Friday, May 1, 2009 | 2 a.m.

Audio Clip

- Jim Murren, MGM Mirage chairman and chief executive, on how a shortfall in CityCenter financing led to the partners putting in more cash.

-

Audio Clip

- Murren describes how the budget for CityCenter fell from more than $9.2 billion to $8.5 billion.

-

Audio Clip

- Murren explains why MGM Mirage still has bullish prospects for CityCenter.

-

Audio Clip

- Murren on why property sales aren’t necessarily going to solve the company’s financial woes.

-

Sun Archives

- CityCenter deal sends MGM Mirage stock soaring (4-30-2009)

- CityCenter deal sends MGM Mirage stock soaring (4-30-2009)

- MGM Mirage, Dubai World working on CityCenter funding plan (4-17-2009)

- Report: MGM, Dubai World reach deal on CityCenter (4-17-2009)

- Report: Icahn, equity fund push for MGM bankruptcy (4-16-2009)

- MGM Mirage gets waiver for $70M CityCenter payment (4-13-2009)

- Dubai World wants assurance of CityCenter funding (4-10-2009)

- MGM Mirage stock surges on corporate financing news (4-6-2009)

- MGM Mirage hires investment firm (4-4-2009)

- Australian businessman weighing CityCenter investment (4-3-2009)

- CityCenter contingency plan emerges; investor shows interest (3-28-2009)

- CityCenter safe — for now (3-28-2009)

- In a recession, a delay could be seen by rivals as a positive development (3-28-2009)

Mirage For Sale?

Is MGM Mirage pondering a potential sale of one of its premier properties? Plus, charges that the smoking ban is hurting business go up in smoke.

MGM Mirage executives said Thursday that the deal struck this week to finance completion of CityCenter marks a turning point for the company, which has been pushed to the edge of bankruptcy by the recession.

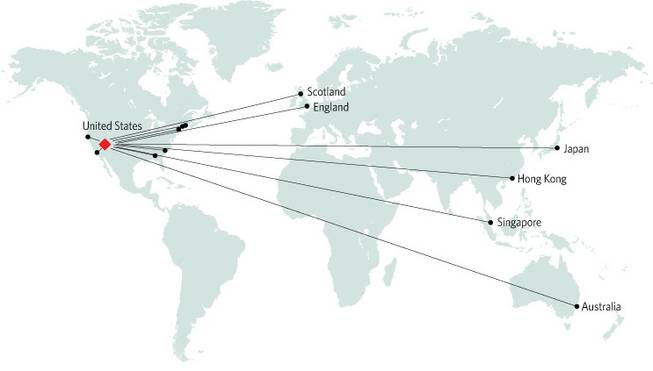

The deal was the result of a months-long effort to persuade eight banks — across four time zones, with representatives speaking at least three languages — to immediately risk $1.8 billion on the massive project, which had been in serious doubt.

“This has been a 24-7 job involving conference calls at three in the morning,” MGM Mirage CEO Jim Murren said Thursday. “There were so many different constituents, and their desires and restrictions, their conflicting objectives, all have to be taken into account.”

The effort succeeded because the banks bought into the project’s and the Strip’s long-term potential, Murren said.

MGM Mirage negotiated a separate deal with the company’s banks, many of the same institutions financing CityCenter, giving the company until June 30 to figure out a plan to restructure $13.5 billion in debt.

Addressing speculation that MGM Mirage would have to sell off properties to survive, Murren said he was confident the CityCenter financing deal will allow the company to emerge from the recession largely intact.

“There are no tag sales going on,” Murren said. “This is not what will drive our restructuring.”

•••

The agreement between MGM Mirage and Dubai World and their banks will provide the remaining cash needed to finish the resort on schedule and under a tightened budget of $8.5 billion.

More significantly for MGM Mirage, Las Vegas’ largest private employer and the state’s biggest taxpayer, the deal represents a major step toward long-term solvency.

“I think we’re going to look back on (this deal) as a turning point for our entire community,” Murren said. “This is an inflection point on the road to recovery.”

MGM Mirage’s agreement with its creditors allows the company to pay less than $300 million in cash to fund the company’s remaining financial commitment to the project.

Dubai World agreed to drop its lawsuit against MGM Mirage over management and the rising price tag of CityCenter and will pay its 50 percent share of the funding needed to complete the project, about $400 million. Dubai World now has the comfort of knowing that MGM Mirage is responsible for any costs that exceed the $8.5 billion threshold.

The parties kissed and made up just before a Thursday deadline for a monthly payment on CityCenter. Had the payment not been made, the bank financing might have been in jeopardy, which could have resulted in a bankruptcy filing for the CityCenter joint venture and a stalled project.

Unlike typical bank deals, the CityCenter agreement required 100 percent approval from all eight banks.

Until now the banks, which had committed in October to lend the money for CityCenter, haven’t put a single dollar into the project. Payments from MGM Mirage and Dubai World, which has invested more than $4 billion in cash in CityCenter, have so far funded construction of the 67-acre resort complex, which will open the first of its six towers, Vdara, in October. When CityCenter is complete, the partners will have sunk nearly $7 billion into the project.

“In Vegas terms, we’re all in,” Murren said. “We have all the money we need to finish CityCenter, money the partners have already spent or have committed to spend.”

•••

Now that a CityCenter bankruptcy filing has been averted, MGM Mirage must reduce debts that are too great a burden to be supported by the company’s declining earnings and fend off a potential Chapter 11 filing.

MGM Mirage has emerged from these marathon CityCenter negotiations with a key bargaining chip in the coming battle with the company’s own lenders. Even as it stares down billions in debt maturities and casino earnings that have been halved, MGM Mirage didn’t give up collateral in any of its premier Strip properties — a sign that the company’s bargaining power with lenders remains strong.

MGM Mirage gave the CityCenter lenders collateral in the company’s Circus Circus property and adjacent land. If MGM Mirage can’t make those payments and CityCenter doesn’t open as planned, the banks would have rights to Circus Circus and could, say, sell the property and keep the proceeds. The banks will have a lien on Circus Circus only until CityCenter is complete, as well as collateral in undeveloped land across from the Luxor, MGM Grand Detroit and the Gold Strike casino in Tunica, Miss.

Murren said the company gave up very little, retaining the ability to offer at least $2.5 billion worth of properties as future collateral to lenders.

Liens may become a key bargaining chip in efforts to avoid bankruptcy.

Although lenders and Dubai World received concessions from MGM Mirage in this deal, financial observers say MGM Mirage probably got the best deal imaginable under the circumstances.

MGM Mirage also agreed to repay $100 million in a revolving credit line — a relatively small amount of money, analysts say, and a recognition of the company’s precarious finances.

While the company has marketed its MGM Grand Detroit and Beau Rivage casino in Biloxi, Miss., for sale, it has steered clear of marketing any of its Strip casinos to potential buyers. Murren said he has been “inundated” with offers for properties but hasn’t acted on them.

MGM Mirage’s casinos, especially its crown jewels along the Strip, are more valuable to the company as collateral in a potential debt exchange than for the one-time cash they could yield for the company, which wouldn’t make much dent in the company’s finances after taxes are paid, Murren said.

•••

Murren said he isn’t resting easy after helping CityCenter dodge a bullet, which will save 20,000 construction and resort jobs and keep a significant investment in the company’s future intact.

The deal coincides with a company-

wide mandate to strengthen MGM Mirage against future downturns.

“Las Vegas was a little bit slow to react to a changing economy,” he said. “These are scars that are going to be with us for a long time and it’s incumbent upon us to remember what we did and the sacrifices we made as a company.”

MGM Mirage will hopefully emerge “more humble, more thoughtful, more nimble than ever, and more efficient,” he said.

The company’s chances for a successful restructuring without resorting to bankruptcy reorganization are good if the banks continue to cooperate with the company as they have been, Murren said.

“This is going to be difficult,” he said. “It’s a risky world right now.”

Nor will Murren get more sleep — he’s hitting the road to meet with lenders and will draw up a recovery plan in the next month or two.

“All roads to our total recovery lead through CityCenter — we had to solve that riddle first,” he said. “This was the best possible outcome for us.”

Join the Discussion:

Check this out for a full explanation of our conversion to the LiveFyre commenting system and instructions on how to sign up for an account.

Full comments policy