Friday, Nov. 21, 2008 | 2 a.m.

FOCUS PROPERTY GROUP

Kyle Canyon Gateway: Focus owned 23 percent of the project. The other partners were Toll Brothers, Lennar, Pulte, KB Home, Kimball Hill Homes, Woodside Homes, Meritage Homes and Ryland Homes.

Also in trouble: Focus is also developing Inspirada, a master-planned community in Henderson, where it and its homebuilders are in default on loans from J.P. Morgan and Chase & Co., but foreclosure proceedings haven’t begun.

When Focus Property Group gathered eight homebuilders and purchased 1,710 acres of government land at the base of Kyle Canyon in 2005, it promised to extend Las Vegas still farther into the desert, delivering suburbia to the doorstep of Mount Charleston.

The group put down $510 million for the property, snapped up at a Bureau of Land Management auction at a time when developers of master-planned communities were paying top dollar to feed their homebuilding habits.

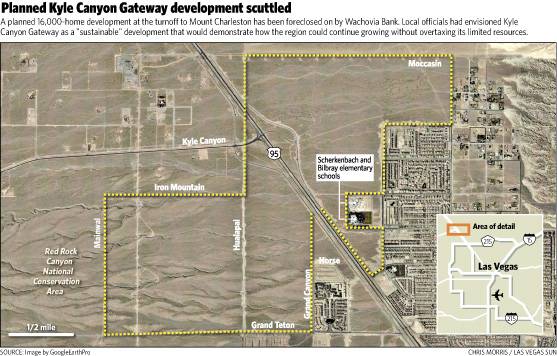

This project, approved by Las Vegas for as many as 16,000 homes, wouldn’t be as large as Focus Property Group’s Mountain’s Edge master planned community, but would be larger than its Providence.

This project was called Kyle Canyon Gateway.

But that was then.

Without a single home being built, the property has been foreclosed on by its lender, Wachovia Bank, said John Ritter, chief executive of Focus Property Group.

The foreclosed project had been envisioned by Las Vegas officials as a “sustainable” development that would demonstrate how the region could continue its rapid growth without overtaxing limited resources.

Yet environmentalists had complained that the project’s distance from the city center would lead to long commutes. And some residents of Mount Charleston worried that a large-scale development near the mountain would burden the alpine oasis.

“I’m sorry for the financial mayhem involved, but I think this (bankruptcy) is a good thing for the mountain,” said Rebecca Grismanauskas, an area resident since 1989. “There were going to be mega-residences and businesses, and with that, of course, a lot of people close by ... Mount Charleston doesn’t have infrastructure to support more visitors than we already have.”

In October, Wachovia, which is being taken over by Wells Fargo, sued Focus and its eight partners for defaulting on payments for the northwest Las Vegas development.

Focus owned 23 percent of the project. The other partners were Toll Brothers, Lennar, Pulte, KB Home, Kimball Hill Homes, Woodside Homes, Meritage Homes and Ryland Homes.

The Kyle Canyon project isn’t the first major stress point for Focus.

The company is developing Inspirada, a master-planned community in Henderson, where it and its homebuilders are in default on loans from J.P. Morgan and Chase & Co., but foreclosure proceedings haven’t begun.

Builders had been selling only three to five homes a week at Inspirada, but sales have “fallen off the cliff” because of job losses and the Wall Street collapse, Ritter said.

When the economy recovers, “we are going to be a much smaller company,” Ritter said. “Hopefully we will position ourselves to deal with the distressed deals in the marketplace and be prepared to gear up when the marketplace comes back because people are going to need guys to develop master plans.”

In remarks at a recent housing conference, Ritter said of the marketplace: “I think the consensus is that it is going to get worse before it gets better. I think everyone right now is confused. The market went from bad to worse, worse to horrible and horrible to holy crap. And is there something below holy crap? I don’t know.”

The lessons of the downturn have been sobering, Ritter said. If anyone thought he had control over his business and the marketplace, he was wrong, Ritter added.

He said he has no problems speaking candidly about the marketplace, unlike those who find positive spins.

“To a certain extent, that is how we got into this mess,” Ritter said. “We all just encouraged each other to go farther out on a limb and take more leverage. I think there is a light at the end of the tunnel, and I am hoping it is not a locomotive coming. But ultimately in Vegas the good news is there is very limited supply, and when things turn round here, values are going to increase relatively quickly. I think the market has the capacity to become very strong again.”

He warned: “When we come out of this thing, we need to be more conservative. We need to use less leverage if any leverage at all. It is going to be long time before banks jump back in the lending game for land and land developers, and even to a large extent the builders.”

A longer version of this story appears in this week’s In Business Las Vegas, a sister publication of the Las Vegas Sun.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy