. "And I have."

Your retirement

If and when the United States defaults, the stock markets are almost guaranteed to take a nosedive. And when that happens, so will your retirement accounts. Although the exchange averages are experiencing all-time highs, those will quickly plummet in the case of a default. Union retirement funds will drop with the market, too.

-

Protesters rally against taxes Wednesday outside the James C. Brown Jr. Post Office.

Your taxes and the deficit

In 2011, when the U.S. came within a few hours of hitting its debt ceiling, the economic shock was enough to cause one major credit rating agency to downgrade its assessment of the country’s creditworthiness. Just like a bank would charge higher fees and interest rates if you missed your credit card payments, a downgraded credit rating makes it more expensive for the U.S. to borrow money.

If the cost of borrowing goes up, that means the U.S. will have to find some other way to pay off mounting bills — and there’s really only two options. One is to raise taxes. The other is to just borrow the money and let the deficit build faster than it ever has before. Eventually though, that leads you back to the same conundrum the country is in today: trying to figure out how to pay down its mounting deficit, an end which will likely include some combination of spending cuts and raised tax revenues.

-

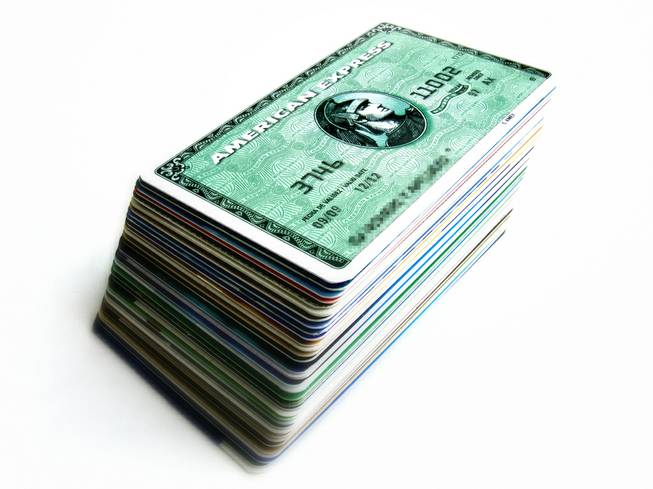

Your credit cards, home loans, student loans

If it gets more expensive for the United States to start borrowing, guess what — it’s only going to be worse for the average consumer. A lack of confidence in the country’s creditworthiness will start to make the markets doubt the security of Treasury bonds — considered the safest, most risk-averse investment out there. Most interest rates, whether it’s your mortgage, your credit card, or your student loans, are tied to some measure of the Treasury bond rate, plus a few percentage points. If the Treasury rate rises, so does everything else — which means unless you’ve locked in a fixed rate on your loan, your personal borrowing costs are going to rise, no matter how responsible you’ve been with your payments.

-

Exports and tourism — a story of your dollar

If the U.S. gets the post-default reputation of being a risky investment, the dollar will start to lose its purchasing value compared with other currencies, which could lead to inflation. Now there are pluses and minuses to inflation. The biggest minus is that your money won’t buy you as much. Prices will rise. Your purchasing power will fall. And odds are that your paycheck won’t keep pace with the changes.

On the bright side, when the dollar is low, U.S. exports start to look very attractive to overseas customers, and that could help to right our trade balance. Having a cheap dollar is also a draw for foreign tourists, who will be able to stay and play for less, and thus have an excuse to visit places like Las Vegas in droves.

But there’s a catch.

Because of the government shutdown, there aren't enough federal employees working to process visa requests, which will keep many deep-pocketed foreign travelers from being able to enter and spend in the United States. A debt ceiling default could complicate the problem by pulling back on Customs and Border Patrol at ports of entry as well. If they can’t get the paperwork, tourists can’t come.

-

Unemployment benefits

Gov. Brian Sandoval has estimated that Nevada will run out of federal money to cut unemployment checks by Nov. 1 because of the shutdown. This is sore news to the 9.5 percent of Nevada’s workers who are presently jobless and eligible for benefits. But the news could be a far greater blow to the local economy as well, especially if affected by a default: Unemployment benefits are largely assumed to be the best drivers of consumption, as an unemployed worker is far more likely to spend a dollar of unemployment benefits on goods and services — keeping the local economy going — than a wealthier person who has that dollar sitting in a savings account. The jobless worker will feel the hardest hit when his check disappears, but all the local businesses where he spent that check will miss the benefit, too.

-

Food stamps

Nevada managed to ride out the government shutdown without much happening to curtail Supplemental Nutrition Assistance Program benefits. Yet. Sandoval also surmised that come Nov. 1, Nevadans on food stamps will have to turn to soup kitchens, or simply go hungry, because the money will have dried up. A federal default may drive up that date even earlier.

-

Troops

Active-duty troops and the civilian Defense Department employees who support them will continue to be paid through the duration of a government shutdown, according to the new law Congress passed earlier this month. But if there’s a default on top of a shutdown, there’s no guarantee that the government will pay for much else beyond those paychecks. In Nevada, the National Guard has already run out of cash for gas in trucks; across the nation, flights have been grounded, leaving certain active-duty members stranded, and death benefits have been stalled. A default likely only makes events like these more widespread and commonplace.

-

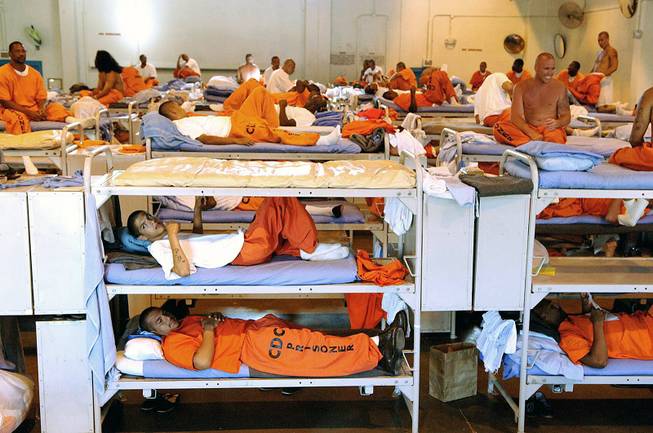

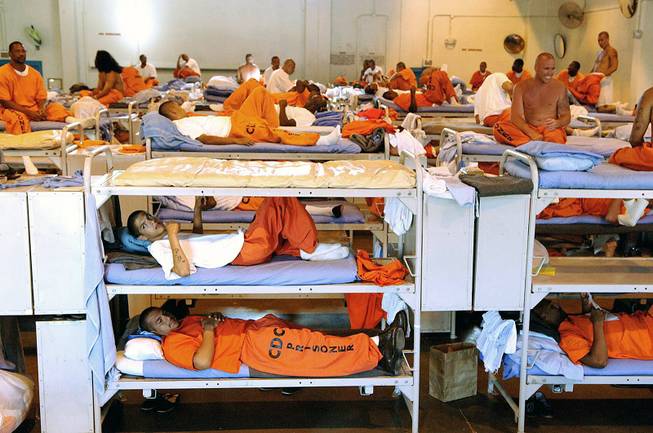

Prison guards. Police. You name it.

Emergency services were deemed untouchable during the government shutdown, and most likely, emergency workers will be compelled to report for duty during a default too, even if they can’t get paid right away. But people aren’t the whole job. If the government runs out of money for the expenses of doing business, from gas to bullets to processing systems, the default could take a chunk out of some of the country’s most basic services.

-

Gold

When the dollar dips, people flock to the gold markets, because the price of precious metals goes up when the value of paper is perceived to go down. This will be welcome news to the gold mining companies that operate in Nevada and their employees. Perhaps it is also a secure fallback option for anyone who just inherited a whole lot of jewelry. But in general, the rising price of gold is just another sign of financial insecurity.

-

Public lands

The government has several revenue-raising options open to it: It can raise taxes (a politically challenging suggestion), close tax loopholes (also a sticking point between the parties) or try to sell off government assets.

There’s no real rules about what government assets can or can’t be sold off to the highest bidder or at a fair market rate to raise money to keep the government alive. Technically, the government could sell off anything from federal buildings to the bars of gold in Fort Knox. Or perhaps, big chunks of Nevada. While there’s no precedent for such a move, the idea of selling off big chunks of BLM land to avoid a fiscal disaster has at least inspired a few joking suggestions from Nevada lawmakers.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy