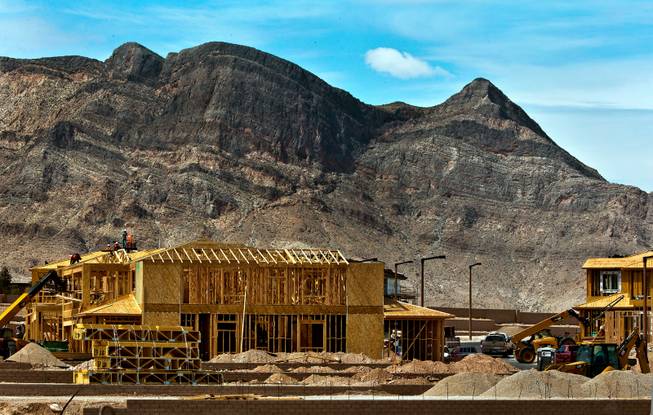

Land prices are rising in Summerlin, including the area within the Delano development off South Fox Hill Drive, shown Thursday, May 14, 2015.

Friday, May 15, 2015 | 2 a.m.

Homebuilder Kent Lay knows all too well that Summerlin land isn’t cheap. His company, Woodside Homes, is paying double what it did a few years ago.

It’s not alone. Land prices have been climbing at a faster rate in the sprawling Las Vegas community than in the valley at large, with the gap growing even wider in recent months.

Summerlin land prices soared 31 percent in the first quarter from a year earlier, while prices valleywide fell 34 percent in that time.

The price jumps are slowing land sales but by no means scaring off builders, who spend big dollars tying up land in the 22,500-acre project, one of the most affluent and popular places to live in Southern Nevada.

High-end builder Toll Brothers, for instance, shelled out nearly $45 million last fall for about 111 acres near Bishop Gorman High School, where it plans to build a 55-and-older community.

“The (land) values in Summerlin are worth it; it is such a premier location,” said Mary Connelly, Nevada division president for William Lyon Homes, a longtime Summerlin builder.

However, the higher land prices will only make new homes more expensive, and parcels might get too costly for builders to turn a profit, potentially slowing development there and fueling construction in cheaper communities.

“It’s right on that cusp now to make these deals work,” said Lay, Las Vegas division president for Woodside.

Investors bought 46 acres in Summerlin in the first quarter, down 11 percent from the same time last year, and paid an average of $715,000 an acre, up 31 percent, according to Dallas-based Howard Hughes Corp., the community’s developer. Homebuilders bought almost all of that.

Summerlin buyers paid an average of $518,000 per acre last year, up 46 percent from 2013. But sales volume fell 12 percent to 280 acres, “primarily” because of higher prices, Howard Hughes CEO David Weinreb recently said.

He’s not expecting prices to keep rising at the same pace, but he doesn’t think they’ll drop, either. Howard Hughes executives figure Summerlin land prices will “stabilize,” Weinreb said, adding “the current level appears to be sustainable.”

“We’re selling everything we put out for sale,” project President Kevin Orrock said.

And there’s plenty left. Summerlin, which began taking shape in 1990, is a long way from being fully built, with a projected completion date of 2039.

The community — which runs along the western rim of the Las Vegas Valley and is known for its parks, trails, upscale homes and proximity to Red Rock Canyon National Conservation Area — is planned for more than 200,000 residents. By the end of 2014, it had roughly 105,400 people, as well as 4,600 acres of available residential land and 850 acres of commercial land.

However, Orrock’s group keeps prices high by tightly controlling and limiting the land they sell.

They don’t flood the market and push prices down on themselves; instead, they typically put certain properties up for bid to certain groups of builders.

Company officials “keep supply and demand in check to keep prices up,” and they could have finished the project by now if they were willing to sell cheap, said land broker and investor Scott Gragson of Colliers International.

Howard Hughes also has a clause in its contracts with builders that lets it buy back undeveloped land. This prevents builders from selling parcels and potentially driving down Howard Hughes' prices.

"I want to control the market here; I don't want a builder to control my market," Orrock said.

Meanwhile, it's a different situation throughout the valley. Land sales rose fast in recent months as prices plunged.

Investors bought almost 900 acres in Southern Nevada in the first quarter this year, up 21 percent from the same time in 2014. They paid an average of nearly $190,000 per acre, down 34 percent from a year earlier, according to Colliers.

Before prices slumped, Southern Nevada homebuilders bought land quickly the past few years, pushing up values, CBRE Group broker Keith Spencer said. This especially sped up after Clark County commissioners in spring 2013 opened roughly 3,600 acres, mostly in southwest Las Vegas, to potential development by shrinking McCarran International Airport’s noise contour.

But new-home sales have slowed from a few years ago, and today, builders aren’t spending money loading up on land they won’t develop anytime soon.

“It’s an appetite issue,” Spencer said.

In their absence, speculators have been buying huge amounts of land and, as a result, getting cheaper prices, he said.

Southern Nevada builders sold about 6,000 new homes last year, down 18 percent from 2013, according to Las Vegas-based Builders Research.

The drop-off was even bigger in Summerlin. The project was the No. 15-selling master-planned community in the country last year with 437 sales, but that was down 23 percent from 2013, according to real estate consulting firm RCLCO.

However, things are picking up this year, with local builders selling about 1,380 homes in the first quarter, up 8 percent from the same period last year.

And it’s rebounding even faster in Summerlin, with new-home sales up 46 percent year-over-year, Orrock said.

Builders won’t pay any price for land in Summerlin, but they’ll keep spending as long as they can keep selling homes at high-enough prices, said Dennis Smith, president of Home Builders Research.

And, as locals know, it’s not cheap to live there. Builders’ median base price in Summerlin is $519,950 — two-thirds higher than the median sales price of all new homes in Southern Nevada, Smith’s company says.

All told, Summerlin land is easily some of the most expensive in the valley, if not the priciest outside the Strip, and that’s unlikely to change anytime soon.

“If you look at the other (master-planned communities), which one would even come close?” Smith said. “None.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy