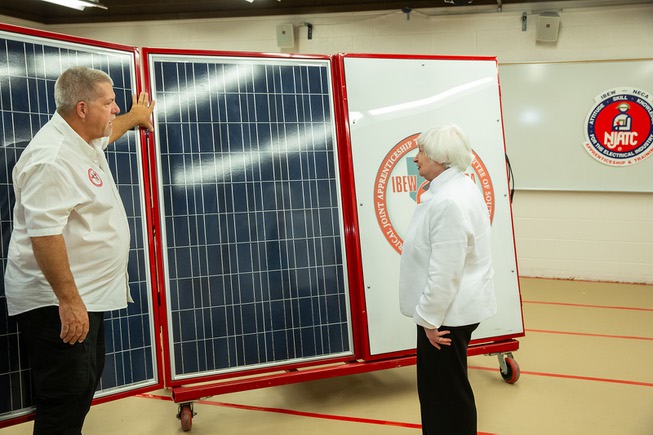

Guy Snow, instructor at the Electrical JATC of Southern Nevada, welcomes US Secretary of Treasury Janet Yellen to the facility for a tour of their renewable energy program, Monday Aug. 14, 2023.

Tuesday, Aug. 15, 2023 | 2 a.m.

The economic upshot in Nevada and across the nation appears bright, as climate and infrastructure projects bolstered by President Joe Biden’s Inflation Reduction Act begin to take root, U.S. Treasury Secretary Janet Yellen said Monday in Las Vegas.

Yellen touted an economy on the upswing in the year since Congress passed a $750 billion spending bill aimed at reducing inflation.

“American workers are central to our nation’s economic progress,” Yellen told members of the International Brotherhood of Electrical Workers Local 357.

“What you are doing here in Vegas — and across the country — demonstrates every day how skilled workers are literally building our new economic future,” she said.

Nevada, however, has an unemployment rate of 5.4%, last among the 50 states and the District of Columbia, according to the U.S. Bureau of Labor Statistics.

That can be attributed to the glut of hospitality and gaming workers laid off at the onset of the COVID-19 pandemic, when unemployment here spiked to about 30%, she said.

Officials from both major political parties have talked about the need to diversify the state’s tourism-dependent economy.

Between renewable energy projects in rural Nevada and provisions of the Inflation Reduction Act that allow states to negotiate drug prices, everyday people should see dividends, Yellen said.

She said her tour Monday of union trading programs shows “the potential is there for expanding the clean-energy economy here.”

“The Inflation Reduction Act brought down health care costs, is expanding access to health care, is bringing down the out-of-pocket costs for pharmaceuticals and has capped the price of insulin at $35 per month,” she said.

To understand the importance of the Inflation Reduction Act, people must remember the economic condition in the U.S. prior to the bill’s passage, Yellen said.

A perfect storm of consumer spending, job growth and supply chain bottlenecks amid the coronavirus pandemic allowed inflation to fester at the highest rate since the 1970s, she said.

But a trifecta of historic spending bills, which also included hundreds of billions of dollars for infrastructure improvements and bolstering U.S. semiconductor production, have kept the nation on a relatively strong path economically, Yellen said.

“Over the past year, our task has been to transition the economy from rapid recovery to stable growth,” Yellen said. “Our path so far shows that we are on the right track, even as we remain vigilant about potential challenges and uncertainties.”

Yellen acknowledged the latest findings from the Department of Labor, which reported that inflation edged up to 3% last month, largely due to increases in gas prices.

But with unemployment near a record-low at 3.5%, wage growth is finally outpacing inflation, a key indicator that the economy appears to be staying strong.

“Workers are better off than they were last year,” Yellen said. “The administration remains committed to taking actions to lower prices for Americans where we can. And we continue to monitor developments, particularly those abroad, that may affect prices and growth.”

Whether Americans will credit Biden for improvements in the economy is yet to be seen. Recent polling from The Associated Press shows the president’s approval rating at 41% nationally, with just 34% say they agree with Biden’s handling of the economy.

“Americans are beginning to see in their daily lives the impact” of so-called Bidenomics, Yellen said. “But there’s a lot more coming down the pike. And what’s more important to explain to Americans is what’s happened and that this is really great for our future.”

The Federal Reserve has played a key role in tamping down inflation by raising interest rates.

The goal is to achieve a so-called soft landing by gradually cooling off consumer spending to decrease inflation, while not raising rates too rapidly and causing a recession.

Interest rates have climbed more than 5% since February, increasing the cost of lending for autos, mortgages and credit cards.

Yellen said the moves were necessary to stave off greater damage to the economy.

“We know that progress rarely moves in a straight line, but I still believe that there is a path to continue reducing inflation while maintaining a healthy labor market,” Yellen said. “While there are risks, the evidence we’ve seen so far suggests we are on such a path.”

“I expect the important gains that we’ve made over the past two and a half years to serve as a source of resilience in the weeks and months to come, even if we see further cooling in our economy,” she said.

In addition to strengthening economic resilience, the Inflation Reduction Act has been pivotal in helping the U.S. tackle climate change, expand its energy portfolio to include more renewable sources and expand economic opportunity, Yellen said.

Biden has touted his economic policy as a “modern supply-side” agenda that emboldens workers and provides tax incentives to companies to invest in new technologies, especially in the area of renewable energy.

“These incentives provide long-term certainty for investors in pursuing clean energy projects,” Yellen said. “With the IRA, investors have greater confidence to scale-up deployment of established technologies like solar energy.”

Yellen also mentioned extreme weather events, including a heat wave last month in Las Vegas when temperatures exceeded 110 degrees for 10 consecutive days. Canadian wildfires this year sent smoke across U.S. cities in the Midwest and on the East Coast.

Natural disasters can wreak havoc on economic growth and can be detrimental to the economy as a whole, she said.

“These climate events have real economic impacts on Americans — even if they are spared from the physical impacts,” Yellen said.

“As an example, home insurers are hiking rates or pulling back entirely from highly vulnerable areas in states like California and Florida. These developments are having a significant economic impact on homeownership,” she said.

Some international factors, such as Russia’s ongoing war with Ukraine — and the recent collapse of a deal that allowed grain to be shipped from Ukrainian ports on the Black Sea — as well as economic uncertainties could also affect the U.S. economy, Yellen said.

Unless a deal is brokered soon to allow grain exports to continue out of Ukraine, food prices could be on the rise soon, “which will have a very adverse effect on many poor parts of the world and push up food costs globally,” Yellen said.

China’s economic slowdown “will have the largest impact” on its neighbors but could also have some lingering effects on U.S. supply chains, Yellen said.

But inflation remains trending in the right direction, and that will be the driving force behind a continued economic rebound, she said.

“The risk that many economists have focused on is risks of a U.S. recession,” Yellen said. “I’ve long said I believed it was possible to bring inflation down while keeping the labor market strong. Of course, there is the risk of a recession, but to me what we’re seeing is consistent with the path I though the U.S. would be on.”

[email protected] / 702 990-2681 / @Casey_Harrison1