Thursday, Aug. 16, 2018 | 2 a.m.

In case there was any doubt, it’s back.

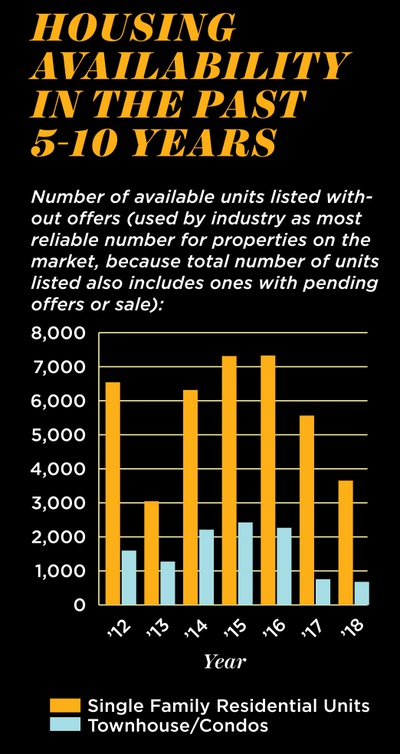

The real estate market in the Las Vegas Valley has seen explosive growth the past two years, creeping toward its pre-recession boom from 2005 to 2007, according to Las Vegas housing experts and real estate agents in the valley.

Single-family residential units available

• $1-$100,000: 41

• $100,000-$250,000: 675

• $250,000-$500,000: 3,229

• $500,000-$750,000: 790

• $750,000-$ 1million: 287

• $1 million-plus: 438

Townhomes/Condos

• $1-$100,000: 122

• $100,000-$250,000: 529

• $250,000-$500,000: 188

• $500,000-$750,000: 9

• $750,000-$ 1million: 13

• $1 million-plus: 2

High-rises

• $1-$100,000: 0

• $100,000-$250,000: 49

• $250,000-$500,000: 159

• $500,000-$750,000: 68

• $750,000-$ 1million: 13

• $1 million-plus: 63

While the addition of more than 100,000 residents since 2016 and three professional sports teams has certainly had a positive role in helping the market, those in the industry claim our local growth is — as it has almost always been — thanks to Vegas’ booming economy. Its progression, compounded with the typical Las Vegas investment mindset of risk and optimism, helped prop housing values up to 10-year highs in May, said Brian Gordon of Las Vegas economic research firm Applied Analysis.

“We’re seeing pretty healthy levels of sales activity and we’re not seeing as much distressed activity in the resale market,” Gordon said. “The market is now dominated by traditional or equity sellers, with fewer short sales, REO sales and auction sales.”

Fewer than 900 condos, 800 single-family residences and 60 high-rise apartments are available in the Las Vegas Valley for less than $250,000, often seen as the entry-level price range for couples or small families looking for their first home, according to Forrest Barbee, Equity Title of Nevada researcher and broker.

The healthy market and increased demand for housing, especially affordable housing that is less than $300,000, has created its own set of challenges for homebuyers in Southern Nevada. Gordon in June described the state of our area as a textbook “seller’s market,” in which a low supply of available homes drove prices up and away from the many eager buyers looking to purchase a home here. But a slight dropoff in median prices for June and July showed that Las Vegas’ market is becoming more seasonal, typical of markets in metropolitan cities, Barbee said. As many families use vacation time to travel during summer months, that season is typically among the slower times of the year for housing sales.

“The seasonality also shows Las Vegas isn’t as transient as it used to be,” Barbee explained. “More people are being born and raised here, going to school and looking for jobs here. It’s not just people dropping in for a few years to work at a casino, make some money and leave.”

Chris Bishop heads the 14,000-member Greater Las Vegas Association of Realtors, having accepted the presidency this year after 14 years as an agent in the Valley. Bishop said median home prices in Southern Nevada climbed by an average of $5,000 per month from last December to May to reach an 11-year high of about $295,000 in May. With thousands of people per month moving into the Valley from higher-priced areas across California and some parts of Arizona and Utah, Bishop said growth in the Southern Nevada housing market has been across all categories, from more affordable homes to the $1 million-plus estates in the luxury market.

The two-person team of Cokie Booth and Kris Jeffries at BC Real Estate has sold homes in Boulder City and Henderson for the past 20 years. For their Henderson properties, they too have seen affordable houses selling “like hotcakes,” especially during the past two years.

Booth estimated in June that an attractive home priced between $200,000 and $300,000 would last less than three days on the open market, and usually have more than a dozen interested buyers fighting for their chance to own the home. That’s compared with an average of about one week on the market two years ago, usually contested by two or three potential buyers at most.

Many homes that cost $200,000 as recently as 2012 are now priced as high as $300,000-$400,000, Jeffries said, pricing out many would-be first-time home buyers or even seniors looking to downgrade to a smaller home.

“We have a lot of people that need a home under $300,000, and there’s nothing out there,” Jeffries said. “When the lower-priced homes sold off and they weren’t available anymore, these prices had to go up. For anything under $300,000, we tell people to prepare for a fight because there are going to be a lot of people looking at the same home at the same time as they are,” he added.

The growing number of people who miss out on those properties are forced to rent or stay at home with their families or roommates while they wait for more such homes to be constructed or hit the market.

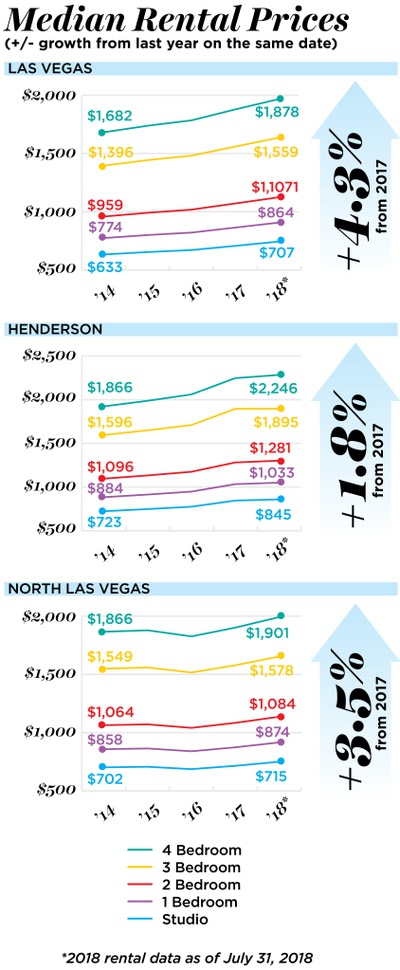

Rent prices in the Valley are skyrocketing, too.

Median home values as of June 30

• United States: $217,300 (+8.3% in 12 months)

• San Francisco: $1,358,500 (+9.8%)

• Los Angeles: $677,400 (+8.7%)

• New York: $674,500 (+7.8%)

• San Diego: $622,300 (+7.1%)

• Salt Lake City: $365,500 (+14.6%)

• Reno: $354,900 (+10.2%)

• Miami: $329,900 (+4.5%)

• Henderson: $313,800 (+12.2%)

• Las Vegas: $260,100 (+15.9%)

• North Las Vegas: $241,600 (+17.2%)

• Phoenix: $231,500 (+9.6%)

• Chicago: $227,100 (+3%)

• Houston: $178,300 (+7.1%)

With a 4.3 percent increase in rental rates from August 2017 to this month, Las Vegas ranked third among major U.S. cities for highest 12-month rent increase, trailing only Orlando (5.9 percent) and Tampa (4.4 percent), per rental site Apartment List. North Las Vegas saw rent prices increase 3.5 percent, while Henderson’s rates increased 1.8 percent. Nevada experienced the fastest year-over-year growth at 3.5 percent, more than 2 percent above the national average.

Valley unemployment rate by year

• 1998: 4.1%

• 1999: 3.9%

• 2000: 4.3%

• 2001: 5.4%

• 2002: 5.9%

• 2003: 5.2%

• 2004: 4.3%

• 2005: 4.1%

• 2006: 4%

• 2007: 4.5%

• 2008: 6.6%

• 2009: 11.5%

• 2010: 13.8%

• 2011: 13.2%

• 2012: 11.3%

• 2013: 9.7%

• 2014: 8%

• 2015: 6.8%

• 2016: 5.9%

• 2017: 5.2%

Apartment List Economist Chris Salviati said “substantial” increases in Southern Nevada rental rates are a direct result of restrictions in affordable housing. But as one of the nation’s cheapest metropolitan areas to live, Las Vegas still continues to draw priced-out residents of expensive coastal cities, such as San Diego, Los Angeles, San Francisco, Portland, Seattle, New York and Boston.

“Recently, it has just made more sense for people to seek out more affordable cities like Las Vegas,” Salviati said.

The rising housing values and rental rates, while still only 80 percent of Southern Nevada’s pre-recession highs, have made analysts and credit agencies across the U.S. skeptical of the Las Vegas market. Homes in the Las Vegas-Henderson-Paradise

metropolitan statistical area are priced on average 21 percent above fair market value, according to figures released by Fitch Ratings. Among concerns with the rapidly increasing home values in the Valley, Fitch cited a similar price rise last decade before Southern Nevada was hit hard during the housing crash-induced recession.

Vivek Sah, who oversees UNLV’s Lied Institute for Real Estate Studies, said despite annual growth of over 10 percent in the Valley housing market since 2016, the disastrous crash of last decade is unlikely to repeat. He pointed to stricter lending policies and more home buyers using their properties as personal residences instead of investment properties as leading factors.

“If something happens and it stops growing, we’ll see a more gradual decline instead of falling off a cliff,” Sah explained. “There’s more stability in this market than what we saw in the mid-2000s.”

Sah, whose department also runs monthly Valley real estate data and projection reports, said many properties during last decade’s housing crisis were sold multiple times per year—often a sign of investors looking to leverage and flip properties for profit. He argued that analyses labeling the Valley housing market as overvalued were also inaccurate, because fewer properties are being flipped.

The solution to Vegas’ growing affordable housing and rent problem isn’t as simple as building new homes, Sah and Applied Analysis’ Gordon said. With prices for raw land, construction materials and labor all increasing because of demand, developing houses at the $200,000 to $300,000 price range is “limited.”

“A rental property might make more financial sense,” Gordon said. “Our indicators are continuing to point towards growth in the housing market.”

Sah said professional sports have not and will not play an immediate role in shifting the housing market. While the Golden Knights, Aces, Lights and eventually the Raiders collectively bring a share of high-paid executives and some higher-earning athletes to Las Vegas, those people represent a small portion of the overall population. Gordon said the teams will contribute to the tourism economy, including casino resort hotels, local restaurants and entertainment, but Sah said such teams don’t serve to create employment in other industries. At best, sports could draw hype and potentially lead major corporations to build their headquarters in the Valley. If that’s the case, the long-term effect of such franchises will likely take about 10 years to make a significant impact.

For now, the luxury side is the only sector of the housing market feeling the professional sports boom.

Nancy Storey of Berkshire Hathaway HomeServices in Henderson has been selling homes to Las Vegas Valley customers for 38 years. The longtime Valley resident, who now focuses on higher-end properties priced at $750,000 to more than $10 million, called that market “very healthy,” thanks in part to more athletes and executives moving into higher-priced areas like Summerlin, MacDonald Ranch, Anthem and Green Valley.

“It’s a steady market now,” Storey said. “We don’t want it to be crazy, but it’s good.”

Meanwhile, Californians are flocking to Vegas

This winter, Daniel Watabayashi joined the tide of Californians moving to Las Vegas. Most transplants cite the comparatively low cost of living, low taxes and Vegas vibes as reasons for moving. He left Vallejo, California, for a management job at a Strip resort.

“I ended up renting a 2-bedroom 1-bath cottage-style unit just east of UNLV for a very affordable $710 a month,” Watabayashi said. “Compared to California, that was a steal of a deal. Around the Bay Area, you find places like what I have here for around $2,000 a month. I definitely can say I like it here so far.”

Rental median

• Nevada 1 bedroom: $873

• Nevada 2 bedroom: $1,095

• U.S. 1 bedroom: $951

• U.S. 2 bedroom: $1,180

There are two types of California transplants, according to Realtor Brian DiMarzio: “The older Californians who are looking to sell their properties for top dollar in California and move into a less expensive property here in Las Vegas (which is a more tax-friendly state for their retirement benefits). Then you see a lot of younger Californians who are just priced out of market. They come here looking for jobs and affordable housing.

“[Californians are] driving a lot of the price increases, because there’s so many of them coming. They’re looking for more of the amenities, similar to what they get in California: restaurants, health clubs, gyms. I think it’s going to drive a lot of expansion of services here in Las Vegas.”

How might so many new arrivals change the anything-goes Las Vegas ethos? “Las Vegas is a melting pot of cultures and thoughts,” said Erica Macias, a Realtor with Barrett & Co. Inc. Realtors. “The influence of a large import of Californians coming to Las Vegas could have an effect on politics and on tax structures.”

So far, newcomer Watabayashi enjoys mixing with his newfound neighbors: “I do have to say the locals here are so much more polite than in the Bay Area, and while the overall drivers may not be the best, I have seen a lot more compassion on the roads than in the Bay. Maybe one day I will go back, but not in this current market.”

Tips for buyers in a seller's market

• If you’re willing to be patient and work hard, you can find a deal in any market.

• Get preapproved, look for a property that you really like and plan to live in for five to 10 years. Make a reasonable offer and, if it’s not accepted, repeat the process.

• “If you’re brand new to Vegas, rent for a year, get to know the city and then purchase,” said Brian DiMarzio, a Realtor at Huntington & Ellis. “That’s the best advice I can give to new arrivals: Take your time figuring out the areas that you like out here. Then get preapproved and start the process looking for a home.”

• Do NOT feel pressured or desperate because you fear that prices will go up forever, DiMarzio advised.

• Because inventory is tight, any property less than $300,000 will garner multiple offers. “You need to go into any offer fully prepared,” DiMarzio said. He helps clients get ahead of the game by having a lender fully underwrite his buyers. “When they go [to buy], the only thing they need is the property. It’s not just approved by the loan officer, but also by the underwriter.”

• When making an offer, it’s not just who offers the most money, it’s who’s most qualified to close quickly. This is also true when bidding wars push prices higher than their appraised value. If you’re not willing to pay the difference in cash or you’re not already underwritten, then you probably won’t get the house.

Sellers must remember ...

• It’s a seller’s market, but it’s not as easy as you’d think to cash out on recent price increases. If you sell, you still need a place to live, so you’ll have to rent or buy a new house at equally increased prices.

• “Most people need to sell their home in order to purchase the next one,” Realtor Brian DiMarzio said. “It can become a complicated situation.” You can use services such as Opendoor or OfferPad to sell your house immediately. But they will pay less money than if it were put on the market.

• Every situation is unique. “Some people absolutely need to move, say they’re having another child. Others have all the time in the world,” DiMarzio said. Either way, he suggests finding an agent who will look after your best interest, one who will help you make the right decision and present all the options.

How much of your income should you spend on housing?

Realtor and property manager Erica Macias recently discussed this topic with Guild Mortgage’s Senior Mortgage Loan Officer Kevin Helm. They suggest keeping total monthly payments (including property taxes, insurance and HOA) at less than or equal to 36 percent of your gross monthly income. In extreme situations, you might be able to stretch that number to 50 percent. But do yourself a favor and buy within your price range.

However, if everything seems out of your price range, don’t fret. There may be resources you haven’t considered. “In my practice, I use a lot of down-payment assistance programs,” Macias said. “These programs help equalize buyers’ options. So buyers should get in now that there is affordability and down-payment assistance programs to help them. Eighty-three percent of first-time home buyers don’t understand the process. Because of that, I coach my buyers and have them come in for a free buyer’s consultation.”

HOAs: Love ’em or Leave ’em

Nobody wants a junk lawn next door. But nobody wants their neighbor to tell them what color to paint the house they own. What’s the point of buying a home if you can’t do what you want with it, right? “HOAs are a double-edged sword,” Realtor Brian DiMarzio said. “On one hand, they do restrict what you can do to your property. At same time, that’s also their advantage.” HOA fees will add to your monthly payment, and unlike a mortgage, they can never be “paid off.” But they will also work to protect your property value. Ultimately, the choice is up to you.

Renting vs. Buying

• Some monthly mortgage payments may be lower than monthly rent.

• Buyers receive tax breaks and other government incentives

• A mortgage offers price stability, whereas rent can increase at the landlord’s whim.

• For better or worse, when you buy a home, it’s all yours.

• Rentals offer no commitment, no investment, no hassle, no maintenance and no HOA fees.

• Rentals may have restrictions, such as no pets or no smoking.

How to choose a real estate agent

• Shop Around. Buying or selling a home is likely the biggest financial transaction of your life, so don’t skimp on preparation. Take the time to find the right agent for you by interviewing at least three agents.

• Do your homework online. Ask friends for recommendations; do Google searches; check online reviews; look at agents’ recent sales on Zillow, Realtor.com or Redfin.

• Hone your region. Find an agent who is an expert on the part of town where you want to live. A Henderson specialist won’t be your best bet if you want to live in North Las Vegas, and vice versa. “You’re paying for their knowledge of the inventory and their knowledge of the process,” Huntington & Ellis Realtor Brian DiMarzio said.

• Ask meaningful questions: Sellers should ask potential agents about their average days on the market and how their sale prices compare with their list prices. “People can name whatever list price they want, but at end of the day, the only thing that really matters is what that end sale price is,” DiMarzio said.

• Trust your gut. When all else fails, go with the agent that just feels right.

This story originally appeared in the Las Vegas Weekly.