Monday, Aug. 1, 2016 | 2 a.m.

Guests who stay in Clark County hotel rooms pay for much more than a place to sleep. Their bills include a significant tax, generally 12 percent.

“It is a remarkably productive, efficient, reliable source of revenue for the state of Nevada. It has been for more than 50 years,” said Jeremy Aguero, a principal with Applied Analysis who has studied the room tax. “It suffered ups and downs, particularly in the last economic downturn, but when you look at how productive that revenue source is for Southern Nevada compared with what other communities generate from similar taxes, it has been a big benefit.”

If some prominent local leaders get their way, room taxes may start funding two ambitious developments:

• The Las Vegas Convention and Visitors Authority is seeking an increase to fund its $1.4 billion expansion and renovation of the Las Vegas Convention Center.

• Las Vegas Sands Corp. and Majestic Realty Co. are eyeing room-tax revenue to fund part of their proposed 65,000-seat stadium that could bring the Oakland Raiders to town. Total cost could range from $1.7 billion to $2.1 billion.

But just how big is the room tax? Why was it created and where does it go? Here’s a closer look.

What is the room tax?

12 percent

The “real, overall rate in aggregate” applied to Clark County’s hotel rooms

Technically, the room-tax rate can vary depending on what kind of establishment a guest is staying in and where it’s located. Guests at nonresort lodging (i.e., motels) can pay as little as 10 percent, while resort guests can pay as much as 13 percent, according to the Las Vegas Convention and Visitors Authority. The tax isn’t applied until after resort fees are included, said LVCVA Chief Financial Officer Rana Lacer.

So if a guest gets a room for $80 and the hotel charges a $20 resort fee, the room tax would be $12.

How the room tax has changed

5 percent

The original 1957 room-tax maximum. 90 percent of the revenue funded Southern Nevada tourism (via the convention center), while the remaining 10 percent went to collecting jurisdictions

Empowered by the Legislature, Clark County first imposed room taxes on behalf of the Convention Authority in 1957. Through 1960, the main purpose was to fund bonds for the construction of the Las Vegas Convention Center, although some money went back to the jurisdictions that collected the tax.

Over the years, the room tax was increased to fund other expenditures. In 1969, for example, it grew to benefit the county’s general fund. Subsequent increases or diversions channeled the room tax toward education and transportation.

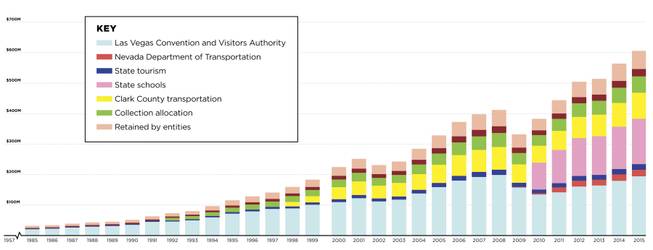

This chart focuses on changes to the room tax since 1985.

• 1983 — Increased the maximum rate to 7 percent for state tourism and special events

• 1991 — Increased the maximum rate to 8 percent to pay for transportation projects within Clark County

• 1997 — Increased the maximum rate to 9 percent for the Clark County School District for capital projects

• 1999 — Redirected the portion that went to special events promotion toward CCSD

• 2007 — This diverted money from the LVCVA for debt service payments for tourism corridor infrastructure improvements

• By 2009, at the height of the Great Recession, the room-tax rate had grown to an average of 12 percent (maximum 13 percent), with 32 percent of the revenue funding Southern Nevada tourism. The rest, as shown below, went to statewide tourism, transportation, education and the local collecting jurisdictions.

• Total room tax collected in 2015: $605.7M

Where the room tax goes

1. Hotels collect room taxes when they are paid.

The following month, according to Lacer, hotels send the revenue to the jurisdiction in which they are located: the city of Las Vegas, the city of Henderson, Clark County and so on.

2. Those jurisdictions take a percentage.

Here’s an example of how it’s used: Unincorporated Clark County gets 1 percent (of the 12 percent tax), which goes into its general fund. In the 2015 fiscal year, the county collected $52.4 million that way, according to spokesperson Stacey Welling.

• The county and the incorporated cities also get 1 percent of the tax for transportation improvements.

3. Clark County first uses revenue from room taxes to pay off annual debt requirements tied to previous transportation projects.

According to Welling, projects that have been funded in that manner include the Desert Inn Super-Arterial, improvements to Paradise and Swenson roads, and pedestrian overpasses on the Strip.

• If any revenue remains after debt is paid, Welling said it’s transferred to a capital fund that helps finance transportation projects throughout the county.

4. The month after local jurisdictions receive room-tax revenue, they pass a share along to the Convention Authority.

The Authority uses the funds to support the operations of the Las Vegas Convention Center, as well as marketing, advertising and special event promotion. “Everything we do with the room tax is all directly tied back to driving visitation,” Lacer said.

5. But it doesn’t end there.

Once a quarter, the Convention Authority looks at everything it received from room taxes and gaming taxes and sends 10 percent back to the local jurisdictions for collecting the tax on the Authority’s behalf.

Where else might it go?

• Las Vegas Convention Center project: The Convention Authority wants to grow and revamp its convention space over the next few years. The project entails building a facility on the site of the former Riviera (and the authority’s Gold Lot) and renovating the existing Las Vegas Convention Center just across Paradise Road.

The authority will likely accomplish that through a combination of a 0.5 percent increase in the room tax and by capping the local government collection amount at $25 million annually (rather than 10 percent). The tourism infrastructure committee approved a legislative recommendation to fund the project. It will need to be approved by the Legislature and signed into law by the governor.

• Stadium project: The stadium is likely the most controversial possible use of room-tax revenue that’s on the table.

To attract an NFL franchise — and offer a new venue for UNLV football games and other large events — Sands and Majestic have offered a plan that would use $750 million in public money, likely via room taxes. An alternate plan introduced by the committee chair and detailed by Applied Analysis’ Aguero would cut the room-tax contribution to $550 million.

Aguero said the original proposal would entail a 1 percent increase in the room tax, while the alternative would raise it by 0.7 percent within the resort corridor, 0.5 percent outside the resort corridor and not at all for the areas more than 25 miles beyond.

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy