Real estate agent Teresa McCormick, left, worked with Lisa Colavito and her husband to buy this house on Decatur Boulevard near Blue Diamond Road.

Thursday, Sept. 25, 2008 | 2 a.m.

While thousands were buying valley homes at the height of the housing boom despite poor credit and little to no money down, the Colavitos were patiently keeping their room at an off-Strip motel, wondering when they’d get their chance at a home.

Then the bubble burst, flooding the market with foreclosed homes. Home prices have plummeted so low some real estate agents suspect a bottom has been hit in the lowest-priced housing sector.

And Lisa and Ed Colavito said their wait has paid off.

Saddled with debt, the Colavitos had known what thousands of others didn’t or wouldn’t accept: that they couldn’t afford homes priced above $250,000. So they bided their time, hoping the market would come down to them.

And has it ever.

As has become common locally, banks list properties above their appraised value, just in case someone bites — anything to minimize their losses. But if no buyers come forward, they’ll drop the price aggressively, said escrow manager Laura Barnson of Prudential Americana, generally by $30,000 to $40,000, but sometimes more.

The 1,231-square-foot home the Colavitos bought two months ago went for the most recent asking price of $169,900, after having been marketed at one point for more than $200,000, real estate agent Teresa McCormick said.

The Colavitos are grateful they got the house, because they couldn’t have afforded anything more, and they were one of a handful of bidders. It was the seventh house they had tried to buy. McCormick assumes that the other bids were under the asking price, a trend that may have passed.

If that same house were to be sold today, it would fetch more than the $169,900 asking price, McCormick said. With prices having dropped so much, buyers — both investors and would-be owner occupants — are now engaging in the market.

“People are coming off the sidelines,” said Brian Gordon, a principal at Applied Analysis.

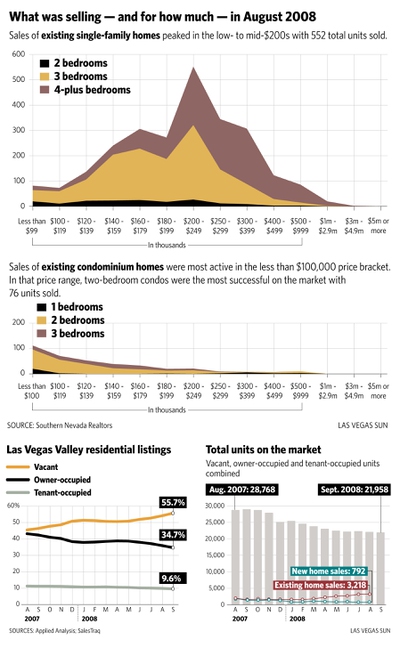

Nearly twice as many single-family homes sold in August as in August 2007.

It is not uncommon now for homes priced at less than a quarter-million dollars to generate multiple offers and competitive bidding, real estate agents said.

It took Las Vegas resident Anna Olin five bids before she secured her first home, for a few thousand dollars more than what the bank sought.

But the increasing sales should not be interpreted to mean housing prices have hit bottom and the massive correction from an overheated residential marketplace is complete.

Some analysts anticipate another wave of foreclosures in the next several months, adding more inventory to the market, which could prompt further price drops.

Increased demand for valley properties over the past year has been bolstered, in part, by a federally backed down payment assistance program. Nearly 1,000 single-family homes — nearly 40 percent of all such homes — were bought last month with a Federal Housing Administration loan, up from 2.2 percent in August 2007, according to the Greater Las Vegas Association of Realtors. FHA loans have included those tied to the down payment assistance program. Under the program, prospective homeowners qualified for homes often without putting down a single dollar upfront. The Colavitos and Olin benefited from this program.

But it ends this month because federal housing experts realized homeowners not financially vested in their properties from Day One were more likely to go into foreclosure than those who had submitted down payments. So real estate agents expect demand could wane starting next week.

“That’s why everyone’s so concerned with what’s going to happen with the market,” mortgage planner Steve Schauer said.

There was a slight decrease in home sales from July to August, which may be attributable to the coming end of the down payment assistance program. “Most lenders have eliminated that program already, starting around Aug. 15,” Schauer said.

Still, there’s hope the market won’t tumble further. The federal government is offering new home buyers, as well as those who haven’t owned a property in three years, tax credits of $7,500.

Some have kept a worried eye on the median house price in the valley, which has fallen about 30 percent in one year, to $210,000 in August. But Re/Max broker/owner Rick Shelton, president-elect of the Realtors association, noted that home sales haven’t fared well at the top of the market, while the lower end has seen great demand — a dynamic that has driven the median price down. It doesn’t necessarily mean the market will fall further.

“It’s a misleading figure,” Shelton said, noting the increased demand for homes under $250,000.

It’s possible, then, that the bottom has been established, though its actual depth is still being measured — like the young child in a swimming pool who moves over the uncertain floor, barely gracing it with his toes, unsure how deep he’s gone.

“We’ve been in a trough for the past 60 to 90 days,” Shelton said. “We’re at the bottom, but it’s sloshing back and forth.”

One home drew 48 bidders recently, agent Michele Trumbo of Keller Williams said.

Barnson said she generally is getting three to five bids for each bank-owned property she represents for sale, and has received as many as 15 offers on some properties.

As a result, it is becoming more common for the seller to fetch more than the asking price.

“Sales are starting to pick up for the past five months,” said Jason Schuck of American Realty & Investments. “That’s a good sign. However, what needs to go in conjunction is increase in prices. That’ll mean we’ve hit bottom.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy